NY TC TC105 2021 free printable template

Show details

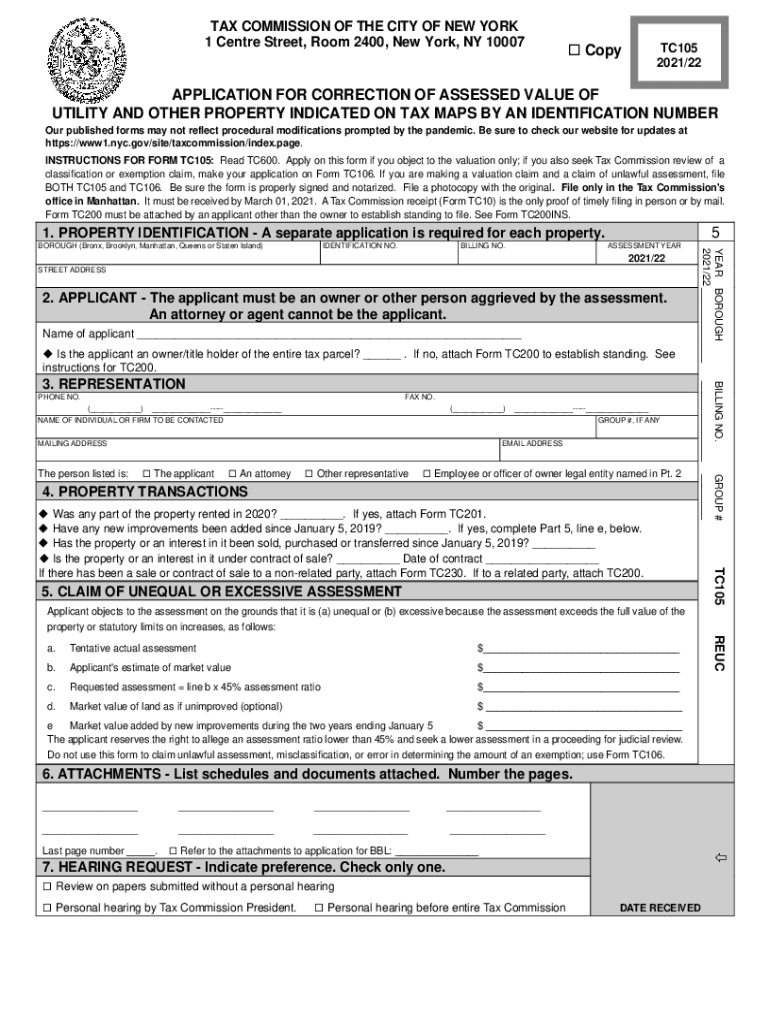

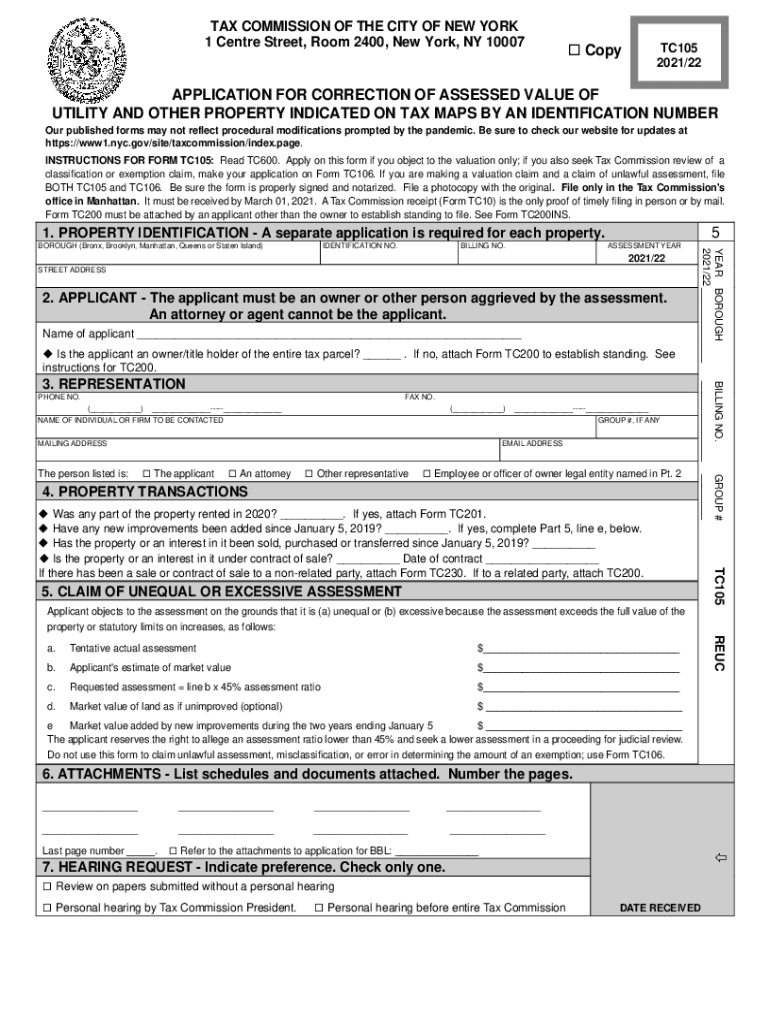

TAX COMMISSION OF THE CITY OF NEW YORK

1 Center Street, Room 2400, New York, NY 10007 CopyTC105

2021/22APPLICATION FOR CORRECTION OF ASSESSED VALUE OF

UTILITY AND OTHER PROPERTY INDICATED ON TAX MAPS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC TC105

Edit your NY TC TC105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC TC105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC TC105 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY TC TC105. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC TC105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC TC105

How to fill out NY TC TC105

01

Obtain a copy of the NY TC TC105 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information including your name, address, and identification number.

03

Indicate the tax year for which you are filing the TC105.

04

Provide details of your income sources including wages, pensions, and any other taxable income.

05

Calculate your total income and any applicable deductions as required by the instructions on the form.

06

Review the form for any errors or omissions.

07

Sign and date the form at the bottom.

08

Submit your completed TC105 form either electronically or by mailing it to the designated address.

Who needs NY TC TC105?

01

Individuals who are residents of New York and need to request a tax credit for certain eligible expenses.

02

Taxpayers who are filing state income tax returns and qualify for the specific tax credits outlined in the TC105.

Fill

form

: Try Risk Free

People Also Ask about

What does SBL stand for in real estate?

The term securities-based lending (SBL) refers to the practice of making loans using securities as collateral. Securities-based lending provides ready access to capital that can be used for almost any purpose such as buying real estate, purchasing property like jewelry or a sports car, or investing in a business.

What is a tax map number in South Carolina?

Parcels of Real Estate in SC are divided into tax maps in each county. This is a drawing that the county keeps on record for real estate tax purposes. Every property is identified by a TMS# or Tax Map Number.

Where can I get a copy of my property survey in NYC?

Call the ACRIS Help Line at (212) 487-6300 for assistance or Email the ACRIS Help Desk. Contact the Division of Land Records. Historical index data is also available for download by special request to the City Register.

What is a tax map number in New York?

It is simply a measurement of the parcel's location from a given point added to the constant readings at the given point in the New York Coordinate System. The first set of digits shows the final easterly reading. The second shows the final northerly reading. See Exhibit #5.

What is tax map?

What is Tax Mapping? Tax Mapping is where the Bureau of Internal Revenue (BIR) visits your company to check whether you are fully compliant with the latest tax laws and regulations.

What is a tax folio number in Florida?

The folio number is a means by which properties are identified in Miami-Dade County. It is also referred to as the parcel identifier and represents a unique number that computer systems use to associate to a property. The folio number is formatted as a 13 digit number (99-9999-999-9999).

What is a parcel on a map?

A Parcel Map shows the subdivision of land into Parcels for sale and is recorded in the County Recorder's Office. Parcel Maps typically contain fewer “Lots” than Tract Maps and requirements for improvements (to the property) are less extensive than for Tract Maps.

What is a tax map number in New York?

The parcel identification number from the assessment roll, sometimes referred to as the tax map number or SBL, is synonymous with the location of the parcel on the tax map. The county tax map is broken down into approximately 1,133 sections and subsections.

What is a parcel code?

An assessor's parcel number is a series of fourteen numbers/digits that are used as a file number to inventory or identify property. The first three numbers of the series are used to identify the map book the real property is located in. The next three digits represent the page number within the map book.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NY TC TC105 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NY TC TC105.

Can I edit NY TC TC105 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NY TC TC105 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete NY TC TC105 on an Android device?

Use the pdfFiller app for Android to finish your NY TC TC105. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY TC TC105?

NY TC TC105 is a tax form used in New York State for claiming certain tax credits or for reporting specific tax-related information.

Who is required to file NY TC TC105?

Individuals or businesses that are claiming certain tax credits or benefits mandated by New York State must file NY TC TC105.

How to fill out NY TC TC105?

To fill out NY TC TC105, taxpayers need to provide specific personal or business information, complete required sections based on the tax credits being claimed, and submit it according to the filing instructions provided by the New York State Department of Taxation and Finance.

What is the purpose of NY TC TC105?

The purpose of NY TC TC105 is to enable taxpayers to report information necessary to qualify for and claim tax credits or incentives offered by New York State.

What information must be reported on NY TC TC105?

The information that must be reported on NY TC TC105 includes personal identification details, tax credit types being claimed, supporting documentation for the claims, and any other relevant information as specified in the form instructions.

Fill out your NY TC TC105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC tc105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.