DOL WH-530 2020 free printable template

Show details

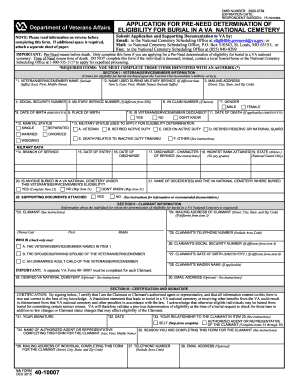

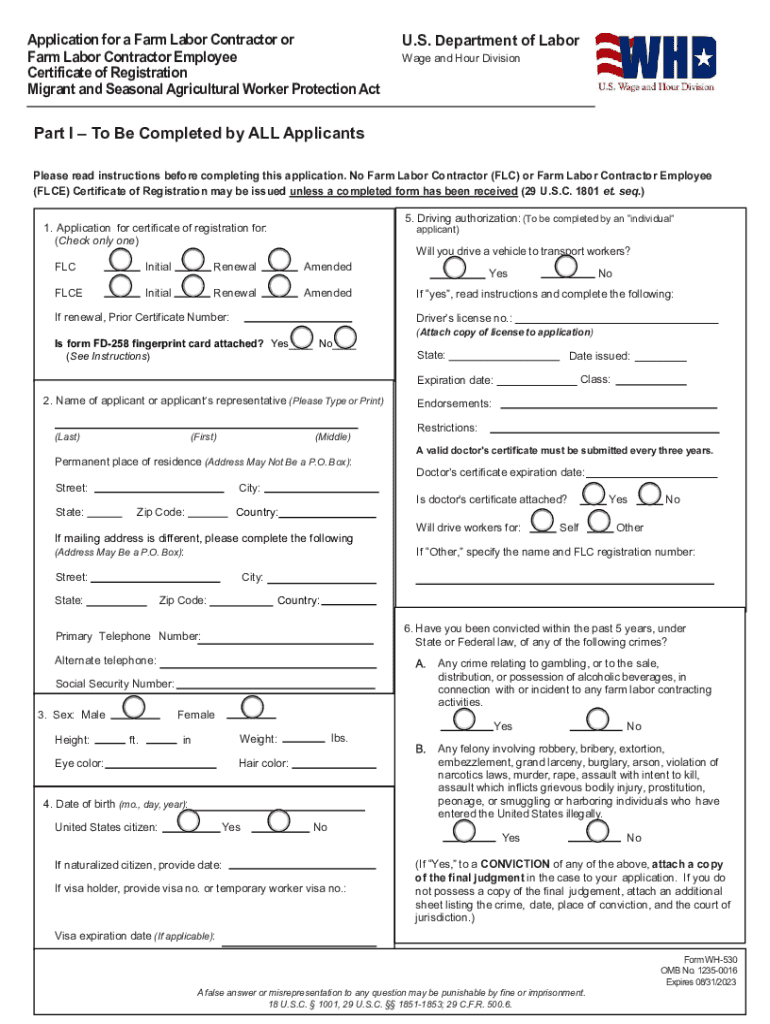

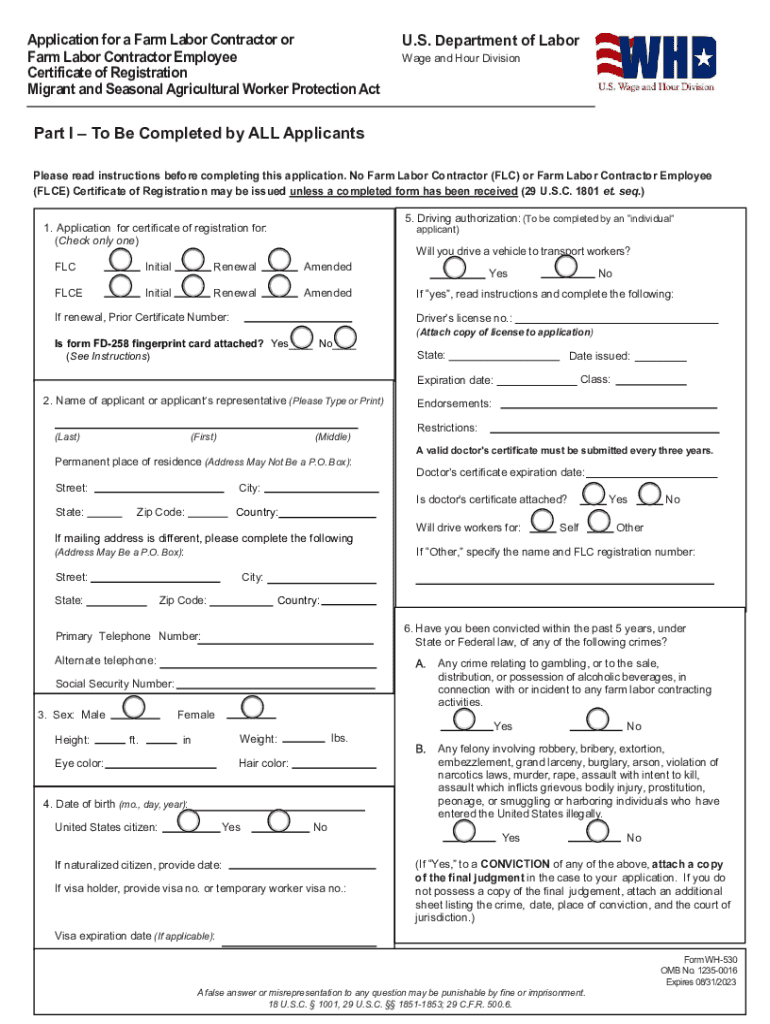

Application for a Farm Labor Contractor or Farm Labor Contractor Employee Certificate of Registration Migrant and Seasonal Agricultural Worker Protection Act U.S. Department of Labor Wage and Hour Division Part I To Be Completed by ALL Applicants Please read instructions before completing this application. No Farm Labor Contractor FLC or Farm Labor Contractor Employee FLCE Certificate of Registration may be issued unless a completed form has been received 29 U.S.C. Item 11 A farm contractor...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DOL WH-530

Edit your DOL WH-530 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DOL WH-530 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DOL WH-530 online

Follow the steps below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit DOL WH-530. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DOL WH-530 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DOL WH-530

How to fill out DOL WH-530

01

Begin with the employee's information: Fill in the employee's name, address, and Social Security number.

02

Enter the employer's details: Provide the employer's name, address, and contact information.

03

Specify the type of work: Indicate the specific job or position the employee is engaged in.

04

Report hours worked: Fill in the total hours worked by the employee during the relevant pay period.

05

Enter wage information: Provide the hourly wage rate or salary information of the employee.

06

Detail deductions: List any deductions that are applicable from the employee's pay.

07

Include signatures: Ensure that both the employee and employer sign the form to validate the information provided.

08

Submit the form: Send the completed DOL WH-530 to the appropriate government office as instructed.

Who needs DOL WH-530?

01

Employers who offer wage payments to employees and need to report wages, hours worked, and deductions required under the Fair Labor Standards Act.

02

Employees who work under any federally regulated wage and hour provisions to ensure their pay records are accurately maintained.

Fill

form

: Try Risk Free

People Also Ask about

What is FLC in labor?

A Permanent Labor Certification allows an employer to hire foreign nationals to work in a permanent basis in the United States.

What is an FLC bond?

The California Farm Labor Contractor Bond amount varies depending on payroll. For new contractors, the bond amount is $25,000. For renewal contractors, the $25,000 bond is acceptable if the annual payroll is $500,000 or less. If the payroll is $500,001 to $2mm, A $50,000 bond is required.

How much does it cost to get a contractors license in California?

The fee is $450. When you pass the tests, you must pay an additional $200 to CSLB to activate your Contractors License.

How do I become a licensed contractor in California?

How To Get a Contractor's License in California in 6 Steps Identify the license classification you need. Meet the basic licensing requirements. Fill out the licensing application. Complete a background check. Pass the California contractor licensing exam. Submit bonding & insurance documents.

How do I become a labor contractor in California?

FLC License Application Instructions and Checklist Register with the federal government as a farm labor contractor and received a federal registration certificate. Complete the state license application and pay the corresponding fee, including: Driver's license for the sole proprietor or for all members/partners.

Does Minnesota require a contractor's license?

A building contractor, remodeler or roofer license is required for anyone that contracts directly with a homeowner to provide building construction or improvement services in more than one skill area.

How do I become a farm labor contractor in Florida?

To work in Florida, farm labor contractors must obtain both a state and federal license. Disclosing working conditions and posting requirements. Workers must be informed in writing on issues regarding pay, crop, transportation and housing arrangements, contractor and grower information, and rights of farmworkers.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the DOL WH-530 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign DOL WH-530 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit DOL WH-530 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like DOL WH-530. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete DOL WH-530 on an Android device?

Use the pdfFiller mobile app and complete your DOL WH-530 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is DOL WH-530?

DOL WH-530 is a form used by employers to report information about their employees' wages and employment, particularly regarding prevailing wage determinations.

Who is required to file DOL WH-530?

Employers who are required to comply with the Davis-Bacon and Related Acts, which govern wage standards for federal construction projects, are required to file DOL WH-530.

How to fill out DOL WH-530?

To fill out DOL WH-530, employers must complete all relevant sections of the form, including information about the employer, employee wages, hours worked, and the specific project details.

What is the purpose of DOL WH-530?

The purpose of DOL WH-530 is to ensure compliance with wage standards set by the Department of Labor, by providing a detailed account of employee wages during federal construction projects.

What information must be reported on DOL WH-530?

Information that must be reported on DOL WH-530 includes the names and addresses of employees, their job classifications, rates of pay, hours worked, and any fringe benefits provided.

Fill out your DOL WH-530 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DOL WH-530 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.