CA STD 436 2019 free printable template

Show details

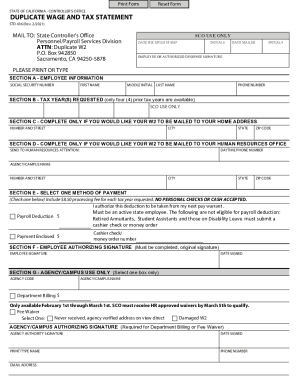

Print Form Reset Form STATE OF CALIFORNIA — CONTROLLER IS OFFICE DUPLICATE WAGE AND TAX STATEMENT STD 436 (Rev. 10/2019) SCO USE ONLY DATE RECEIVED STAMP MAIL TO: State Controller's Office Personnel/Payroll

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA STD 436

Edit your CA STD 436 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA STD 436 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA STD 436 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA STD 436. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA STD 436 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA STD 436

How to fill out CA STD 436

01

Begin by downloading the CA STD 436 form from the official website.

02

Enter your organization's name and address at the top of the form.

03

Fill in the fiscal year for which you are reporting.

04

Provide the contact information of the person responsible for the report.

05

Complete the sections regarding financial data, ensuring all figures are accurate.

06

Review the instructions for any specific categories or additional documentation required.

07

Sign and date the form at the designated section.

08

Submit the completed form to the appropriate state department.

Who needs CA STD 436?

01

Government agencies.

02

Nonprofit organizations seeking state funding.

03

Entities required to report financial data to the state.

04

Businesses operating in California that need to comply with state reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a copy of W-2 from SSA?

Most requests will be processed within 10 business days from the IRS received date.

How do you get a copy of your W-2 if you lost it?

If you lost or haven't received your W-2 for the current tax year, you can: contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

How can I get a copy of my W-2 without contacting my employer?

If there is no way for you to contact a past employer, you can request that the IRS send you a copy directly. The IRS advises those in this situation to give them a call at 800-829-1040. Additionally, those who live near an IRS Taxpayer Assistance Center can make an appointment to receive their W-2 in person.

How can I get a copy of my W-2 fast?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Can you get a copy of your W-2 immediately online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How to get a copy of W-2 from Social Security Administration?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I get my old W-2 without contacting my employer?

If there is no way for you to contact a past employer, you can request that the IRS send you a copy directly. The IRS advises those in this situation to give them a call at 800-829-1040. Additionally, those who live near an IRS Taxpayer Assistance Center can make an appointment to receive their W-2 in person.

How do I get my old W-2 if I didn't file taxes?

Call the payroll department of your current or former employer. This is the easiest way to get an old W-2 form. Employers are required to save important tax information such as your current and prior-year W-2s.

Can the IRS give me my old W-2?

The only way to get an actual copy of your Form W-2 from us is to order a copy of the entire return by using Form 4506, Request for Copy of Tax Return and paying a $43 fee for each return requested. We will waive the fee for taxpayers impacted by a federally declared disaster or a significant fire.

How can I get a copy of W-2 quickly?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA STD 436?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CA STD 436 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in CA STD 436 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your CA STD 436, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out CA STD 436 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign CA STD 436 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is CA STD 436?

CA STD 436 is a form used by California state agencies to report expenditures related to the state's environmental compliance and restoration efforts.

Who is required to file CA STD 436?

State agencies and departments that incur expenses related to environmental compliance and restoration are required to file CA STD 436.

How to fill out CA STD 436?

To fill out CA STD 436, agencies must provide detailed information regarding their expenditures, including the type of expense, the amount spent, and the purpose of the expenditure.

What is the purpose of CA STD 436?

The purpose of CA STD 436 is to ensure accountability and transparency in the state's environmental spending by documenting and reporting financial activities related to environmental compliance.

What information must be reported on CA STD 436?

CA STD 436 must report information such as the agency name, project description, type of environmental expense, date of expenditure, and the amount spent.

Fill out your CA STD 436 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA STD 436 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.