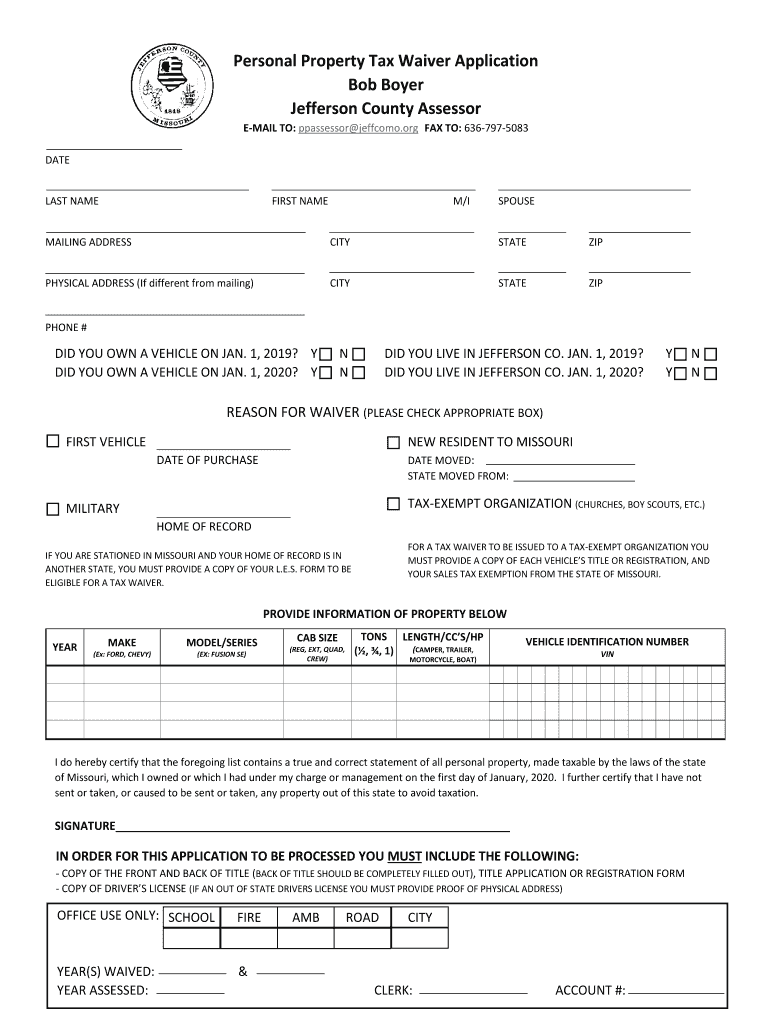

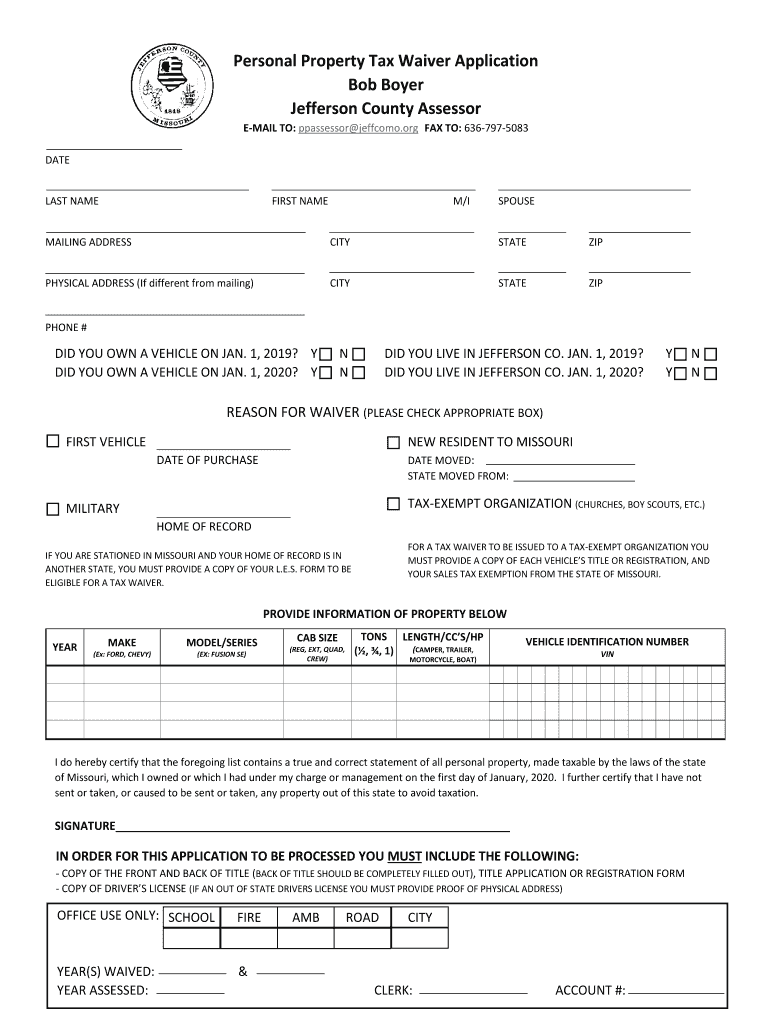

MO Personal Property Tax Waiver Application - Jefferson County 2019 free printable template

Get, Create, Make and Sign MO Personal Property Tax Waiver Application

How to edit MO Personal Property Tax Waiver Application online

Uncompromising security for your PDF editing and eSignature needs

MO Personal Property Tax Waiver Application - Jefferson County Form Versions

How to fill out MO Personal Property Tax Waiver Application

How to fill out MO Personal Property Tax Waiver Application

Who needs MO Personal Property Tax Waiver Application?

Instructions and Help about MO Personal Property Tax Waiver Application

Daphne's good Tuesday afternoon to you and fellow Americans more specifically this is for you guys in Missouri went to the mailbox today and received those dreaded bills that you get to end of the year every year and that's your real estate tax and your personal property tax now I don't I don't like any tax, but I mean I can understand I'm okay with the real estate tax I'm okay with that you know for the most part but David the personal property tax is ridiculous, and it's really it's unfair it's unfair and well when you think about the real estate tax it's not fair to, and I'll get back to the personal property tax here in a minute but let's talk about the real estate tax for a minute and I know I stated that I'm okay with the kind of sorta but when you think about it the real estate tax is not fair because if you're a homeowner then if you own any land or anything you're the one that's paying that tax nobody else is paying if they don't own property they're not paying their tax but yet they benefit from everything else your real estate tax goes to schools and whatnot and then use that they use that money for other stuff so the people who aren't like I said stated the people who are not paying real estate tax it's benefiting from you and me that is if you're paying real estate tax and that's not that's not fair tax it's not fair at all so now let me go to personal property tax this is the one that really gets me there's the first property tax because basically what you're taxed on is young vehicles or kind of bit my tongue here for a minute ouch funny sayings back to us saying the only vehicles motorcycles what not then you're taxed on that now with a vehicle you've already paid tip taxes on that in the form of sales tax when you go by vehicle you're paying sales tax so your tax there every year you've everything that you do to that mean against your upkeep on it all changes tires all that stuff you're generating tax you're through sales tax you don't have to pay, so you don't have to pay sales tax on labor if your car is getting fixed, but you get a picture in Exxon in parts this parts of taxable Labor's not one said to me that's kind of weird meaning of itself but for me for us to have to keep paying a tax every year on something that we've already paid taxes on in the form of sales taxes that's not fair tax they Sydney taxation either what about all the people that don't have vehicles you know they still benefit from the revenue that this person approach that does yes personal property tax generates they're benefiting from through some form or another what we need to do, and I'm speaking more or less from Missouri because I don't know other states I don't know how other states operate whether they have personal property tax and real estate tax and stuff like that I don't know their ins and outs it in other states I just know a pair in Missouri we have real state tax, and they have pushing property tax, so we have three vehicles three, and...

People Also Ask about

Do you have to pay personal property tax in Missouri?

What is the sales tax on a $20000 car in Missouri?

How do I get a tax waiver in Jefferson County MO?

Who is exempt from personal property tax in Missouri?

How many years can you be behind on property taxes in Missouri?

How do I get around paying sales tax on my car?

Do seniors have to pay property taxes in Missouri?

What personal property is exempt in Missouri?

Can you get a Missouri tax waiver online?

How much is sales tax on a $25000 car in Missouri?

How long can you go without paying personal property taxes in Missouri?

How do I avoid paying sales tax on a car in Missouri?

How do I get a tax waiver in Missouri?

At what age do you stop paying personal property taxes in Missouri?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MO Personal Property Tax Waiver Application without leaving Google Drive?

How can I send MO Personal Property Tax Waiver Application to be eSigned by others?

Can I create an electronic signature for the MO Personal Property Tax Waiver Application in Chrome?

What is MO Personal Property Tax Waiver Application?

Who is required to file MO Personal Property Tax Waiver Application?

How to fill out MO Personal Property Tax Waiver Application?

What is the purpose of MO Personal Property Tax Waiver Application?

What information must be reported on MO Personal Property Tax Waiver Application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.