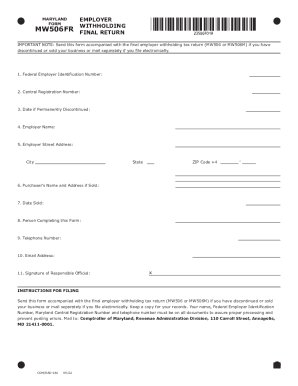

MD MW506FR 2022 free printable template

Get, Create, Make and Sign MD MW506FR

How to edit MD MW506FR online

Uncompromising security for your PDF editing and eSignature needs

MD MW506FR Form Versions

How to fill out MD MW506FR

How to fill out maryland employer form withholding:

Who needs maryland employer form withholding:

Instructions and Help about MD MW506FR

Aaron build thinner here from penguin laser systems we got a new division from penguins called scanner max right see these three words up there stronger cooler faster that's what these new scanners are all about so lets talk about stronger what's so much stronger about it, we start off with stronger rotors see I have two pieces of steel here that represents the diameter of the shaft that we use on scanner mac scanners here you see the rotor from ordinary galvanometers and here you see the rotor from our Galván AMI you might notice that these a lot bigger around this bigger around really make that much of a difference yes take a look at how wimpy this is the diameter of the competitors rotors now take a look at how much stronger it is when you make it just a little thicker in diameter big difference, so that's one of the things stronger about it another thing is stronger about it is our magnetic field we use a different type of neodymium iron boron you might notice the color is different right see that this is unplaced it, and it will not corrode over time so because of that it gives us a stronger magnetic field now finally cooler lets take a look at the inside of a competitor scanner every conventional galvanometers like this on the insides got little teeny tiny wires on the inside shoved up against the wall in between the wall and the magnet heats the magnet great doesn't produce a lot of torque great so what we do is we bury the wire in little slots and because of that we can get more wire in there thicker wire, and it runs cooler to take a look at the back of our card and on our promotional literature we show a picture this is a conventional Galván armor this is ours right you tell how much cool they're ours is so when you put these two things together stronger plus cooler it results in faster scanning and that's what were seeing right here were seeing scanners operating with an ordinary galvanometer driver which normally can only go 30k at this booth running a lot faster here's the completed package what it looks like there's a couple of really cool things about this one of them is that if you want to move this around change this right now we have a left coming beam entrance right lets say you want to write coming beam entrance no problem because what we've done we've separated the XY mount and the two pieces, so you can just change it around right so really simple there's a lot of cool stuff going on in here I don't want to take a lot of time check us out scanner max calm well get you fixed right up

People Also Ask about

What is Maryland nonresident withholding?

Do I have to pay Maryland state taxes if I live in another state?

How do I close my Maryland withholding account?

Do I need to file a Maryland nonresident return?

Who must file a Maryland state tax return?

How do I end my corporation?

How do I close a Maryland withholding account?

Can I change my tax withholding at any time?

How do I change my Maryland withholding?

Do non residents need to file a tax return?

How do I dissolve an inactive corporation?

How do you close an MD Corporation?

How do I change my tax withholding?

What is employees Maryland withholding Exemption Certificate?

What is MD MW506 form?

How do I know if I am exempt from Maryland withholding?

How do I close my Maryland sales tax account?

How do I change my Maryland tax withholding?

How do I contact the Comptroller of Maryland?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MD MW506FR online?

How do I fill out the MD MW506FR form on my smartphone?

How do I edit MD MW506FR on an iOS device?

What is MD MW506FR?

Who is required to file MD MW506FR?

How to fill out MD MW506FR?

What is the purpose of MD MW506FR?

What information must be reported on MD MW506FR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.