Get the free 401(k) Loans, Hardship Withdrawals and Other Important ...

Show details

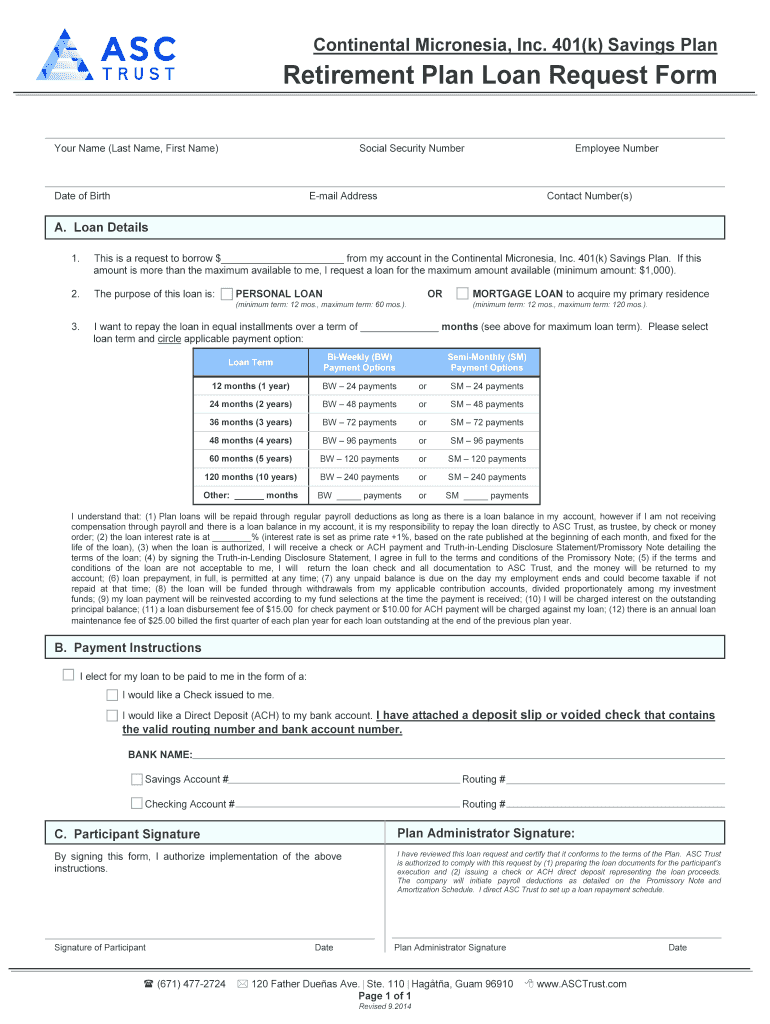

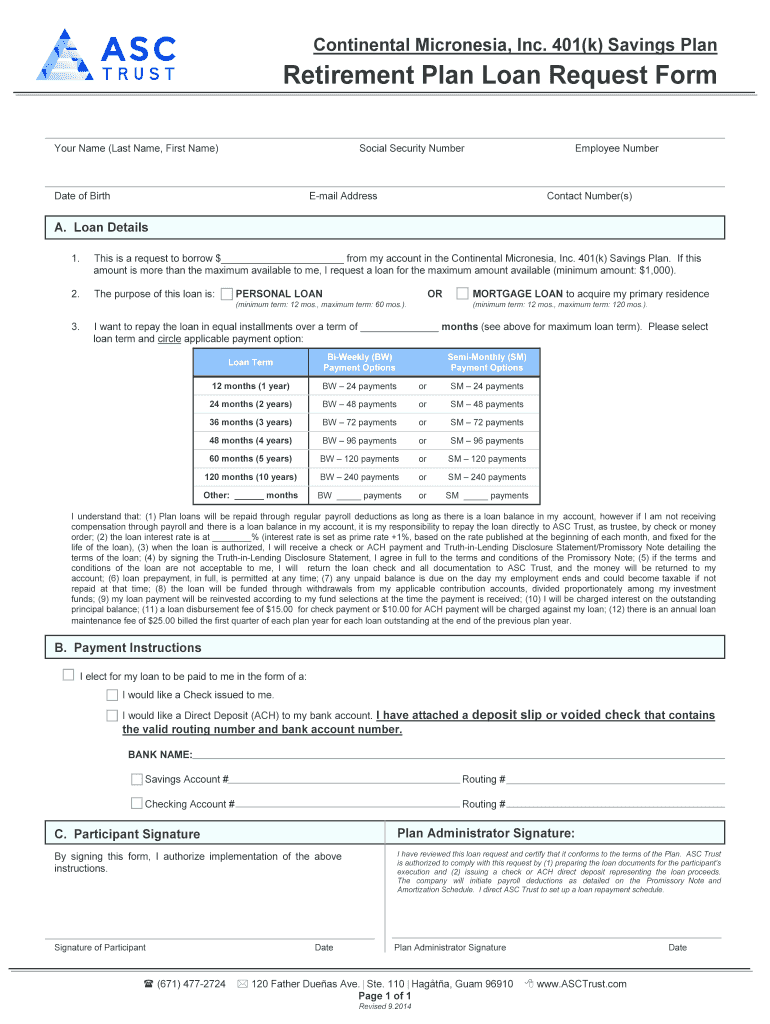

Continental Micronesia, Inc. 401(k) Savings PlanRetirement Plan Loan Request Form Your Name (Last Name, First Name)Social Security Numerate of BirthEmployee NumberEmail AddressContact Number(s)A.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k loans hardship withdrawals

Edit your 401k loans hardship withdrawals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k loans hardship withdrawals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401k loans hardship withdrawals online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 401k loans hardship withdrawals. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k loans hardship withdrawals

How to fill out 401k loans hardship withdrawals

01

To fill out a 401k loan hardship withdrawal, follow these steps:

02

Gather all necessary documents and information, such as your 401k account details, financial records, and personal identification.

03

Contact your employer or retirement plan administrator to obtain the required forms for a hardship withdrawal.

04

Complete the hardship withdrawal application form, providing accurate and detailed information about your financial hardship.

05

Attach any supporting documents required by your retirement plan, such as medical bills, funeral expenses, or proof of imminent foreclosure.

06

Review the completed form and supporting documents to ensure accuracy and completeness.

07

Submit the application and supporting documents to your employer or retirement plan administrator as per their instructions.

08

Wait for the review and approval process, which can vary depending on your retirement plan and the complexity of your hardship situation.

09

If approved, carefully review and understand the terms and conditions of the 401k loan hardship withdrawal, including any tax implications and repayment requirements.

10

Proceed with the withdrawal according to the approved terms, and use the funds responsibly to address your financial hardship.

11

Keep track of any documentation related to the withdrawal for future reference or tax purposes.

Who needs 401k loans hardship withdrawals?

01

401k loan hardship withdrawals are typically needed by individuals who are experiencing significant financial difficulties and require access to their retirement savings. Some common situations where these withdrawals may be necessary include:

02

Medical emergencies or high medical expenses that are not covered by insurance.

03

Unforeseen significant property repairs or damage, such as from natural disasters or accidents.

04

Funeral expenses for a close family member or dependent.

05

Preventing foreclosure or eviction due to imminent loss of housing.

06

Substantial educational expenses, particularly if related to job retraining or career advancement.

07

It's important to note that accessing 401k funds through hardship withdrawals should be considered a last resort, as it can significantly impact your retirement savings and may have tax implications. Before pursuing this option, it's recommended to explore other alternatives or seek financial advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 401k loans hardship withdrawals for eSignature?

Once your 401k loans hardship withdrawals is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in 401k loans hardship withdrawals?

The editing procedure is simple with pdfFiller. Open your 401k loans hardship withdrawals in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit 401k loans hardship withdrawals straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 401k loans hardship withdrawals, you can start right away.

What is 401k loans hardship withdrawals?

401k loans hardship withdrawals refer to taking out money from your 401k account due to financial hardship.

Who is required to file 401k loans hardship withdrawals?

Individuals who are experiencing financial hardship and meet the eligibility requirements set by their 401k plan are required to file for hardship withdrawals.

How to fill out 401k loans hardship withdrawals?

To fill out 401k loans hardship withdrawals, you need to complete the necessary forms provided by your 401k plan administrator and submit documentation supporting your financial hardship.

What is the purpose of 401k loans hardship withdrawals?

The purpose of 401k loans hardship withdrawals is to provide individuals with access to their retirement savings in case of financial emergencies or hardships.

What information must be reported on 401k loans hardship withdrawals?

Information such as the reason for the hardship withdrawal, amount requested, supporting documentation, and any applicable taxes or penalties must be reported on 401k loans hardship withdrawals.

Fill out your 401k loans hardship withdrawals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Loans Hardship Withdrawals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.