OH IT 1040 2019 free printable template

Show details

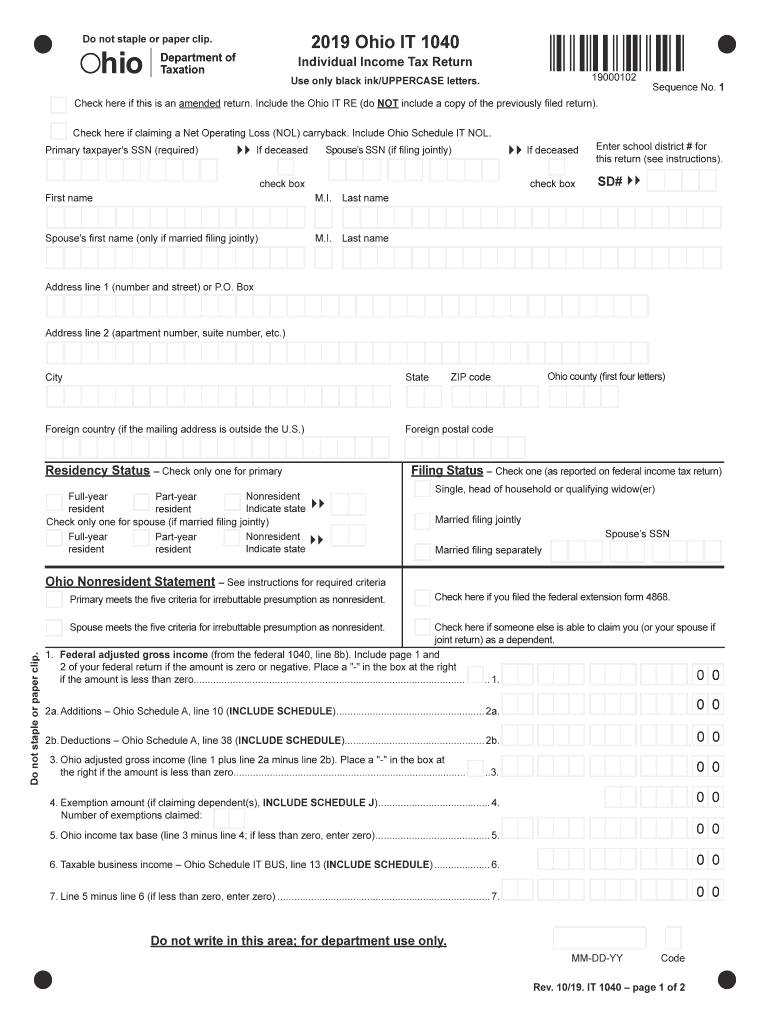

2019 Ohio IT 1040Do not staple or paper clip. Department of

TaxationIndividual Income Tax Return19000102Use only black ink/UPPERCASE letters. Check here if this is an amended return. Include the Ohio

pdfFiller is not affiliated with any government organization

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

Instructions and Help about OH IT 1040

How to edit OH IT 1040

To edit OH IT 1040, utilize a PDF editor that allows for text modifications. Software like pdfFiller enables users to input information into the form digitally, ensuring that all fields are accurately filled out before submission. Start by uploading the form to the platform, then click on the areas that require changes. Save your work frequently to avoid losing any adjustments you make.

How to fill out OH IT 1040

Filling out OH IT 1040 involves several steps to ensure complete and accurate submission. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any other income statements. Follow these steps:

01

Download the OH IT 1040 form from the Ohio Department of Taxation website.

02

Enter your personal information in the appropriate fields, including your name, address, and Social Security number.

03

Record your total income, deductions, and credits as applicable.

04

Calculate your total tax liability.

05

Sign and date the form before submission.

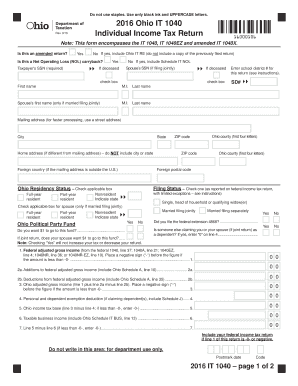

About OH IT previous version

What is OH IT 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH IT previous version

What is OH IT 1040?

OH IT 1040 is the individual income tax return form used by Ohio residents. This form is filed to report income earned during the tax year and determine tax obligations to the state of Ohio. It's essential for residents to comply with state tax laws by submitting this form annually.

What is the purpose of this form?

The primary purpose of the OH IT 1040 is to report individual income and calculate the tax owed to the state. This form collects information on income sources, deductions, and credits available to taxpayers. Proper completion of the form helps ensure accurate tax assessment and compliance with state tax regulations.

Who needs the form?

Residents of Ohio who receive income must file the OH IT 1040. This includes individuals working for an employer, self-employed workers, and those receiving income from various sources such as interest or dividends. Additionally, if you owe taxes or seek a refund, you must submit the form.

When am I exempt from filling out this form?

Taxpayers are exempt from filing the OH IT 1040 if their income falls below the taxable threshold set by the state. Also, if you have no reportable income, or are claiming certain types of unemployment benefits, filing may not be necessary. Always verify the latest guidelines from the Ohio Department of Taxation to confirm your exemption status.

Components of the form

OH IT 1040 consists of several key components necessary for reporting your financial information. These include personal identification details, income sources, adjustments to income, tax calculation, and signature sections. Completing each component accurately is crucial for tax compliance.

What are the penalties for not issuing the form?

Failure to submit OH IT 1040 can result in penalties from the state of Ohio. Taxpayers may incur fines, interest on unpaid taxes, and additional surcharges for late filing. To avoid these penalties, ensure timely submission and compliance with all state tax regulations.

What information do you need when you file the form?

When filing OH IT 1040, gather essential information including proof of income, tax deductions, and credits. Collect W-2 forms from your employer, 1099 forms for self-employment earnings, and receipts for deductible expenses. This documentation supports your claims and helps ensure accurate reporting.

Is the form accompanied by other forms?

In some cases, filing the OH IT 1040 may require additional forms, such as schedules for specific deductions or credits. Review the instructions for the form carefully to determine if supplementary documentation is necessary based on your financial situation.

Where do I send the form?

The completed OH IT 1040 should be mailed to the address specified in the filing instructions. It’s important to check the Ohio Department of Taxation's website for any updates regarding filing locations. Ensure that adequate postage is applied to avoid any delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

love learning everything. Problem with sending multiple pages in one email to have signed. Problems with getting the signature from the recepient because the codes don't work consistently.

I am selling my own piece of real estate and this has been awesome for the necessary forms.

See what our users say