IRS 8995 2021 free printable template

Show details

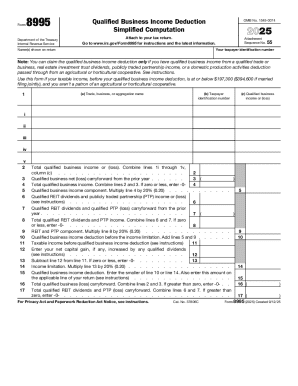

Form8995Department of the Treasury

Internal Revenue ServiceQualified Business Income Deduction

Simplified Computation OMB No. 15452294 Attach to your tax return.

Go to www.irs.gov/Form8995 for instructions

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8995

Edit your IRS 8995 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8995 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8995 online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8995. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8995 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8995

How to fill out IRS 8995

01

Download or obtain a copy of IRS Form 8995.

02

Enter your name and Social Security Number (SSN) or Employer Identification Number (EIN) at the top of the form.

03

Complete Part I by reporting the Qualified Business Income (QBI) you received.

04

If applicable, include any items listed as deductions or losses from the trade or business.

05

Calculate the total amount of QBI, deductions, and any applicable modifications.

06

Complete Part II to determine the amount of your Qualified Business Income Deduction.

07

Transfer the calculated deduction amount to your tax return, generally on Form 1040 or appropriate business tax form.

08

Review the completed form for accuracy and ensure all information corresponds with supporting documentation.

Who needs IRS 8995?

01

Individuals who have qualified business income from pass-through entities like sole proprietorships, partnerships, or S corporations.

02

Taxpayers claiming the Qualified Business Income Deduction under Section 199A.

03

Self-employed individuals who operate a business and generate income eligible for deduction.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I qualify for qualified business income deduction?

Determine whether your income is related to a qualified trade or business. You must have ownership interest in a qualified trade or business to claim the QBI deduction. A qualified business is a partnership, S corporation, or sole proprietorship. They're also known as pass-through entities.

What is the purpose of the qualified business income deduction?

The qualified business income deduction (QBI) is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income on their taxes. In general, total taxable income in 2022 must be under $170,050 for single filers or $340,100 for joint filers to qualify.

Do I need tax form 8995?

If your income is more than the threshold, you must use Form 8995-A. Your QBI includes qualified items of income, gain, deduction, and loss from your trades or businesses that are effectively connected with the conduct of a trade or business in the United States.

Why am I being asked for a Form 8995?

Form 8995 is the IRS tax form that owners of pass-through entities—sole proprietorships, partnerships, LLCs, or S corporations—use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

What is qualified business income on Form 8995?

If your income is more than the threshold, you must use Form 8995-A. Determining Your. Qualified Business Income. Your QBI includes qualified items of income, gain, deduction, and loss from your trades or businesses that are effectively connected with the conduct of a trade or business in the United States.

What triggers a form 8995?

With the pass-through business deduction, you may be able to deduct up to 20% of your share of qualified business income from your total taxable income. If your total taxable income before the credit falls below $170,050 for single filers or $340,100 for joint filers, use Form 8995.

Who qualifies for qualified business income?

Many individuals, including owners of businesses operated through sole proprietorships, partnerships, S corporations, trusts and estates may be eligible for a qualified business income deduction, also called the section 199A deduction. Some trusts and estates may also claim the deduction directly.

Do I have to fill out form 8995?

ing to the IRS: Form 8995-A must be used if taxable income is over the [minimum income] threshold or if you or any of your trades or businesses are patrons of a specified cooperative. Alternatively, Form 8995 may be used in all other cases…

Do I have to take the Qbi deduction?

The QBI deduction is only available to owners of pass-through businesses, even if you've opted to take the standard deduction as opposed to an itemized deduction. But the limitations don't end there.The taxable income limits for 2023 are: Filing statusTotal taxable incomeAvailable deductionSingle< $182,10020%5 more rows • Nov 30, 2022

Why do I need tax form 8995?

Use Form 8995 to figure your qualified business income deduction.

Who needs an 8995?

Form 8995 is the IRS tax form that owners of pass-through entities—sole proprietorships, partnerships, LLCs, or S corporations—use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

Who Must File 8995?

Form 8995 is the IRS tax form that owners of pass-through entities—sole proprietorships, partnerships, LLCs, or S corporations—use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

Who must file IRS form 8995?

Form 8995-A must be used if taxable income is over the [minimum income] threshold or if you or any of your trades or businesses are patrons of a specified cooperative. Alternatively, Form 8995 may be used in all other cases… …

What is the purpose of IRS form 8995?

Use Form 8995 to figure your qualified business income deduction.

Why am I getting a qualified business income deduction?

The qualified business income deduction is for people who have “pass-through income” — that's business income that you report on your personal tax return. Entities eligible for the qualified business income deduction include: Sole proprietorship s. Partnerships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS 8995 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS 8995 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit IRS 8995 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IRS 8995.

Can I edit IRS 8995 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS 8995 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS 8995?

IRS Form 8995 is a tax form used by businesses and individuals to claim the Qualified Business Income (QBI) deduction under Section 199A.

Who is required to file IRS 8995?

Taxpayers with qualified business income from pass-through entities, including sole proprietorships, partnerships, and S corporations, who meet certain income thresholds must file IRS 8995.

How to fill out IRS 8995?

To fill out IRS 8995, taxpayers should gather their income information from qualifying businesses, complete the necessary sections detailing qualified business income and deductions, and ensure accurate calculations according to IRS guidelines.

What is the purpose of IRS 8995?

The purpose of IRS 8995 is to calculate and claim the QBI deduction, allowing eligible taxpayers to reduce their taxable income based on their qualified business income.

What information must be reported on IRS 8995?

IRS 8995 requires reporting of qualified business income, the total deductions, and the final QBI deduction amount, as well as identifying information about the business and taxpayer.

Fill out your IRS 8995 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8995 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.