MD MW506FR 2021 free printable template

Show details

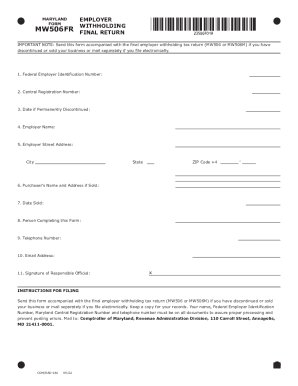

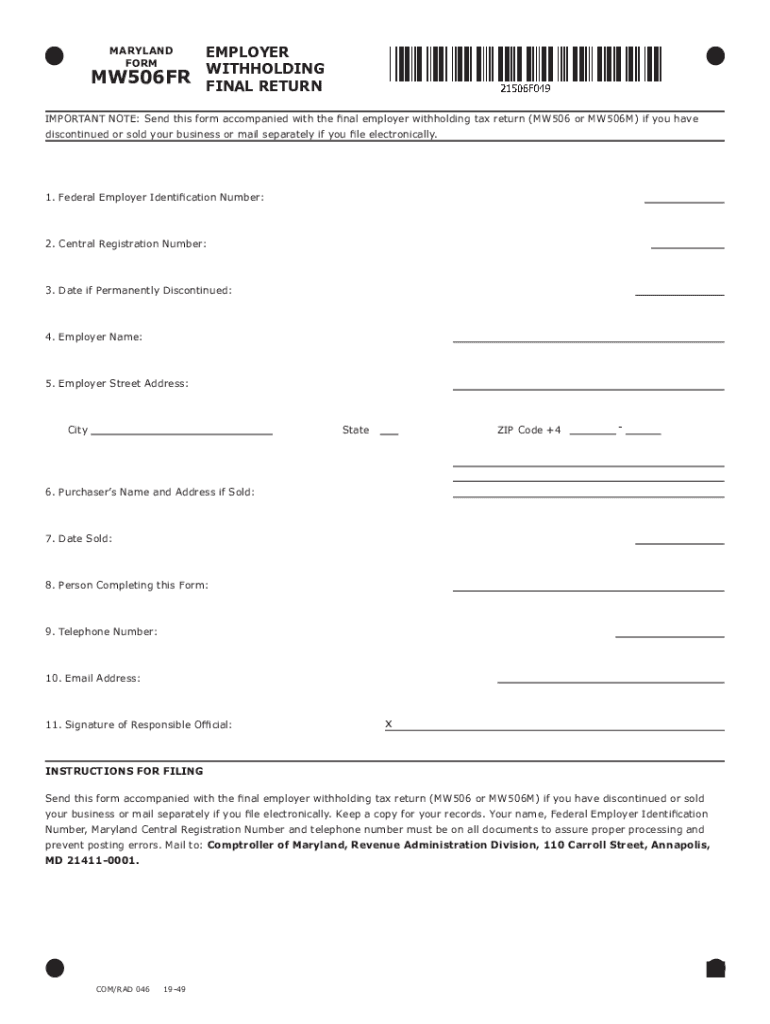

MARYLAND FORMMW506FREMPLOYER WITHHOLDING FINAL RETURN FORMIMPORTANT NOTE: Send this form accompanied by the final employer withholding tax return (MW506 or MW506M) if you have discontinued or sold

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD MW506FR

Edit your MD MW506FR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD MW506FR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD MW506FR online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD MW506FR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD MW506FR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD MW506FR

How to fill out MD MW506FR

01

Gather all relevant financial information for the tax year.

02

Begin filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Input the total amount of Maryland income tax withheld from your wages during the year.

04

Report any other adjustments or income as required by the form.

05

Calculate your total deductions, if applicable.

06

Determine your taxable income by subtracting deductions from total income.

07

Use the Maryland tax rates to calculate the tax owed based on your taxable income.

08

Complete any additional schedules required by the form, if applicable.

09

Review all entries for accuracy and completeness.

10

Sign and date the form before submitting it to the Maryland Comptroller's Office.

Who needs MD MW506FR?

01

Individuals who earned income in Maryland and had state taxes withheld.

02

Residents of Maryland who are required to file an income tax return.

03

Any taxpayer who needs to report additional income adjustments or deductions.

Fill

form

: Try Risk Free

People Also Ask about

What is Maryland nonresident withholding?

A nonresident entity must make an 8.25% payment. See Withholding Requirements for Sales of Real Property by Nonresidents.

Do I have to pay Maryland state taxes if I live in another state?

You should file a resident income tax return with Maryland. Generally, taxpayers should file with the jurisdiction in which they live. If you live in Maryland, file with Maryland. If you live in Washington, D.C., Pennsylvania, Virginia or West Virginia, you should file with your home state.

How do I close my Maryland withholding account?

Closing a Withholding Account You can close your withholding account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, 8:30 a.m. - 4:30 p.m.

Do I need to file a Maryland nonresident return?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

Who must file a Maryland state tax return?

ing to Maryland Instructions for Form 502, you are required to file a Maryland Income Tax Return if: you are or were a Maryland resident, you are required to file a federal return and your Maryland gross income equals or exceeds the allowed amount for your filing status.

How do I end my corporation?

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

How do I close a Maryland withholding account?

Closing a Withholding Account You can close your withholding account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, 8:30 a.m. - 4:30 p.m.

Can I change my tax withholding at any time?

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

How do I change my Maryland withholding?

Call our telefile line at 410-260-7225 or contact Taxpayer Service at 410-260-7980 or 1-800-638-2937 from elsewhere. Please be ready to provide: the account number. type of tax (employer withholding, sales and use)

Do non residents need to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

How do I dissolve an inactive corporation?

In order to begin the process of corporation dissolution, the owner(s) must file the articles of dissolution, a document that outlines the plan to dissolve.Dissolving a Corporation Distribute any remaining assets to its shareholders. Pay any outstanding taxes to reach a current status. Pay off any outstanding debts.

How do you close an MD Corporation?

Send a written request to close the account (must be on letterhead and signed by an officer, member or partner) Return license with the letter. Close-out audit may be requested. License will be closed once audit is complete. We will verify that all returns/reports/liabilities are current before the account will be closed.

How do I change my tax withholding?

Change Your Withholding Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

What is employees Maryland withholding Exemption Certificate?

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

What is MD MW506 form?

MARYLAND EMPLOYER WITHHOLDING. FINAL RETURN FORM. IMPORTANT NOTE: Send this form accompanied with the final employer withholding tax return (MW506 or MW506M) if you have discontinued or sold your business or mail separately if you file electronically.

How do I know if I am exempt from Maryland withholding?

If you have an employee who expects to have less than $12,950 in income during 2022, you are not required to withhold Maryland state and local income tax.

How do I close my Maryland sales tax account?

You can close your sales and use tax account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, 8:30 a.m. - 4:30 p.m.

How do I change my Maryland tax withholding?

You can call us at 800-492-5909 or 410-625-5555. online. This is the fastest and most secure method to update your Maryland state tax withholding.

How do I contact the Comptroller of Maryland?

Telephone Assistance Call 1-800-MD TAXES or 410-260-7980 from Central Maryland. Telephone assistance is available 8:30 a.m. - 4:30 p.m., Monday through Friday. The Comptroller of Maryland offers extended hours February 3 - April 15, 2020 Monday through Friday from 8:30 a.m. until 7:00 p.m. for telephone assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MD MW506FR to be eSigned by others?

To distribute your MD MW506FR, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit MD MW506FR in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your MD MW506FR, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit MD MW506FR on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute MD MW506FR from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is MD MW506FR?

MD MW506FR is a form used in the state of Maryland for reporting and remitting withholding tax for non-resident employees.

Who is required to file MD MW506FR?

Employers who withhold Maryland income tax from non-resident employees' wages are required to file MD MW506FR.

How to fill out MD MW506FR?

To fill out MD MW506FR, provide the employer's information, the non-resident employee's information, details of the wages paid, and the amount of tax withheld, followed by signature and date.

What is the purpose of MD MW506FR?

The purpose of MD MW506FR is to inform the Maryland Comptroller about the amount of state income tax withheld from the wages of non-resident employees.

What information must be reported on MD MW506FR?

MD MW506FR must report the employer's name and ID, the employee's name and SSN, total wages paid, total Maryland tax withheld, and any applicable signatures.

Fill out your MD MW506FR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD mw506fr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.