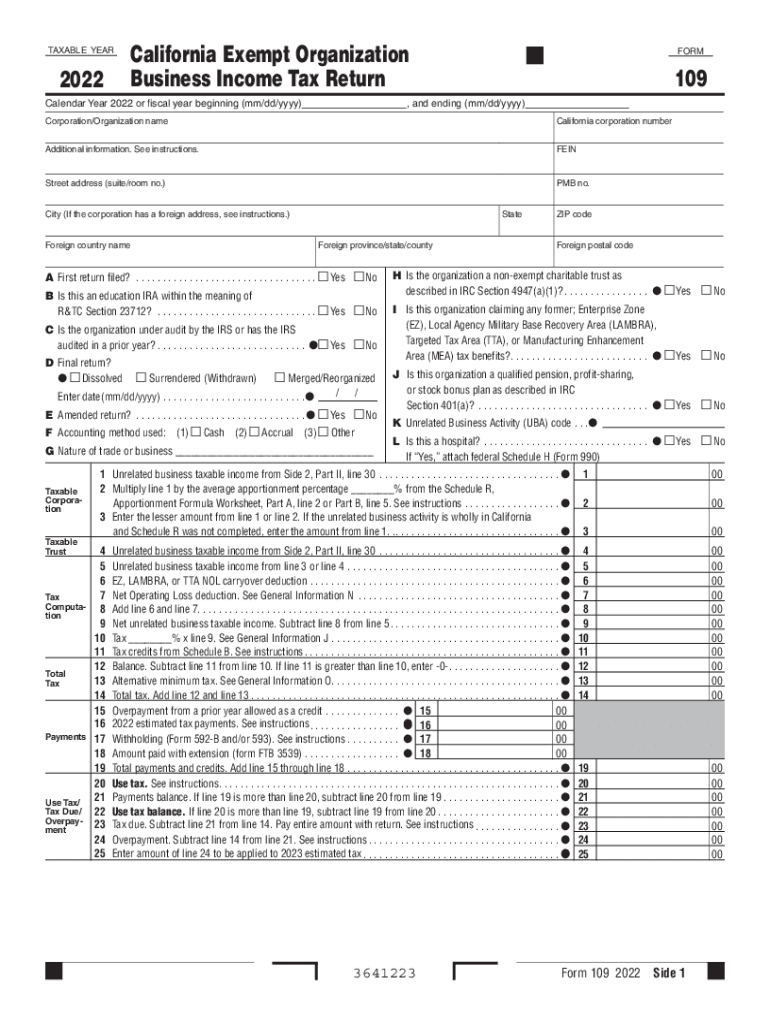

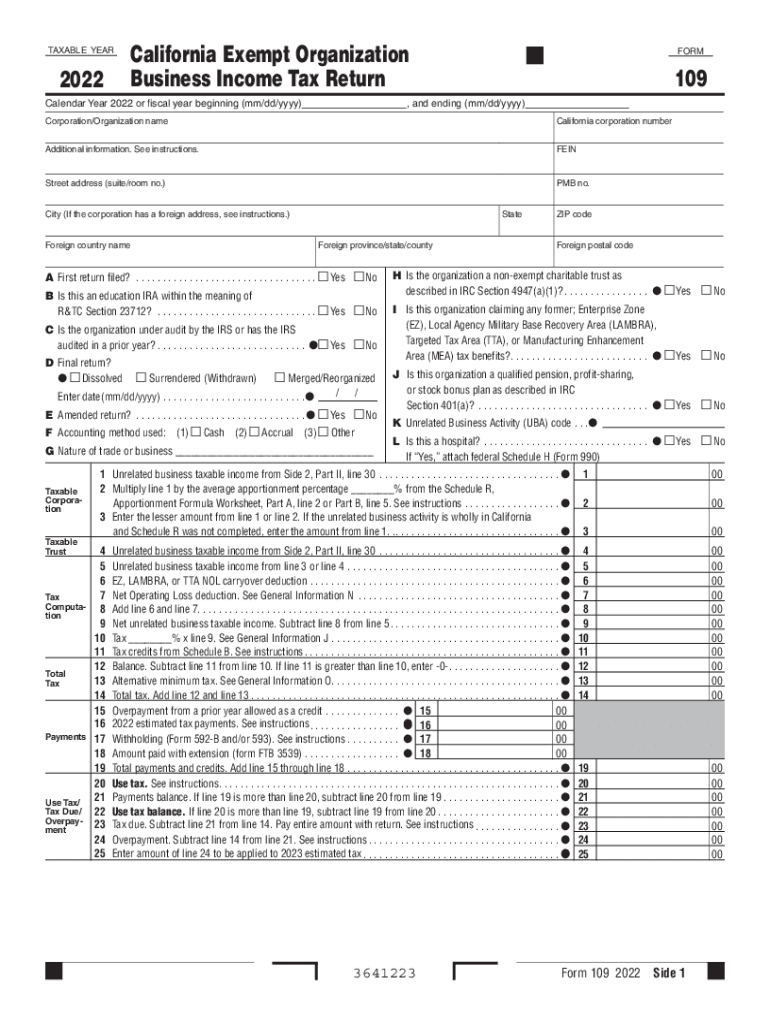

CA FTB 109 2022 free printable template

Get, Create, Make and Sign california form 109

How to edit california form 109 online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 109 Form Versions

How to fill out california form 109

How to fill out CA FTB 109

Who needs CA FTB 109?

Instructions and Help about california form 109

Hey guys this is episode 109 of modern minecraft this has fared the best infinity evo so last episode we got pretty much the actors accumulators installed and we tried to get the rest of the turbines going but it failed badly because there was not enough a kiss accumulators and there's none of water and ah crikey what a pain in the butt all that was absolute pain in the butt but I've gone ahead and ripped out all the actors accumulate all the freaking lie near all the pipeline and everything else and go on ahead and installed literally 14 acuras accumulators and the the super flu adduct which is pretty much you know unlimited transfer weight when pressurized in the bottom of every single reactor here so it is there literally all getting enough water now to supply each of them so kind of sucks where I'm standing is all going to be filled in obviously i just thought i would show you guys but if it all gets filled in but it's it is working quite well real real well so if we go click on each of these guys now as you can see they're all wound up and at full speed i've got it set to 1970 mb here that's that's really nice and stable if i set a little bit higher i noticed i notice will get like we're over 20,000 RF like each of these do 20,000 irf no problem thanks to all the testing we did but if i crank it up a little bit more it will go extra hundred but then I noticed it will drop like there will be a peak and then it'll drop down a whole thousand RF before climbing again and it rinse and repeat so I noticed that 1970 mb seems to be you know roughly the stable where she where she's sitting at but each of these as you can see is set to the same thing all producing pretty much the same power I think one of these might be a bit lower nope not about just over 20,000 RF or one error of difference in this one Wow one RF difference but each one of them is now powering the entire base check this out I got the tesseract installed on top they are sending energy I've got the big reactor in the in the other room disabled she is no longer running which is fantastic these guys now are the there is literally 80,000 RF in this room alone for the this is the the Raptors a baby using barely any fuel like literally freak or fuel so crikey I'm so impressed like literally a few of these bad boys or even bigger versions I would mind playing with the trying to get the size up a little bit more and getting it getting like 30 40 thousand RF per turbine that would be freaking mad but I'm not sure so anyway anyway anyway anyway I managed to school myself some ludicrous block so last episode we talked about the ludic right and how I was pretty much at voiding it because I thought it required a nether star so we went with most of the second best stuff which is the interior and that's a pain in the bum to make art I was pulling out my hair left right and blooming center there but venom just pretty much handed over an entire stack a ludic ride and gave me something just to borrow...

People Also Ask about

How do I write an affidavit in BC?

What are the requirements for a valid affidavit?

What is a notice of civil claim in BC?

What is a notice of claim in BC?

What happens after you file a civil claim?

How do I respond to a civil claim in BC?

How do I serve Supreme Court documents in BC?

What is civil claim?

What is an affidavit simple?

What is the format of affidavit?

What is form P17?

How many pages is an affidavit?

How do you write a proof affidavit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the california form 109 in Chrome?

How can I edit california form 109 on a smartphone?

How do I complete california form 109 on an iOS device?

What is CA FTB 109?

Who is required to file CA FTB 109?

How to fill out CA FTB 109?

What is the purpose of CA FTB 109?

What information must be reported on CA FTB 109?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.