CA FTB 109 2019 free printable template

Show details

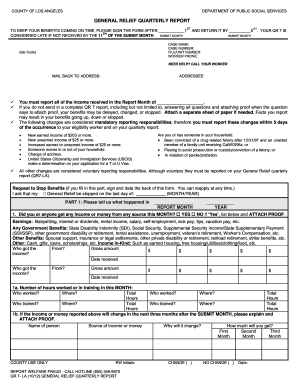

I 25 3641183 Form 109 2018 Side 1 26 Refund. If line 25 is less than line 24 then subtract line 25 from line 24. Side 2 Form 109 2018 m Yes m No Schedule A Cost of Goods Sold and/or Operations. Method of inventory valuation specify 1 Inventory at beginning of year. 4 Total percentage Add the percentages in column c. 5 Average apportionment percentage Divide the factor on line 4 by 3 and enter the result here and on Form 109 Side 1 line 2. Multiply the result by 100. Enter the result here and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 109

Edit your CA FTB 109 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 109 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 109 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 109. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 109 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 109

How to fill out CA FTB 109

01

Obtain the CA FTB 109 form from the California Franchise Tax Board website or through your tax preparer.

02

Fill in your name, address, and Social Security number or Individual Taxpayer Identification Number at the top of the form.

03

Indicate the type of income you are reporting, such as wages, interest, or dividends.

04

Enter all relevant income amounts in the appropriate fields provided on the form.

05

Include any deductions or adjustments that apply to your income.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs CA FTB 109?

01

Individuals who received income from California sources.

02

Taxpayers who need to report California business income.

03

People who qualify for specific tax credits related to California income.

Fill

form

: Try Risk Free

People Also Ask about

How do I write an affidavit in BC?

Written evidence is called an affidavit. An affidavit is your statement of facts about your case – your evidence. You sign the bottom of the statement to confirm that what you've written is true.You must: Tell the truth. Stick to the facts, not opinions. Only include things that are relevant (related) to your case.

What are the requirements for a valid affidavit?

The requirements for the use of an affidavit can be found in a large array of areas, and for an affidavit to be valid, it must be made in the presence of the Commission of Oaths attesting to the oath.

What is a notice of civil claim in BC?

A notice of civil claim is a document that starts a lawsuit against you. The person who started the action is called the plaintiff and you are called the defendant. Generally, you must be personally served with the notice of civil claim.

What is a notice of claim in BC?

NOTICE OF CLAIM with a copy of the document, your filed Address for Service form, and blank copies of the REPLY and Address for Service forms. This is how the defendant is notified they are being sued, and what the case is about.

What happens after you file a civil claim?

After you issue your civil claim and the court serves it, and after the defendant files their defence, the court manages the next steps in the process (including the timetable) between then and the final hearing (trial) or settlement.

How do I respond to a civil claim in BC?

IF YOU INTEND TO RESPOND TO this claim against you, or if you have a set-off or counterclaim that you wish to have taken into account at the trial, YOU MUST FILE a response to third party notice in Form 6 in the above- named registry of this court within the time for response to third party notice provided for below

How do I serve Supreme Court documents in BC?

You can't do this yourself — you must have another adult serve it for you. This can be a friend or relative, or you can hire a professional process server. Ordinary service means that the document can be dropped off, mailed, faxed, or emailed to the other person's address for service.

What is civil claim?

If someone (a debtor) owes you money, you can sue (institute a civil action against) him or her to recover the debt that he or she owes you. This means that you can have your debtor appear before the Small Claims Court to try to make him or her return your money.

What is an affidavit simple?

An affidavit is a sworn statement put in writing. When you use an affidavit, you're claiming that the information within the document is true and correct to the best of your knowledge. Like taking an oath in court, an affidavit is only valid when you make it voluntarily and without any coercion.

What is the format of affidavit?

I _ (Applicant Name as per id proof), residing at _(Address as per address proof) do solemnly affirm and stated as under: I am __ and my name _, appearing on the enclosed ID proof, is single name. My father's name is _.

What is form P17?

If a co-executor doesn't want to apply for probate, that person can renounce their executorship (using form P17). This means they're giving up their right to apply to be executor. If a co-executor doesn't renounce, the grant of probate must reserve the right of that person to apply at a later time.

How many pages is an affidavit?

Character affidavits should be one page in most cases. Personal or client affidavits will run longer, 2 to 4 pages or more depending on the facts of the case.

How do you write a proof affidavit?

Contents of the affidavit should relate and connect with the said facts of the case, The declaration must be in writing, The language of the said declaration must be in the first person, The affidavit must be signed or affirmed, before a Magistrate or other authorised and appropriate officer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA FTB 109 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CA FTB 109 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send CA FTB 109 to be eSigned by others?

Once your CA FTB 109 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the CA FTB 109 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA FTB 109 in minutes.

What is CA FTB 109?

CA FTB 109 is a tax form used by the California Franchise Tax Board to report income for non-residents and individuals who earned income from California sources.

Who is required to file CA FTB 109?

Individuals who are non-residents or part-year residents of California and have income sourced from California are required to file CA FTB 109.

How to fill out CA FTB 109?

To fill out CA FTB 109, individuals must provide personal information such as name, address, and Social Security number, report their California income, and calculate any applicable taxes owed.

What is the purpose of CA FTB 109?

The purpose of CA FTB 109 is to ensure that non-residents report their California income accurately and comply with state tax laws.

What information must be reported on CA FTB 109?

CA FTB 109 requires reporting of personal identification information, the amount of California source income, and tax calculations based on that income.

Fill out your CA FTB 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 109 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.