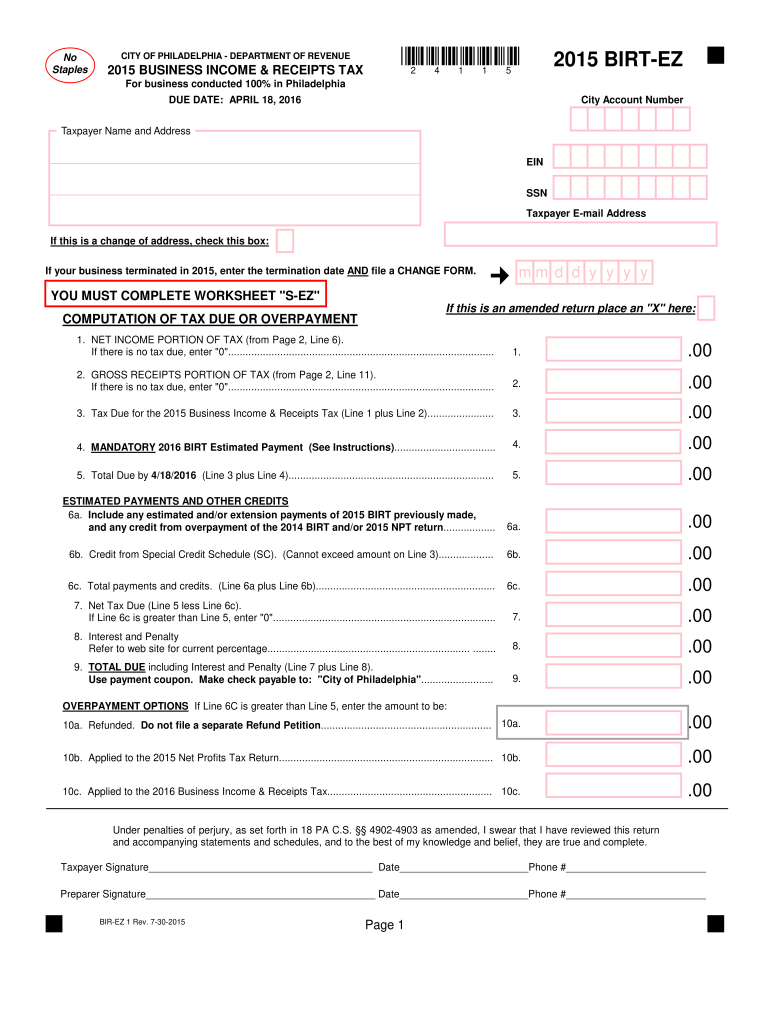

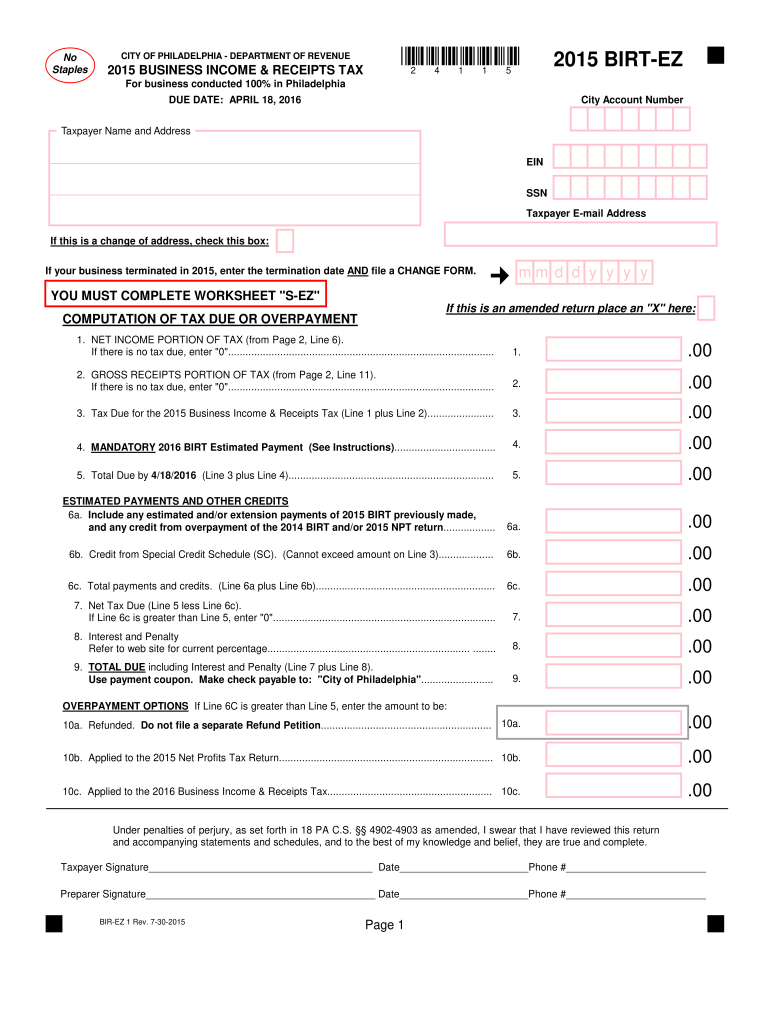

PA BIRT-EZ 2015 free printable template

Get, Create, Make and Sign PA BIRT-EZ

Editing PA BIRT-EZ online

Uncompromising security for your PDF editing and eSignature needs

PA BIRT-EZ Form Versions

How to fill out PA BIRT-EZ

How to fill out PA BIRT-EZ

Who needs PA BIRT-EZ?

Instructions and Help about PA BIRT-EZ

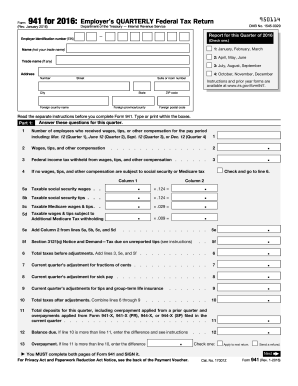

Hey everyone this is Josh with job business solutions, and today we're going to a short video on filling out a Schedule C is used to report your business income it is mostly for people who are sole proprietors meaning you don't you never set up any business entity, and it's also for people who are an in an LLC and their that it's called a single-member LLC meaning you're the only member you don't have any partners so if that's the case you'll also put this on your Schedule C is just a form in your personal tax return it's going to take all the information it's going to summarize it here, and it's going to bring one number over to your 1040 to go either offset or add to your income from other sources like w-2s that kind of stuff, so it's a lot of people find this form pretty confusing after you see if it's pretty straightforward, so it starts out it wants to know the name of the proprietor which is you so in this case put my name social security number zero zero zero zero okay and principle business or profession including product or service, so this is kind of what you do for this example we'll use my business we'll say tax preparer the business code it's a six-digit code and the sort of industry has their own code if you're using tax software they're going to give you kind of drop-down menu to choose from if you're trying to fill this out by hand which I strongly recommend you don't but if you do just go to google and google the business code for whatever business code for retail sales and something will come up it'll give you a code you can use so let's just make up a six-digit number here business name if you never set up a business entity this could just be your name in which case you won't fill this out if you did register with the state as an official business you're going to put your actual name here in my case it will be JD be business solutions your employer ID number that's going to be the 9-digit code you used you registered with the IRS with there is a chance that you never did this if you're not a corporation, so you'll know if you did it you registered with the state or with the IRS, and they sent you a nine-digit number two digits — than seven more digits there we go coming out quite right, but that's the gist of it your business address whether you have a separate office there's just in your home you can put the address in here where you do business okay so those that's the easy part other than the business code everything else is very straightforward and the business code again you can just get by googling your industry business code for whatever industry you're in Part F here accounting method this will definitely throw a lot of people off so there's's basically two choices don't worry about the other there's very low chance you're in the other you're either a cash business or an accrual business most of you who are watching this video who are coming to our website are cash businesses so what that means is you record your...

People Also Ask about

Do businesses have to pay local taxes?

What is the sales tax rate for Philadelphia PA?

How to file Philadelphia wage tax return?

What is pa gross receipts tax?

What is the business income tax on 100000?

What is the business receipt tax in Philadelphia?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PA BIRT-EZ online?

How do I edit PA BIRT-EZ in Chrome?

How do I fill out PA BIRT-EZ using my mobile device?

What is PA BIRT-EZ?

Who is required to file PA BIRT-EZ?

How to fill out PA BIRT-EZ?

What is the purpose of PA BIRT-EZ?

What information must be reported on PA BIRT-EZ?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.