CA FTB 540 2EZ 2019 free printable template

Show details

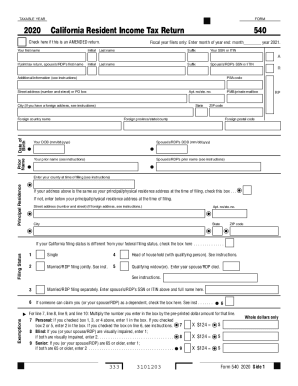

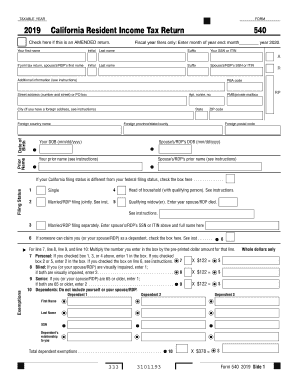

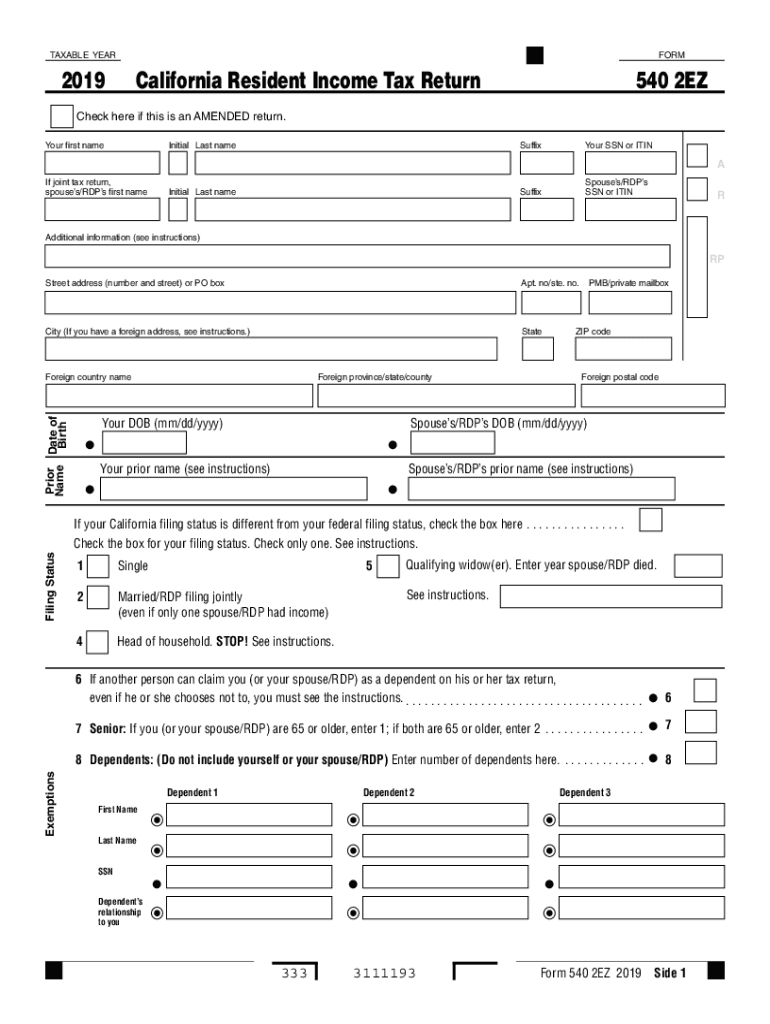

Dependent 1 First Name Last Name SSN relationship to you 3111183 Form 540 2EZ 2018 Side 1 RP Your name Taxable Income and Credits Whole dollars only 9 Total wages federal Form W-2 box 16. This space reserved for 2D barcode Side 2 Form 540 2EZ 2018 Voluntary Contributions Code Amount California Seniors Special Fund. See instructions 400 Rare and Endangered Species Preservation Voluntary Tax Contribution Program.. TAXABLE YEAR FORM 2018 California Resident...Income Tax Return 540 2EZ Check here if this is an AMENDED return. Your first name Initial Last name Suffix Your SSN or ITIN A If joint tax return spouse s/RDP s first name Spouse s/RDP s SSN or ITIN R Additional information see instructions Street address number and street or PO box Apt. no/ste. no. City If you have a foreign address see instructions. Foreign country name Date of Birth Prior Name State PMB/private mailbox ZIP code Foreign province/state/county Your DOB mm/dd/yyyy Foreign postal...code Spouse s/RDP s DOB mm/dd/yyyy Your prior name see instructions Spouse s/RDP s prior name see instructions If your California filing status is different from your federal filing status check the box here. Filing Status Check the box for your filing status. See instructions. Check only one. Single Married/RDP filing jointly even if only one spouse/RDP had income Head of household. STOP See instructions. Qualifying widow er. Enter year spouse/RDP died* See instructions. Exemptions 6 If another...person can claim you or your spouse/RDP as a dependent on his or her tax return even if he or she chooses not to you must see the instructions. 7 Senior If you or your spouse/RDP are 65 or older enter 1 if both are 65 or older enter 2. 8 Dependents Do not include yourself or your spouse/RDP Enter number of dependents here. See instructions. 9 10 Total interest income Form 1099-INT box 1. See instructions. 10 11 Total dividend income Form 1099-DIV box 1a. See instructions. 11 13 Total capital...gains distributions from mutual funds Form 1099-DIV box 2a. 12 Total pension income Enclose but do not staple any payment. Use Tax 16 Add line 9 line 10 line 11 line 12 and line 13. 16 17 Using the 2EZ Table for your filing status enter the tax for the amount on line 16. Caution If you checked the box on line 6 STOP. See instructions for completing the Dependent Tax Worksheet. 17 18 Senior exemption See instructions. If you are 65 or older and entered 1 in the box on line 7 enter 118. If you...entered 2 in the box on line 7 enter 236. 18 19 Nonrefundable renter s credit. See instructions. 19 20 Credits. Add line 18 and line 19. 20 21 Tax. Subtract line 20 from line 17. If zero or less enter -0-. 21 22 Total tax withheld federal Form W-2 box 17 or Form 1099-R box 12. 22 23 Earned Income Tax Credit EITC. See instructions for FTB 3514. 23 24 Total payments. Add line 22 and line 23. 24 26 Payments balance. If line 24 is more than line 25 subtract line 25 from line 24. 26 27 Use Tax...balance. If line 25 is more than line 24 subtract line 24 from line 25.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

To edit the CA FTB 540 2EZ tax form, you can utilize pdfFiller's advanced editing tools. First, open the form within the platform, where you can make necessary adjustments to the text fields. Highlight the sections that require change, and input the correct information directly. Be sure to save your edits before moving on to completion or submission.

How to fill out CA FTB 540 2EZ

To effectively fill out CA FTB 540 2EZ, follow these steps:

01

Gather all necessary documents, including W-2s and 1099s.

02

Begin with your personal information, including your name, address, and Social Security number.

03

Report all sources of income in the appropriate sections.

04

Calculate your California Adjusted Gross Income (CAGI) as instructed on the form.

05

Follow the prompts to determine your tax credits and final tax liability.

Make sure to review each section for accuracy and completeness. Once fully filled, sign and date your form at the bottom.

About CA FTB 540 2EZ 2019 previous version

What is CA FTB 540 2EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540 2EZ 2019 previous version

What is CA FTB 540 2EZ?

CA FTB 540 2EZ is a simplified individual income tax form for California residents. This form allows filers to compute their income tax liability efficiently if they meet specific requirements. It is especially useful for taxpayers with straightforward financial situations, including wage earners and simple tax situations.

What is the purpose of this form?

The purpose of CA FTB 540 2EZ is to facilitate easier tax filing for eligible California residents. By using this form, taxpayers can report their income, claim deductions, and calculate their tax owed or refund due without complex calculations required by more detailed forms.

Who needs the form?

Eligible filers for the CA FTB 540 2EZ include single or married individuals filing jointly, those earning less than a specified income threshold, and those without dependents. Taxpayers should have wages, pensions, interest, and student scholarships as their only income sources to qualify for this form.

When am I exempt from filling out this form?

You may be exempt from using CA FTB 540 2EZ if your total income exceeds the state's specified limit, or if you have adjustments or credits that this form does not accommodate. Additionally, if you are a non-resident or part-year resident, different forms apply.

Components of the form

The CA FTB 540 2EZ includes sections for personal information, income reporting, deductions, tax credits, and payment calculations. Each part requires specific data that aids in determining the taxpayer's final tax obligation to the state.

Due date

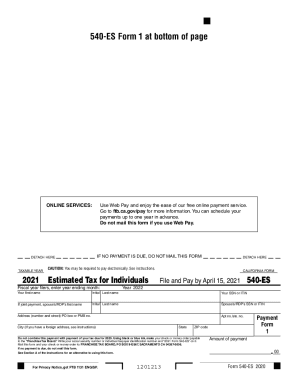

The due date for filing the CA FTB 540 2EZ is typically the 15th of April. If this date falls on a weekend or holiday, the deadline extends to the next business day. It’s important to file on time to avoid penalties.

What are the penalties for not issuing the form?

Failure to file CA FTB 540 2EZ by the due date may result in penalties. Typically, the penalty is a percentage of the unpaid tax amount, accruing each month the return is late. Interest on unpaid taxes also adds to the total owed, compounding monthly.

What information do you need when you file the form?

When filing CA FTB 540 2EZ, you will need your Social Security number, details about your sources of income, any applicable tax credits, and other personal information such as your filing status. Ensure all documents and information are readily available before beginning the form.

Is the form accompanied by other forms?

No additional forms are typically required when filing CA FTB 540 2EZ unless certain situations warrant them, such as specific tax credits or feedback requiring supplementary documentation. Consult the instructions provided with the form for any unique requirements.

Where do I send the form?

Once completed, send CA FTB 540 2EZ to the address specified in the filing instructions included with the form. Ensure to verify whether you are mailing it to a local office or a central processing facility according to your residence and specific instructions for the form.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Awesome; just what I needed. Easy to use and the costs is very affordable.

this is way too expensive for how basic it is...

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.