Get the free Offer in Compromise Booklet, Form 656-B (PDF) - IRS

Show details

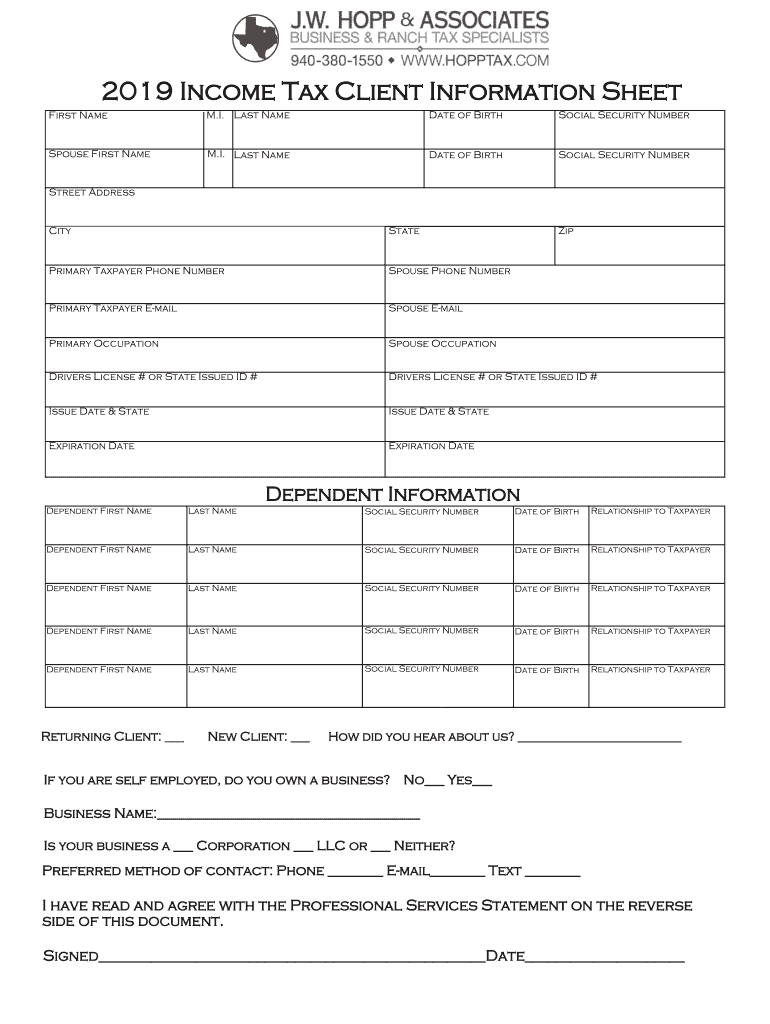

2019 Income Tax Client Information Sheet First Name. I. Last Name Date of Biosocial Security NumberSpouse First Name. I. Last Name Date of Biosocial Security NumberStreet AddressCityStateZipPrimary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offer in compromise booklet

Edit your offer in compromise booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offer in compromise booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offer in compromise booklet online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit offer in compromise booklet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offer in compromise booklet

How to fill out offer in compromise booklet

01

To fill out the offer in compromise booklet, follow these steps:

02

Read the instructions: Begin by carefully reading the instructions provided with the booklet. Understand the eligibility and requirements for submitting an offer in compromise.

03

Gather necessary documents: Collect all the important documents such as financial statements, tax returns, bank statements, and proof of income. Ensure you have all the required information.

04

Complete the necessary forms: Fill out the required forms accurately and completely. This usually includes Form 656, Form 433-A (OIC), or Form 433-B (OIC), depending on your individual or business situation.

05

Calculate your offer amount: Use the provided formula and guidelines to calculate your offer amount. This involves analyzing your income, expenses, assets, and liabilities to determine what you can reasonably offer to settle your tax debt.

06

Attach supporting documents: Include all the supporting documents required to substantiate your financial situation and offer amount. This may include pay stubs, bank statements, receipts, and other relevant records.

07

Review and double-check: Carefully review all the information provided in the booklet and cross-check it with your completed forms. Ensure that there are no errors or omissions.

08

Submit the completed offer: Once you are confident that all the necessary information has been provided accurately, package your offer in compromise booklet along with the required fee and mail it to the appropriate IRS address.

09

Follow up and respond to IRS requests: After submitting your offer, be prepared to respond to any additional requests or inquiries from the IRS. Cooperate with their requests to expedite the review process.

10

Await IRS decision: The IRS will review your offer and determine whether to accept, reject, or negotiate the terms. Be patient during this process, as it may take several months to receive a final decision.

11

Seek professional assistance if needed: If you are unsure about any step or need professional guidance, consider consulting a tax professional or seek assistance from an attorney specializing in tax matters.

Who needs offer in compromise booklet?

01

The offer in compromise booklet is typically needed by individuals or businesses who have a significant tax debt and are unable to pay it in full. It is designed for taxpayers who genuinely cannot meet their tax obligations without experiencing financial hardship.

02

Specific situations where someone may need the offer in compromise booklet include:

03

- Individuals with large tax debts and limited financial resources

04

- Self-employed individuals facing financial difficulties

05

- Businesses struggling to generate enough income to meet tax obligations

06

- Taxpayers facing unexpected financial hardships such as medical expenses or loss of income

07

- Those who believe they have a valid reason to challenge the amount of tax debt owed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute offer in compromise booklet online?

pdfFiller has made filling out and eSigning offer in compromise booklet easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out offer in compromise booklet using my mobile device?

Use the pdfFiller mobile app to fill out and sign offer in compromise booklet. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit offer in compromise booklet on an Android device?

The pdfFiller app for Android allows you to edit PDF files like offer in compromise booklet. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is offer in compromise booklet?

The offer in compromise booklet is a detailed guide provided by the IRS to help taxpayers understand the process of submitting an offer in compromise to settle their tax debt for less than the full amount owed.

Who is required to file offer in compromise booklet?

Taxpayers who are unable to pay their full tax liability and meet certain eligibility requirements may be required to file an offer in compromise using the information provided in the booklet.

How to fill out offer in compromise booklet?

Taxpayers can follow the step-by-step instructions provided in the offer in compromise booklet to accurately complete the necessary forms and submit all required documentation.

What is the purpose of offer in compromise booklet?

The purpose of the offer in compromise booklet is to assist taxpayers in applying for a compromise agreement with the IRS in order to settle their tax debt for an amount less than what is owed.

What information must be reported on offer in compromise booklet?

Taxpayers must report detailed financial information, including income, expenses, assets, and liabilities, in order to support their offer in compromise proposal.

Fill out your offer in compromise booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offer In Compromise Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.