PA REV-1500 EX 2019-2025 free printable template

Show details

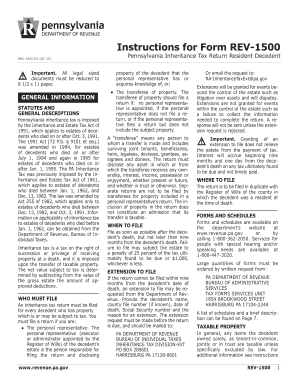

Pennsylvania Department of RevenueInstructions for REV1500REV1500 IN (EX) 0319Pennsylvania Inheritance Tax Return Resident DecedentIMPORTANT: All legal sized documents must be

reduced to 8 1/2 ×

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-1500 EX

Edit your PA REV-1500 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1500 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA REV-1500 EX online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA REV-1500 EX. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1500 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1500 EX

How to fill out PA REV-1500 EX

01

Obtain a copy of the PA REV-1500 EX form from the Pennsylvania Department of Revenue website.

02

Fill out the taxpayer information section, including your name, address, and tax identification number.

03

Indicate the tax period for which you are filing the request.

04

Select the type of tax for which you are claiming a refund or adjustment.

05

Provide a detailed explanation of the reason you are filing the form, including any relevant facts or circumstances.

06

Attach any supporting documents that substantiate your claim.

07

Review all entries for accuracy and completeness before submitting.

08

Sign and date the form to certify that the information provided is true and accurate.

09

Submit the completed form to the appropriate state revenue office, either by mail or electronically if applicable.

Who needs PA REV-1500 EX?

01

Individuals or businesses in Pennsylvania who believe they have overpaid taxes and wish to request a refund.

02

Taxpayers seeking to adjust their tax returns for specific periods due to errors or new information.

03

Anyone who may benefit from tax corrections, including nonprofits or organizations that qualify for tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I file an inheritance tax return in PA?

Deliver your return and payment to the Inheritance Tax Department. You can either file your return in person or by mail. You'll need to submit two completed copies of your return, along with your payment. To drop off your forms in person, you must schedule an appointment.

What tax form is used for inheritance?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

Do I have to file an inheritance tax return in PA?

Failure to file may subject the estate to a penalty of 25 percent of the tax ultimately found to be due or $1,000, whichever is less. An inheritance tax return must be filed in duplicate with the Register of Wills of the county in which the decedent was a resident at the time of death.

How do I report inherited money on my taxes?

If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Example: You inherit and deposit cash that earns interest income. Include only the interest earned in your gross income, not the inhereted cash.

Will I get a 1099 for inheritance?

This means that when the beneficiary withdraws those monies from the accounts, the beneficiary will receive a 1099 from the company administering the plan and must report that income on their income tax return (and must pay income taxes on the sum).

What is PA Form Rev 516?

Form REV-516 "Notice of Transfer"(Stocks,Bonds, Securities or Security Accounts held in Beneficiary Form) to request Waiver Notice of Transfer, must be completed and submitted to Form REV-998 and Form REV-999 have replaced PA Schedule D(P/S).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get PA REV-1500 EX?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific PA REV-1500 EX and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete PA REV-1500 EX online?

pdfFiller makes it easy to finish and sign PA REV-1500 EX online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the PA REV-1500 EX form on my smartphone?

Use the pdfFiller mobile app to fill out and sign PA REV-1500 EX. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is PA REV-1500 EX?

PA REV-1500 EX is a form used for reporting certain health care services and claims for reimbursement in Pennsylvania.

Who is required to file PA REV-1500 EX?

Individuals or providers that render medical services and wish to bill for those services in Pennsylvania are required to file PA REV-1500 EX.

How to fill out PA REV-1500 EX?

To fill out PA REV-1500 EX, providers must provide detailed information including patient demographics, service details, diagnosis codes, and provider information according to the guidelines outlined in the form instructions.

What is the purpose of PA REV-1500 EX?

The purpose of PA REV-1500 EX is to facilitate the billing process for health care services provided to patients and to ensure that providers receive reimbursement for the services rendered.

What information must be reported on PA REV-1500 EX?

PA REV-1500 EX requires reporting of information including patient name, insurance details, service dates, procedure codes, diagnosis codes, and total charges, among other relevant information.

Fill out your PA REV-1500 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1500 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.