Get the free DLiability Insurance

Show details

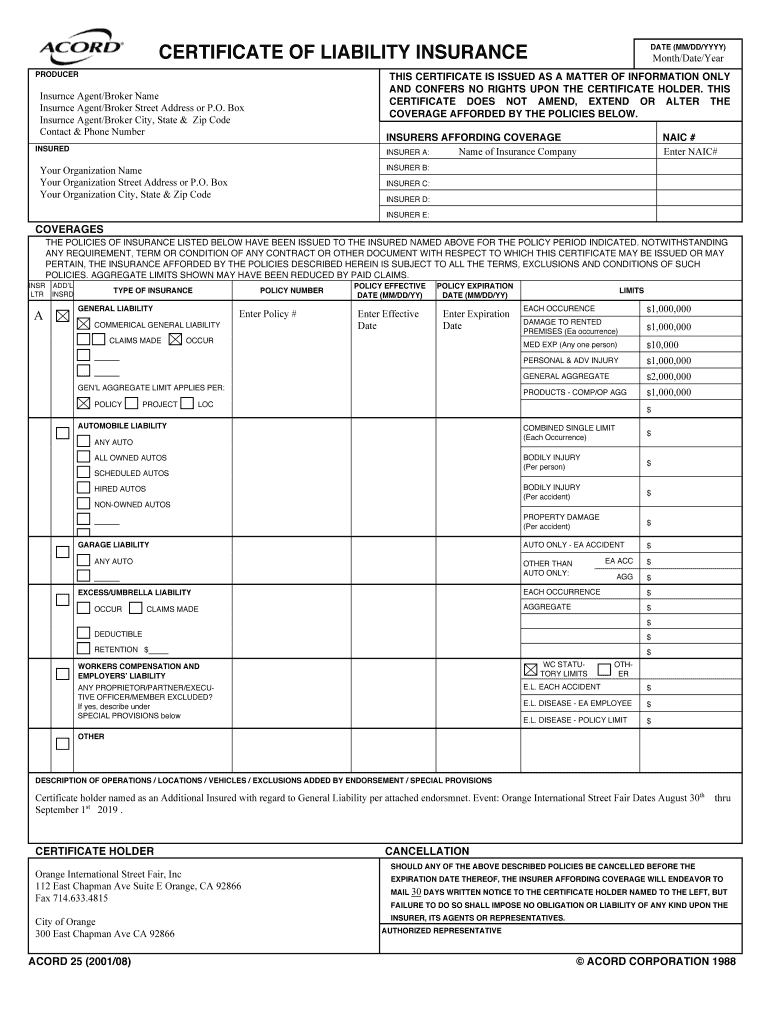

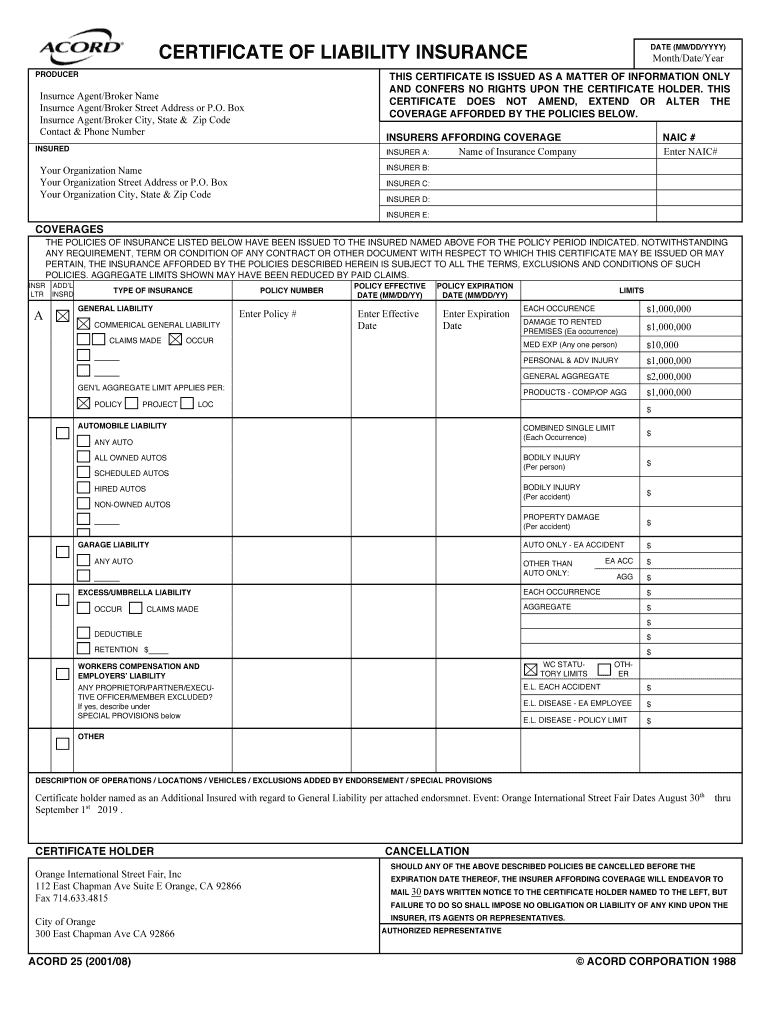

CERTIFICATE OF LIABILITY INSURANCE PRODUCERDATE (MM/DD/YYY)Month/Date/Earths CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dliability insurance

Edit your dliability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dliability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dliability insurance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dliability insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dliability insurance

How to fill out dliability insurance

01

To fill out liability insurance, follow these steps:

02

Gather all necessary information such as your personal information, contact details, and any relevant documents or records.

03

Identify the type of liability insurance coverage you need, whether it's general liability, professional liability, or product liability.

04

Research different insurance providers and compare their offerings, premiums, and coverage limits.

05

Choose a reputable insurance company that meets your requirements and has a good track record.

06

Contact the insurance company either through their website or by phone to initiate the application process.

07

Fill out the application form accurately and provide all the required details.

08

Attach any supporting documents or records as requested.

09

Review the completed application form for any errors or omissions.

10

Submit the application along with any required fees or payments.

11

Await a response from the insurance company regarding the status of your application.

12

If approved, carefully review the policy terms and conditions before signing and accepting the insurance coverage.

13

Make the necessary premium payments as per the agreed terms and conditions.

14

Keep a copy of your liability insurance policy for future reference and ensure you understand the coverage and exclusions provided.

Who needs dliability insurance?

01

Liability insurance is essential for various individuals and businesses, including:

02

- Small business owners: It protects them from potential lawsuits and financial loss arising from accidents, injuries, or property damage caused by their business activities.

03

- Professionals (doctors, lawyers, consultants): It provides coverage for errors, omissions, or negligence in their professional services, safeguarding them from legal claims.

04

- Contractors and subcontractors: It ensures protection against liability for injuries or property damage that may occur during construction projects.

05

- Landlords: It safeguards them from liability claims if a tenant or visitor suffers an injury or property damage on their rented property.

06

- Event organizers: It covers them in case of accidents, injuries, or property damage occurring during an event they organize.

07

- Individuals: It offers personal liability protection against claims resulting from accidents or injuries that occur on their property or due to their actions.

08

- Non-profit organizations: It provides financial protection against liability claims arising from their services, events, or activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the dliability insurance electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your dliability insurance in minutes.

Can I create an eSignature for the dliability insurance in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your dliability insurance and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit dliability insurance on an Android device?

You can edit, sign, and distribute dliability insurance on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is dliability insurance?

Dliability insurance provides protection to individuals and businesses from the risk of being held liable for injuries to others or damage to property.

Who is required to file dliability insurance?

Businesses and individuals who want to protect themselves from potential legal claims are required to file dliability insurance.

How to fill out dliability insurance?

To fill out dliability insurance, you will need to provide information about your personal or business assets, potential risks, and desired coverage limits.

What is the purpose of dliability insurance?

The purpose of dliability insurance is to safeguard against financial losses resulting from legal claims made against you or your business.

What information must be reported on dliability insurance?

You must report details about your assets, potential risks, desired coverage limits, and any previous claims when filling out dliability insurance.

Fill out your dliability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dliability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.