AL ADoR 40 2019 free printable template

Show details

2019 ×19000140×FORM40Alabama Individual Income Tax Return RESIDENTS & PARTNER RESIDENTS For the year Jan. 1 Dec. 31, 2019, or other tax year:Ending: Beginning:Your first nameInitialSpouses first

pdfFiller is not affiliated with any government organization

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

How to fill out AL ADoR 40

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

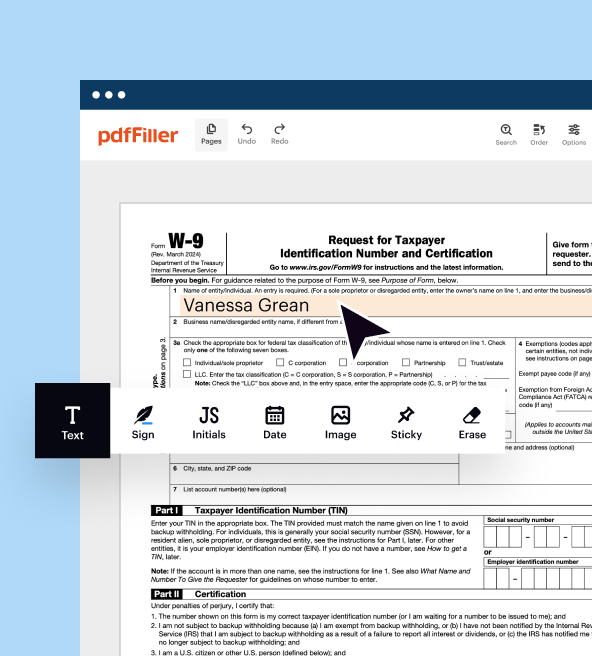

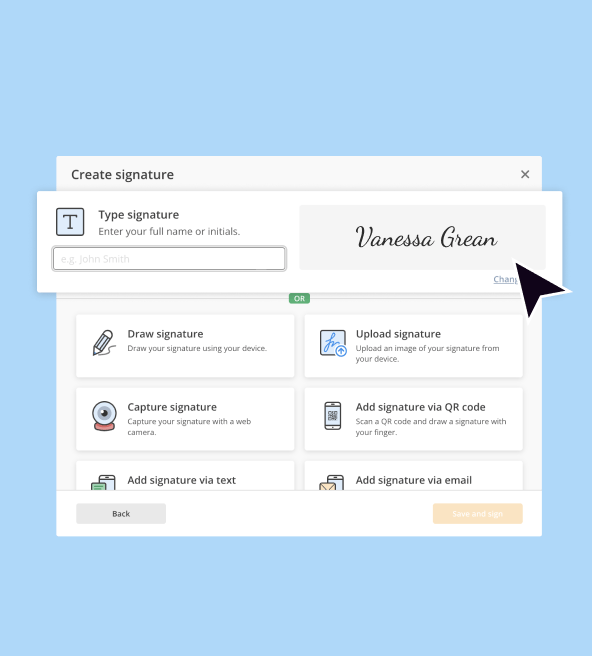

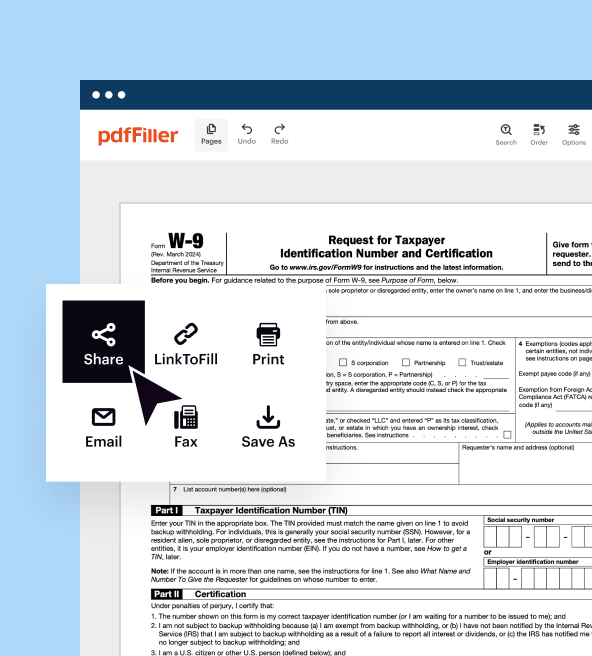

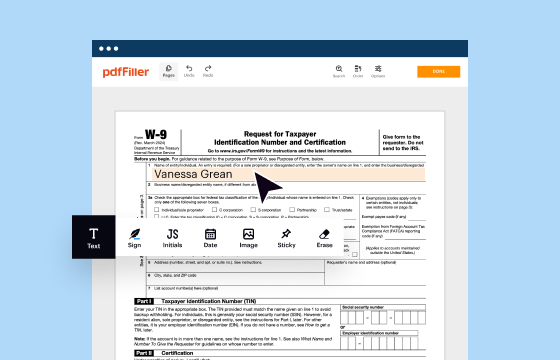

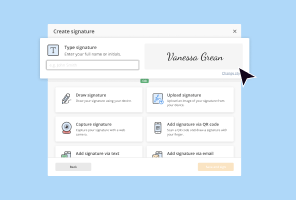

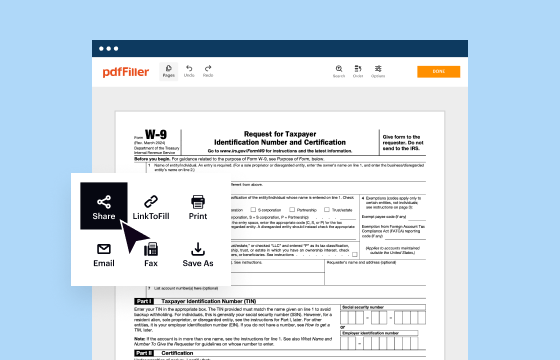

To edit the AL ADoR 40 Tax Form, you may find it beneficial to use tools that allow for form completion and electronic submission. Utilize online PDF editors like pdfFiller to fill out the required information easily. Ensure that all details are accurate, as errors may lead to processing delays or penalties.

How to fill out AL ADoR 40

Filling out the AL ADoR 40 involves providing specific information as required by the Alabama Department of Revenue. Follow these steps to complete the form:

01

Download the AL ADoR 40 form from the Alabama Department of Revenue website.

02

Gather necessary information, including taxpayer identification details and income data.

03

Fill in the form accurately, ensuring compliance with reporting requirements.

04

Review all entries for correctness before finalizing.

About AL ADoR 40 2019 previous version

What is AL ADoR 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AL ADoR 40 2019 previous version

What is AL ADoR 40?

AL ADoR 40 is a tax form used for the reporting of specific financial information to the Alabama Department of Revenue. This form is crucial for ensuring compliance with state tax regulations and is typically used by businesses and individuals to report certain payments and tax-related information.

What is the purpose of this form?

The primary purpose of the AL ADoR 40 is to document and report payments made by taxpayers to recipients, ensuring that both parties comply with Alabama tax laws. This reporting helps the Alabama Department of Revenue track income and enforce compliance with tax obligations.

Who needs the form?

Businesses and individuals who make reportable payments, such as contractors, must file the AL ADoR 40. This requirement applies particularly to those who are subject to Alabama income tax laws and need to report payments made to individuals or entities during a tax year.

When am I exempt from filling out this form?

Exemptions from filing the AL ADoR 40 may apply to taxpayers who do not meet the minimum payment threshold or those who make payments to exempt organizations. It is essential to review the Alabama Department of Revenue guidelines to ensure accurate determination of eligibility for exemption.

Components of the form

The AL ADoR 40 consists of several key components that need to be completed, including taxpayer identification, payment details, and the recipient's information. Each section is designed to collect pertinent information necessary for accurate reporting.

What are the penalties for not issuing the form?

Failing to issue the AL ADoR 40 can result in significant penalties, including fines imposed by the Alabama Department of Revenue. Businesses may face additional scrutiny during audits, which can lead to further penalties if non-compliance is identified.

What information do you need when you file the form?

When filing the AL ADoR 40, you will need the following information:

01

Taxpayer identification number, such as an Employer Identification Number (EIN) or Social Security Number (SSN).

02

Details of payments made during the reporting period.

03

Recipient information, including names and address.

Is the form accompanied by other forms?

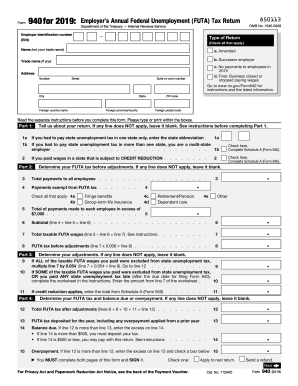

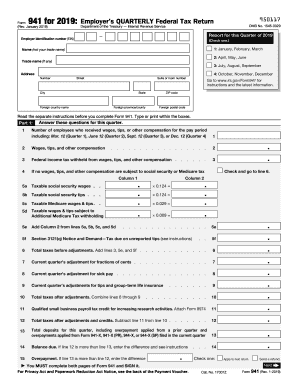

When filing the AL ADoR 40, it may need to be accompanied by other related tax forms or documentation, depending on specific circumstances. It is advisable to confirm requirements with the Alabama Department of Revenue or a tax professional to ensure compliance.

Where do I send the form?

The completed AL ADoR 40 form should be sent to the appropriate mailing address provided by the Alabama Department of Revenue. Ensure to check the state's official website for the current mailing address and any specific submission instructions.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.