NY TC TC105 2020 free printable template

Show details

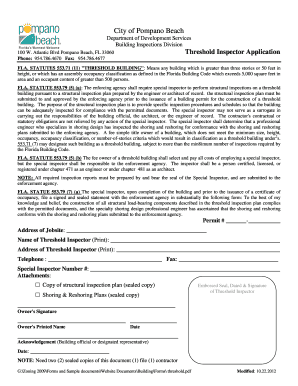

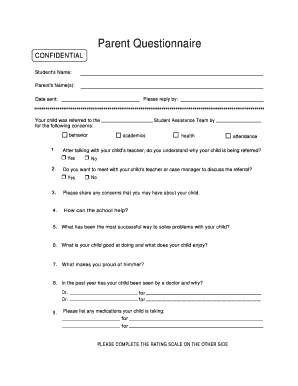

TAX COMMISSION OF THE CITY OF NEW YORK

1 Center Street, Room 2400, New York, NY 10007 CopyTC105

2020/21APPLICATION FOR CORRECTION OF ASSESSED VALUE OF

UTILITY AND OTHER PROPERTY INDICATED ON TAX MAPS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC TC105

Edit your NY TC TC105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC TC105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC TC105 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY TC TC105. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC TC105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC TC105

How to fill out NY TC TC105

01

Begin by downloading the NY TC TC105 form from the New York State Department of Taxation and Finance website.

02

Enter your personal information at the top of the form, including your name, address, and identification number.

03

Provide the details of your tax situation in the designated sections, including income and deductions.

04

Fill in any required calculations or additional information based on your specific filing requirements.

05

Review the instructions carefully to ensure all sections are completed accurately.

06

Sign and date the form where indicated.

07

Submit the completed form by the specified deadline, either electronically or by mailing it to the appropriate address.

Who needs NY TC TC105?

01

Individuals who are required to report certain tax credits and need to claim a refund.

02

Taxpayers who have income that qualifies for New York State tax concessions.

03

Residents of New York who need to provide additional information for their state tax return.

Fill

form

: Try Risk Free

People Also Ask about

What does SBL stand for in real estate?

The term securities-based lending (SBL) refers to the practice of making loans using securities as collateral. Securities-based lending provides ready access to capital that can be used for almost any purpose such as buying real estate, purchasing property like jewelry or a sports car, or investing in a business.

What is a tax map number in South Carolina?

Parcels of Real Estate in SC are divided into tax maps in each county. This is a drawing that the county keeps on record for real estate tax purposes. Every property is identified by a TMS# or Tax Map Number.

Where can I get a copy of my property survey in NYC?

Call the ACRIS Help Line at (212) 487-6300 for assistance or Email the ACRIS Help Desk. Contact the Division of Land Records. Historical index data is also available for download by special request to the City Register.

What is a tax map number in New York?

It is simply a measurement of the parcel's location from a given point added to the constant readings at the given point in the New York Coordinate System. The first set of digits shows the final easterly reading. The second shows the final northerly reading. See Exhibit #5.

What is tax map?

What is Tax Mapping? Tax Mapping is where the Bureau of Internal Revenue (BIR) visits your company to check whether you are fully compliant with the latest tax laws and regulations.

What is a tax folio number in Florida?

The folio number is a means by which properties are identified in Miami-Dade County. It is also referred to as the parcel identifier and represents a unique number that computer systems use to associate to a property. The folio number is formatted as a 13 digit number (99-9999-999-9999).

What is a parcel on a map?

A Parcel Map shows the subdivision of land into Parcels for sale and is recorded in the County Recorder's Office. Parcel Maps typically contain fewer “Lots” than Tract Maps and requirements for improvements (to the property) are less extensive than for Tract Maps.

What is a tax map number in New York?

The parcel identification number from the assessment roll, sometimes referred to as the tax map number or SBL, is synonymous with the location of the parcel on the tax map. The county tax map is broken down into approximately 1,133 sections and subsections.

What is a parcel code?

An assessor's parcel number is a series of fourteen numbers/digits that are used as a file number to inventory or identify property. The first three numbers of the series are used to identify the map book the real property is located in. The next three digits represent the page number within the map book.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY TC TC105 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your NY TC TC105 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify NY TC TC105 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like NY TC TC105, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the NY TC TC105 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is NY TC TC105?

NY TC TC105 is a form used for reporting transactions related to New York State taxes under specific circumstances.

Who is required to file NY TC TC105?

Entities or individuals that engage in certain taxable transactions in New York State are required to file NY TC TC105.

How to fill out NY TC TC105?

To fill out NY TC TC105, provide accurate information regarding the transaction, including relevant dates, identification numbers, and amounts, following the form's specific instructions.

What is the purpose of NY TC TC105?

The purpose of NY TC TC105 is to document and report specific tax-related transactions to ensure compliance with New York State taxation laws.

What information must be reported on NY TC TC105?

The information that must be reported includes the names and addresses of parties involved, transaction details, tax identification numbers, and any applicable payment amounts.

Fill out your NY TC TC105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC tc105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.