IRS 8995 2019 free printable template

Show details

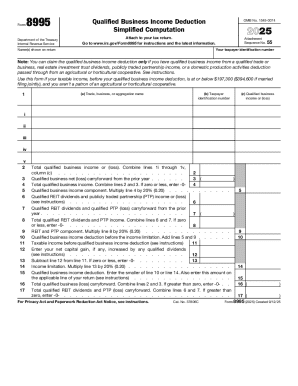

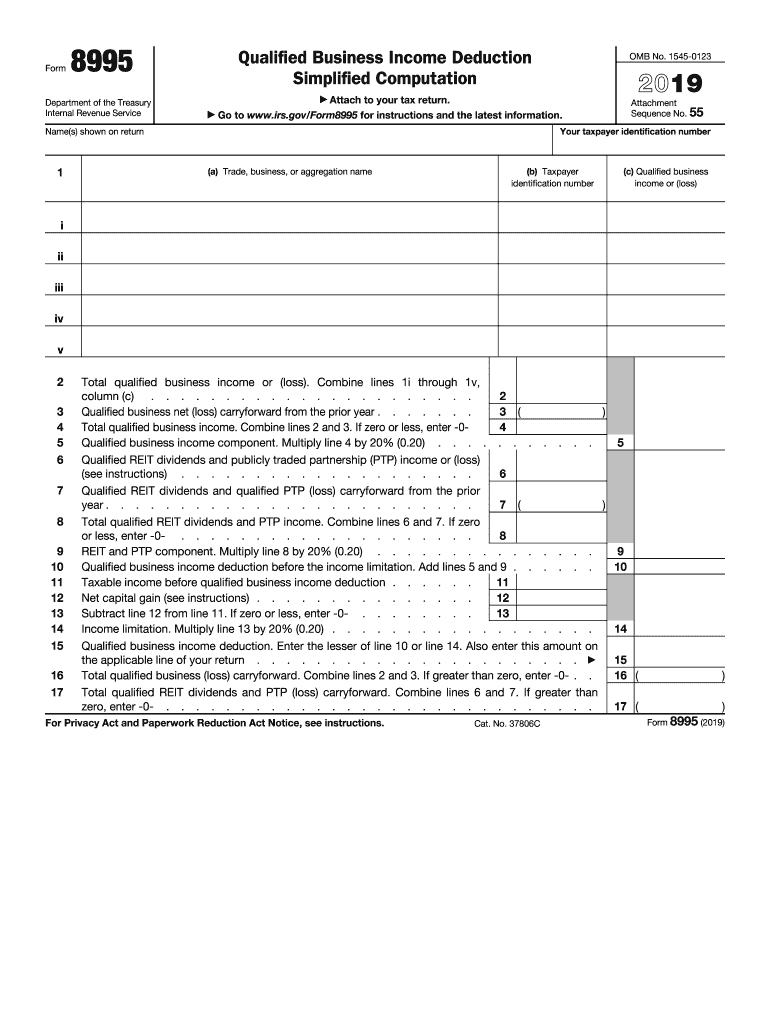

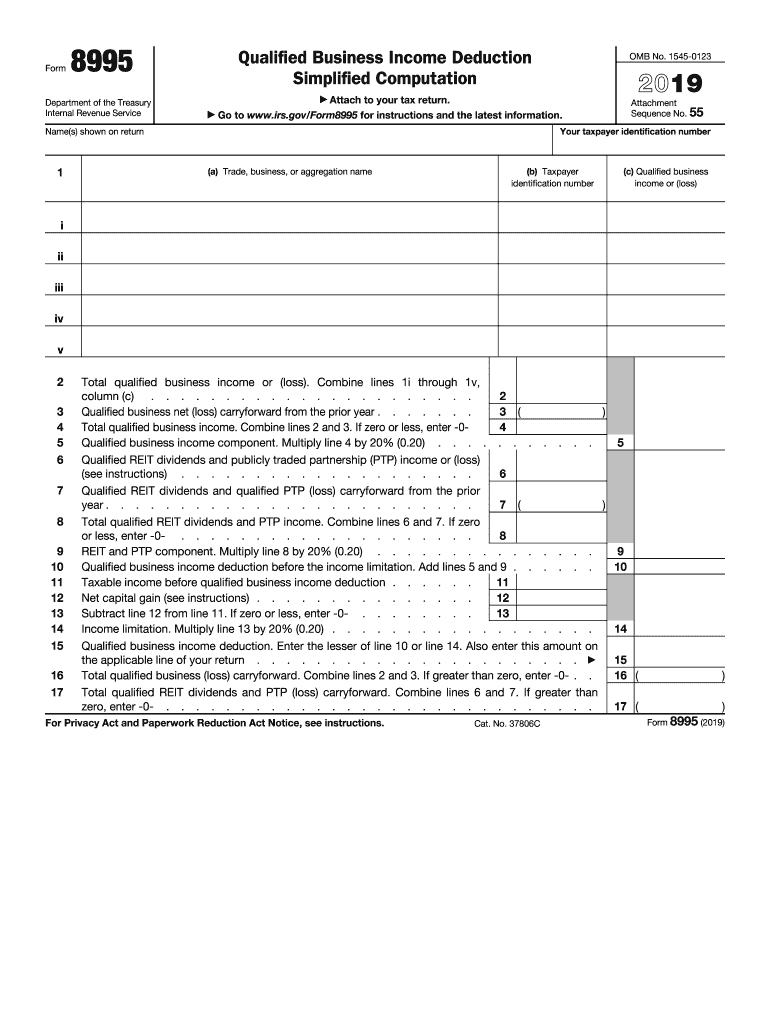

Form8995Department of the Treasury Internal Revenue ServiceQualified Business Income Deduction Simplified Computation Attach to your tax return. Go to www.irs.gov/Form8995 for instructions and the

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8995

Edit your IRS 8995 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8995 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8995 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8995. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8995 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8995

How to fill out IRS 8995

01

Obtain IRS Form 8995 from the IRS website or your tax preparation software.

02

Enter your name and taxpayer identification number at the top of the form.

03

If applicable, enter the name of the pass-through entity if you are claiming deductions through it.

04

Fill out the 'Qualified Business Income' (QBI) section with the appropriate amounts from your business income.

05

Calculate your QBI deduction using the formulas provided in the instructions.

06

Complete any applicable sections related to special circumstances or limitations.

07

Double-check all entries for accuracy before submission.

08

Attach Form 8995 to your tax return when filing.

Who needs IRS 8995?

01

Individuals and entities that have qualified business income (QBI) and are seeking to claim the Qualified Business Income deduction under Section 199A.

02

Self-employed individuals, partnerships, S corporations, and certain trusts and estates may need to file this form.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the 20% pass-through deduction?

You Must Have Taxable Income This is your total taxable income from all sources (business, investment, and job income) minus deductions, including the standard deduction ($13,850 for singles; $27,700 for marrieds in 2023). You must have positive taxable income to take the pass-through deduction.

How do you qualify for qualified business income deduction?

To get the qualified business income deduction, your business can't be a C corporation, and you must pay business taxes on your personal tax return. The qualified business income deduction (QBI) deduction is worth up to 20% of qualified net business income.

What is a 8995 form for?

Use Form 8995 to figure your qualified business income deduction.

Who qualifies for Section 199A qualified business income deduction?

Individuals, as well as owners of sole proprietorships, S corporations, and partnerships can qualify for this deduction.

What counts as qualified business income?

QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts.

Who needs to file form 8995?

If you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (LLCs), you need to file Form 8995 or Form 8995-A to receive a “pass-through” business deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8995 to be eSigned by others?

To distribute your IRS 8995, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the IRS 8995 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IRS 8995 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out IRS 8995 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 8995 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 8995?

IRS Form 8995 is used to report the Qualified Business Income Deduction (QBI) under Section 199A of the Internal Revenue Code, allowing eligible taxpayers to claim a deduction for qualified business income from pass-through entities.

Who is required to file IRS 8995?

Taxpayers who have qualified business income and are eligible for the QBI deduction, including owners of sole proprietorships, partnerships, S corporations, and some trusts, may be required to file IRS 8995.

How to fill out IRS 8995?

To fill out IRS 8995, taxpayers need to complete sections detailing their business income, deduction calculations, and any applicable adjustments. It's important to follow the form instructions and provide accurate information relating to QBI.

What is the purpose of IRS 8995?

The purpose of IRS 8995 is to help taxpayers calculate and report their eligible QBI deduction, ultimately reducing their taxable income and tax liability.

What information must be reported on IRS 8995?

IRS 8995 requires taxpayers to report their qualified business income, total qualified business losses, and any eligible deductions, as well as information about their business entities and owners.

Fill out your IRS 8995 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8995 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.