CA STD 436 2006 free printable template

Show details

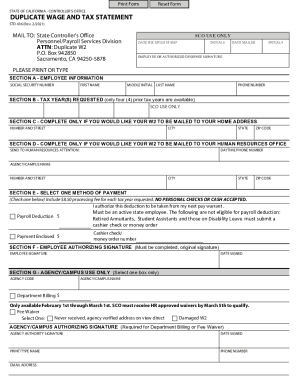

STATE OF CALIFORNIA STATE CONTROLLER'S OFFICE. DUPLICATE WAGE ... SECTION B COMPLETE ONLY IF YOU WOULD LIKE YOUR W2 TO BE MAILED. EMPLOYEE NAME OR AGENCY/CAMPUS NAME. SEND TO HUMAN ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA STD 436

Edit your CA STD 436 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA STD 436 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA STD 436 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA STD 436. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA STD 436 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA STD 436

How to fill out CA STD 436

01

Obtain a copy of the CA STD 436 form from the appropriate website or office.

02

Begin by filling out your personal information at the top of the form, including your name, address, and contact details.

03

Provide the specific information requested in the sections related to your employment or position.

04

Fill in any relevant dates, such as the date of application or the effective date of the information.

05

Review the form for accuracy and completeness, ensuring all sections are filled out as required.

06

Sign and date the form at the designated space.

07

Submit the completed form according to the instructions, either by mail or electronically, as specified.

Who needs CA STD 436?

01

Individuals applying for employment with the State of California.

02

Current employees who need to update their employment information.

03

Anyone required to disclose certain information as part of their application or employment process.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a copy of W-2 from SSA?

Most requests will be processed within 10 business days from the IRS received date.

How do you get a copy of your W-2 if you lost it?

If you lost or haven't received your W-2 for the current tax year, you can: contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

How can I get a copy of my W-2 without contacting my employer?

If there is no way for you to contact a past employer, you can request that the IRS send you a copy directly. The IRS advises those in this situation to give them a call at 800-829-1040. Additionally, those who live near an IRS Taxpayer Assistance Center can make an appointment to receive their W-2 in person.

How can I get a copy of my W-2 fast?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Can you get a copy of your W-2 immediately online?

Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.

How to get a copy of W-2 from Social Security Administration?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I get my old W-2 without contacting my employer?

If there is no way for you to contact a past employer, you can request that the IRS send you a copy directly. The IRS advises those in this situation to give them a call at 800-829-1040. Additionally, those who live near an IRS Taxpayer Assistance Center can make an appointment to receive their W-2 in person.

How do I get my old W-2 if I didn't file taxes?

Call the payroll department of your current or former employer. This is the easiest way to get an old W-2 form. Employers are required to save important tax information such as your current and prior-year W-2s.

Can the IRS give me my old W-2?

The only way to get an actual copy of your Form W-2 from us is to order a copy of the entire return by using Form 4506, Request for Copy of Tax Return and paying a $43 fee for each return requested. We will waive the fee for taxpayers impacted by a federally declared disaster or a significant fire.

How can I get a copy of W-2 quickly?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the CA STD 436 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CA STD 436 in minutes.

Can I create an eSignature for the CA STD 436 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your CA STD 436 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit CA STD 436 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing CA STD 436.

What is CA STD 436?

CA STD 436 is a form used by California state agencies required to report their employee salary data and compensation information for the purpose of transparency and accountability.

Who is required to file CA STD 436?

California state agencies and departments are required to file CA STD 436.

How to fill out CA STD 436?

To fill out CA STD 436, agencies must enter relevant employee salary and compensation data in the specified fields of the form, including employee names, titles, and salaries, following the instructions provided with the form.

What is the purpose of CA STD 436?

The purpose of CA STD 436 is to ensure transparency in government spending by providing detailed information on salaries and compensation of state employees.

What information must be reported on CA STD 436?

CA STD 436 must report information including the names of employees, their job titles, the salaries they receive, and any additional compensation or benefits provided.

Fill out your CA STD 436 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA STD 436 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.