PA BIRT-EZ 2019 free printable template

Show details

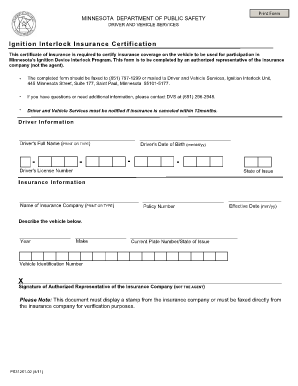

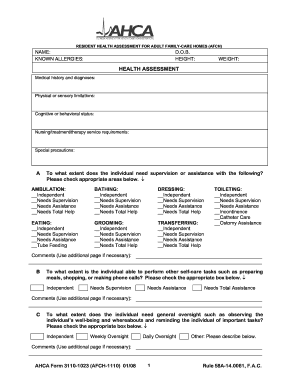

No StaplesCITY OF PHILADELPHIA DEPARTMENT OF REVENUE2019 BIRTH 21219DUE DATE: APRIL 15, 20202019 BUSINESS INCOME & RECEIPTS Toxicity Account Number business conducted 100% in Philadelphia Taxpayer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA BIRT-EZ

Edit your PA BIRT-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA BIRT-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA BIRT-EZ online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA BIRT-EZ. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA BIRT-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA BIRT-EZ

How to fill out PA BIRT-EZ

01

Gather necessary information about your business, including your entity type and taxable income.

02

Complete the top section of the PA BIRT-EZ form by entering your business name, address, and federal employer identification number (FEIN).

03

Provide details about your business activity, including your business code and the date your business started.

04

Fill out the tax calculation section, entering your taxable income and applying the correct tax rate.

05

Review the form for accuracy, ensuring all figures and information are correct.

06

Sign and date the form in the appropriate sections.

07

Submit the completed form to the Pennsylvania Department of Revenue by the specified deadline.

Who needs PA BIRT-EZ?

01

Businesses operating in Pennsylvania with gross receipts of $1 million or less.

02

New businesses looking to report their Business Income and Receipts Tax (BIRT) liabilities.

03

Companies that prefer a simplified filing process for their BIRT obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is pa gross receipts tax?

Private Bankers: The tax is imposed on private bankers doing business in Pennsylvania at a rate of 1 percent on gross receipts from commissions from loans; banking services; discounts on loans; charges or fees on depositor accounts; rents; rentals of safe deposit boxes; interest from bonds, mortgages, premiums and

Do I have to file a Philadelphia City tax return?

Do I need to file a Philadelphia city tax return? Yes. If you live or work in the city and don't have the city wage tax withheld from your paycheck, you must file an earnings tax return with the city each quarter.

Do I need to file Philadelphia birt?

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must file a Business Income & Receipts Tax (BIRT) return.

What income is not taxable in Pennsylvania?

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

What taxes do you pay in PA?

Pennsylvania has a flat 8.99 percent corporate income tax rate and permits local gross receipts taxes. Pennsylvania has a 6.00 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.34 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA BIRT-EZ online?

The editing procedure is simple with pdfFiller. Open your PA BIRT-EZ in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the PA BIRT-EZ electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your PA BIRT-EZ in seconds.

Can I create an eSignature for the PA BIRT-EZ in Gmail?

Create your eSignature using pdfFiller and then eSign your PA BIRT-EZ immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is PA BIRT-EZ?

PA BIRT-EZ is a simplified business income and receipts tax return form used by businesses in Pennsylvania to report their income and receipts.

Who is required to file PA BIRT-EZ?

Businesses in Pennsylvania with gross receipts of $500,000 or less are required to file the PA BIRT-EZ form.

How to fill out PA BIRT-EZ?

To fill out PA BIRT-EZ, collect your business financial information, complete the form with your income and receipts details, and submit it to the appropriate tax authority by the due date.

What is the purpose of PA BIRT-EZ?

The purpose of PA BIRT-EZ is to provide a streamlined process for small businesses to report their income and receipts to the state for tax purposes.

What information must be reported on PA BIRT-EZ?

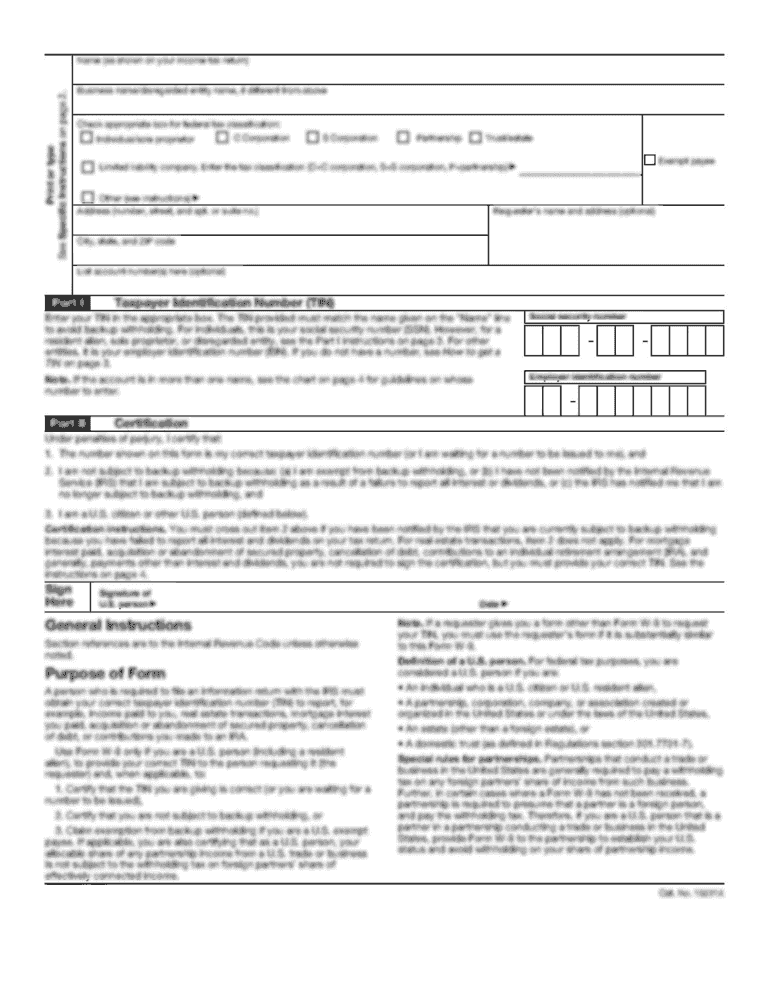

The PA BIRT-EZ requires reporting of gross receipts, business income, and any deductions or credits applicable to the business.

Fill out your PA BIRT-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA BIRT-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.