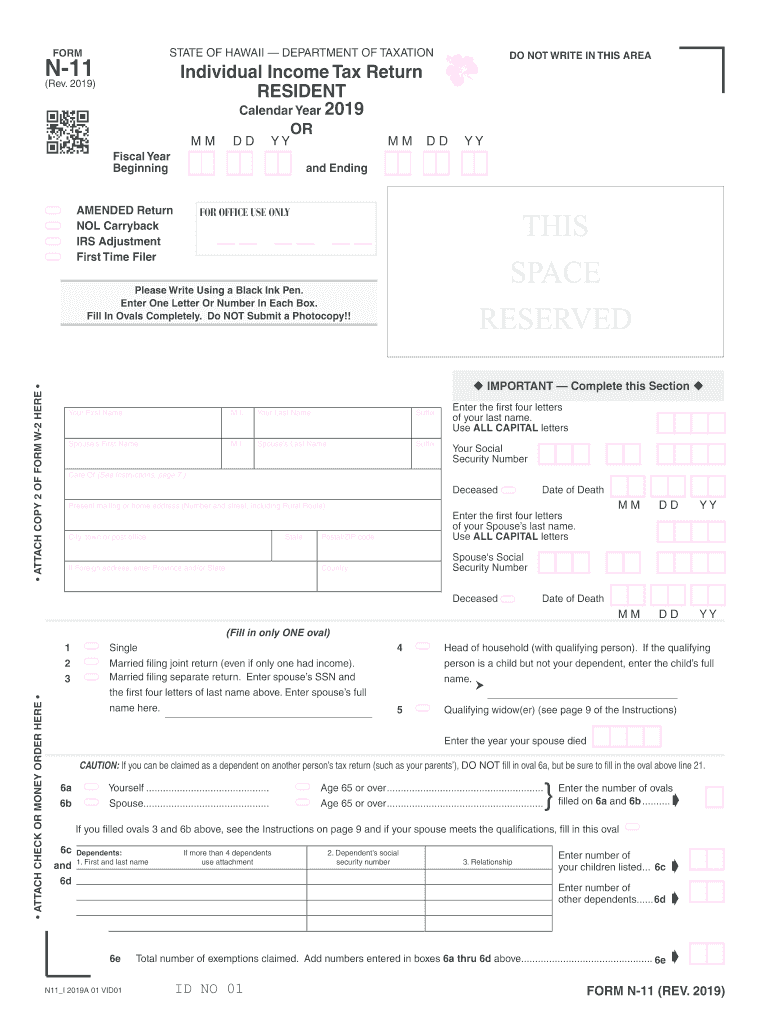

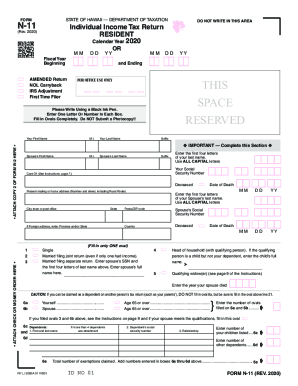

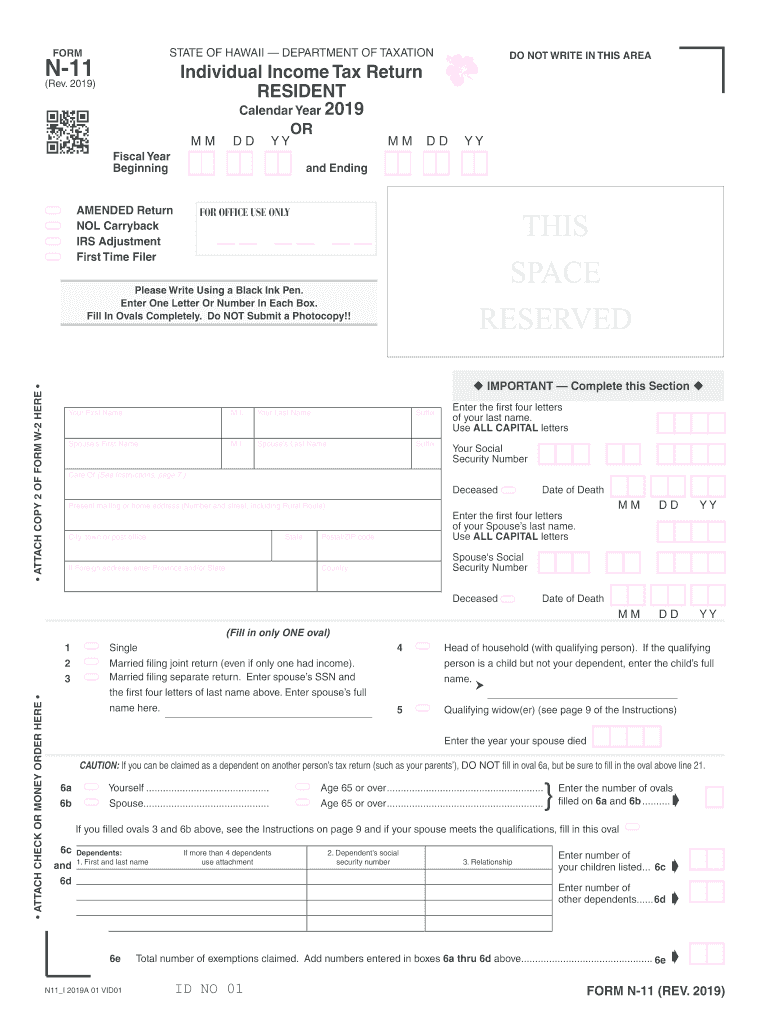

HI N-11 2019 free printable template

Get, Create, Make and Sign HI N-11

Editing HI N-11 online

Uncompromising security for your PDF editing and eSignature needs

HI N-11 Form Versions

How to fill out HI N-11

How to fill out HI N-11

Who needs HI N-11?

Instructions and Help about HI N-11

Good morning everyone I feel so much better today I feel like a new woman my headaches are gone, and I just feel amazing today really fresh I look like crap but believe me I feel it so much better I think I might film today because obviously Saturday was just not good for me yesterday was not good for me, so I'm kind of a day down with work and YouTube stuff, so I'm gonna film our edit today or both probably Jimmy's going over to Montana today which is just if you're from Ireland it's basically were race cars or drift cars which is what he's mostly into drift and rear-wheel drive car I'm going to film because I've the house to myself he's taking work off tomorrow, so we get to spend time together properly I have as you know all that makeup line all over the floor I'm not going to bother with that till later tonight because while I have the light I may as well take advantage of it and then later on tonight when it's dark put away stuff sitting down getting ready to film I have my cup of tea with me, I've tried so many of these flat Tommy T that's what Scott I've tried so many of these teas I've done about a thousand in troll cities like this where I want to make a video and I do like a little intro Mikkel obviously I start at the first day that I start the tea, and then it doesn't work out, so I never do the extra don't do a video on the product so be interesting to see if I actually enjoyed this team the only team that I ever, ever used that I had any benefits was the tiny team got really really really helped me and Cabrini was good this one has a morning and a nighttime tea, and I've never drank a tea like that before, so we will make a video on it if it's interesting or if it works out because a lot of you guys are always interested in these type of teas I'm just finished filming today I filmed too many other films of favorite, and I filmed this video oh and I filmed the intro of the tea because I just tried a cup of it this morning first I'm going to add up my monthly favorites and I have a vlog to edit, so I'm going to edit those two videos I'm gonna stick up the monthly favorites and the vlog today, and then I'm going to go and clean up my makeup and I will show you what I'm doing as I'm going along won't be a makeup collection video I want to do that obviously later on so decided for breakfast I'm going to have the same as I always have my oatmeal, and it's like I said 12 o'clock like it's a bit late to even breakfast Bush it's okay I'll have this I already had something small this morning, so I'm going to have this new boy named the cattle upside sounds review life is great because yesterday the clocks changed they went forward, so now we're getting an extra hour of light I absolutely love daylight saving there's a daylight savings, or I don't know the opposite today about saving I love when the clocks change because you get the extra hour date will say like it's 12 o'clock it should really be 11, so I'm starting like earlier filming...

People Also Ask about

How do I get my Hawaii state tax form?

Who is required to file a Hawaii tax return?

Where can I get Hawaii state tax forms?

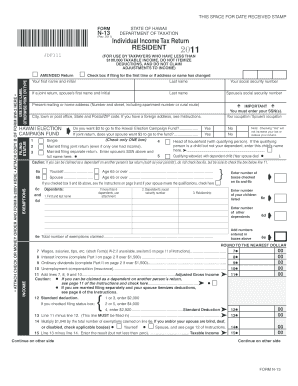

What is the tax form for non residents in Hawaii?

Who has to pay general excise tax in Hawaii?

What is a n11 tax form?

Do I have to file an extension for Hawaii state taxes?

What is the state form for non resident Hawaii?

Do I need to file Hawaii state income tax?

What is an n11 form Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my HI N-11 in Gmail?

How do I edit HI N-11 on an iOS device?

How do I fill out HI N-11 on an Android device?

What is HI N-11?

Who is required to file HI N-11?

How to fill out HI N-11?

What is the purpose of HI N-11?

What information must be reported on HI N-11?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.