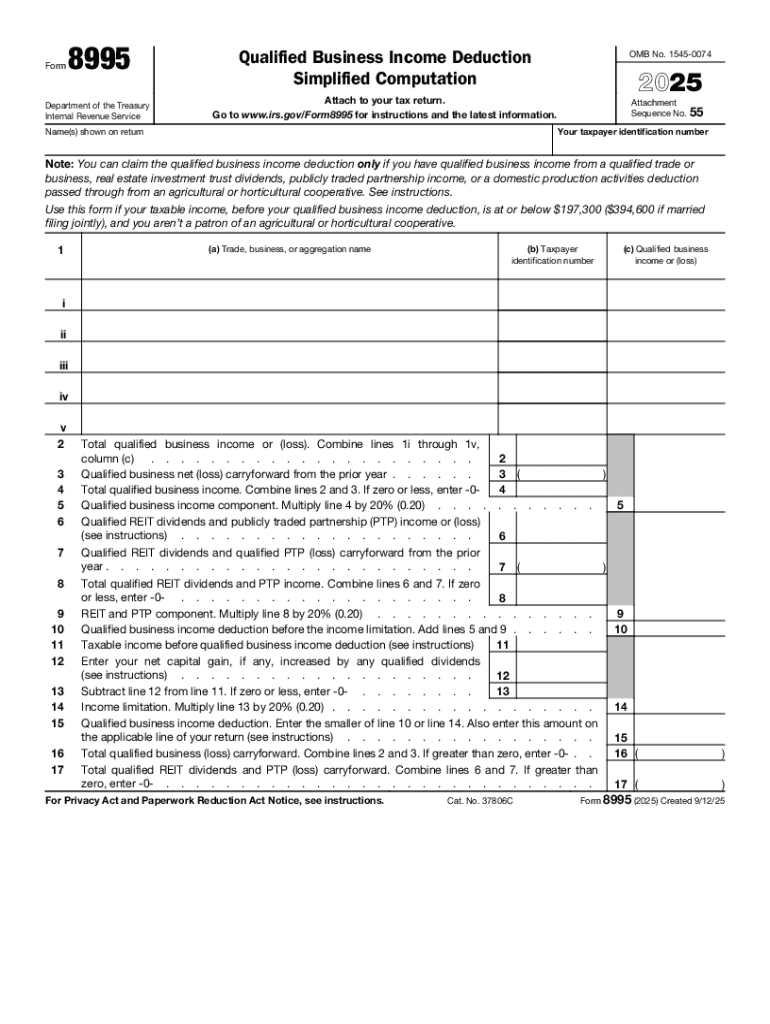

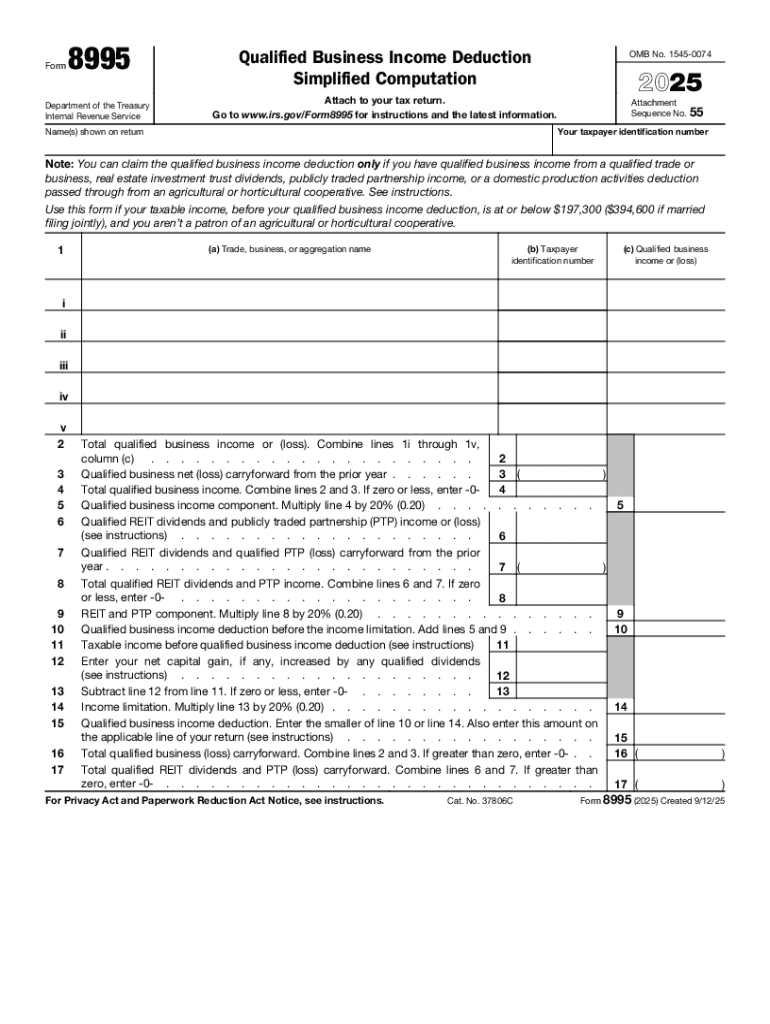

IRS 8995 2025-2026 free printable template

Get, Create, Make and Sign IRS 8995

Editing IRS 8995 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8995 Form Versions

How to fill out IRS 8995

How to fill out 2025 form 8995

Who needs 2025 form 8995?

A Comprehensive Guide to the 2025 Form 8995 Form

Understanding Form 8995

The 2025 Form 8995 serves as a crucial tool for taxpayers seeking to benefit from the Qualified Business Income (QBI) Deduction. Introduced under Section 199A, this form is primarily aimed at simplifying the calculation of eligible deductions for individuals and certain pass-through entities, like partnerships and S corporations. By using Form 8995, taxpayers can efficiently declare their qualified business income, ensuring they receive the tax relief intended for small businesses and self-employed individuals.

Filing this form is especially important because it helps taxpayers reduce their taxable income, thereby potentially lowering their overall tax obligation. The Qualified Business Income deduction allows eligible taxpayers to deduct up to 20% of their business income, which is significant for many who are self-employed or run small businesses.

Key features of Form 8995

One of the key features of Form 8995 is its simplified computation process. Unlike the more complex Form 8995-A, which provides additional calculations for higher-income earners and those with specified service trades or businesses, the simpler format of Form 8995 is tailored for those whose taxable income is below certain thresholds.

Who should file Form 8995?

Form 8995 is specifically designed for qualifying individuals and entities that wish to claim the QBI deduction. This includes individuals with eligible business income, as well as pass-through entities and self-employed individuals. Typically, individuals operating sole proprietorships, rental real estate activities, and partnerships may find this form advantageous.

However, it's essential to understand the filing requirements and considerations tied to forming 8995. Taxpayers must keep in mind income thresholds that can impact their filing strategy. For example, should your taxable income exceed the set limits, it may be beneficial to explore Form 8995-A, which accounts for limitations based on higher income and additional calculations.

Detailed step-by-step guide to filing Form 8995

Filing Form 8995 involves several critical steps to ensure accuracy and completeness. First, gather all necessary information, including documentation related to your business income and expenses. This is vital for accurately reporting QBI, as well as determining the appropriate deductions.

Gathering required information

Key documents to collect include income statements, expense receipts, and any records of prior year QBI deductions. Organizing these documents effectively can also simplify the filing process immensely.

Completing each section of Form 8995

When completing Form 8995, it can be helpful to break down the form into its three main parts.

Common mistakes to avoid

Common mistakes while filing include misreporting QBI, miscalculating deductions, and failing to sign the form. Always double-check entries for completeness and accuracy before submission to avoid year-end surprises.

Tools and resources for managing your Form 8995 filing

Utilizing interactive tools can be a game-changer when completing Form 8995. Services like pdfFiller help streamline the process by allowing users to fill out, edit, and sign forms directly within a cloud-based platform.

Interactive tools for form completion

pdfFiller enhances the filing experience through its user-friendly features. Users can walk through the process of completing Form 8995 with integrated tips and guidelines, ensuring every section is correctly filled out and compliant with IRS regulations.

Supporting documents and records

Maintaining organized records is essential for audits or reviews. Keeping a file of all supporting documents related to Form 8995 will help you respond quickly to any inquiries, paving the way for a smoother experience in tax season.

FAQ about Form 8995

When filing Form 8995, taxpayers often have common questions. Understanding these nuances can safeguard your filing from potential issues.

General questions

A frequent inquiry is how the QBI deduction works. Essentially, it allows eligible taxpayers to deduct a specific portion of their income, serving as a vital means of tax relief. Another concern is about errors on forms; if you make a mistake, it is essential to amend your filing promptly to avoid complications.

Filing specific inquiries

Additionally, awareness of deadlines for filing Form 8995 is crucial, especially as they can differ based on your individual tax situation. Should educational inquiries arise post-filing, options are available for amending your return through the IRS guidelines.

Advanced considerations

Tax laws can evolve, and potential changes in 2025 might affect how Form 8995 is filed. Staying updated with relevant changes in tax regulations should be a priority for business owners and self-employed individuals to ensure compliance and optimize filing strategies.

Consulting a tax professional

When complexities arise, seeking professional advice is beneficial. Tax professionals can offer insights specific to your situation, especially for unique business structures or high-income scenarios where the implications of different forms can substantially affect your tax liabilities.

Using pdfFiller for optimal form management

pdfFiller not only provides a platform for completing Form 8995, but also enhances the overall management of your forms through comprehensive PDF editing, eSigning, and collaboration features. This all-in-one solution empowers individuals and teams to manage their documents effectively.

Overview of pdfFiller features

With pdfFiller, you can drag and drop your files for easy upload, access templates, and sign documents electronically. These features significantly improve efficiency and reduce the friction commonly associated with traditional filing processes.

Case studies and user testimonials

There are numerous case studies illustrating the success story of users who leveraged pdfFiller for their Form 8995 filings. Testimonials highlight the stress reduction and increased accuracy achieved with the platform, demonstrating how it enhances the filing experience by simplifying complex tasks.

People Also Ask about

How do I know if I qualify for qualified business income deduction?

What is the purpose of the qualified business income deduction?

Do I need tax form 8995?

Why am I being asked for a Form 8995?

What is qualified business income on Form 8995?

What triggers a form 8995?

Who qualifies for qualified business income?

Do I have to fill out form 8995?

Do I have to take the Qbi deduction?

Why do I need tax form 8995?

Who needs an 8995?

Who Must File 8995?

Who must file IRS form 8995?

What is the purpose of IRS form 8995?

Why am I getting a qualified business income deduction?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS 8995 online?

How do I edit IRS 8995 online?

How do I edit IRS 8995 in Chrome?

What is 2025 form 8995?

Who is required to file 2025 form 8995?

How to fill out 2025 form 8995?

What is the purpose of 2025 form 8995?

What information must be reported on 2025 form 8995?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.