Get the free ANNUAL AUDITED RERORT PART lil SOFi ... - SEC.gov

Show details

APPROVAL

OMB Number:

32350123

Expires:

August 31, 2020,

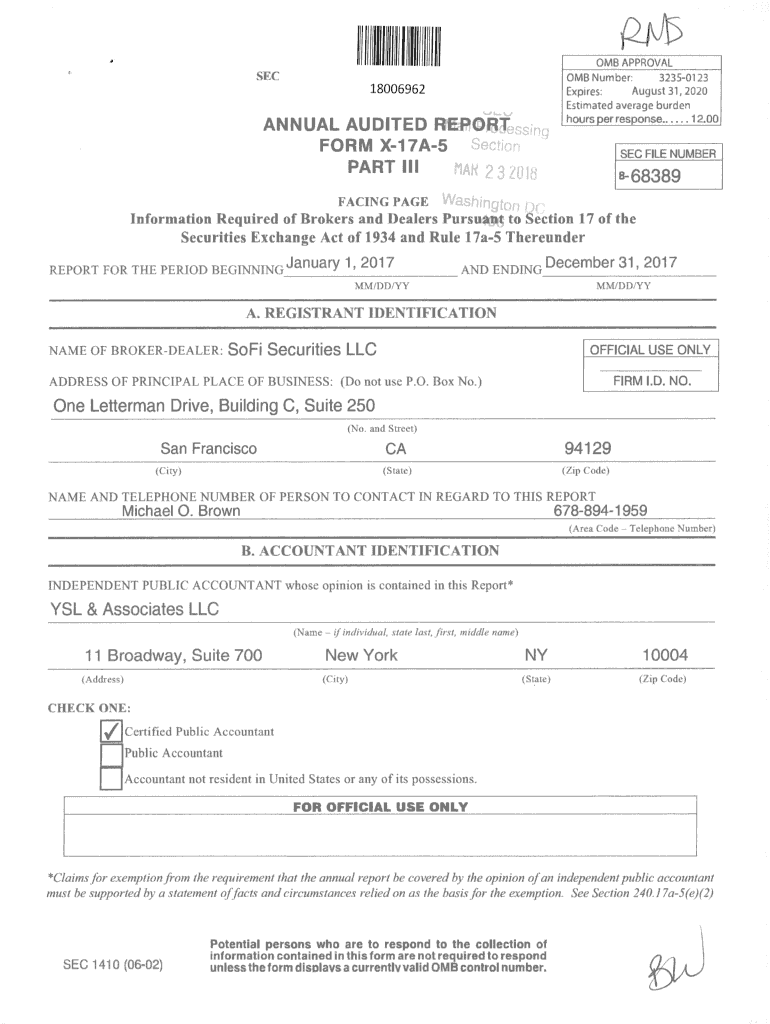

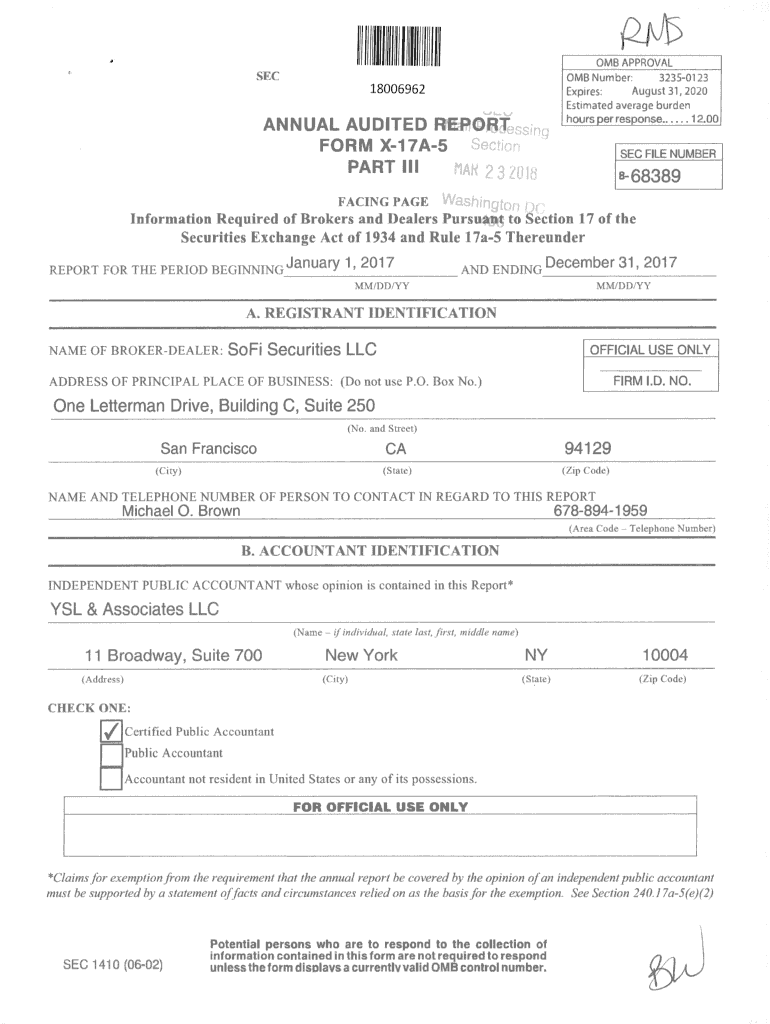

Estimated average burdenSEC18006962ANNUALAUDITED RERORThoursperresponse......12.00FORM X17A5

PART lila68389PAGEFACINGInformationSECFILENUMBERof

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited rerort part

Edit your annual audited rerort part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited rerort part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual audited rerort part online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual audited rerort part. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited rerort part

How to fill out annual audited rerort part

01

Gather all relevant financial documents, including income statements, balance sheets, and cash flow statements.

02

Review the previous year's audited report to understand the format and requirements for the current report.

03

Start by filling out the introductory section, which includes the name of the company, fiscal year covered, and a brief overview of the audit process.

04

Proceed to the financial statements section, which includes the income statement, balance sheet, and cash flow statement. Fill in the relevant figures and ensure they are accurate.

05

Provide detailed footnotes or disclosures for any significant accounting policies, estimates, or contingent liabilities.

06

Include any supplementary schedules or exhibits required by regulatory authorities or industry standards.

07

Complete the management discussion and analysis section, which provides an overview of the company's financial performance, risks, and future prospects.

08

Include the auditor's report, which provides an independent opinion on the fairness and accuracy of the financial statements.

09

Review the completed report for any errors or inconsistencies, making necessary corrections.

10

Submit the audited report to relevant stakeholders, such as shareholders, regulatory bodies, and financial institutions.

Who needs annual audited rerort part?

01

Companies that are publicly traded and listed on stock exchanges usually need to prepare and submit annual audited reports as part of their legal and regulatory obligations.

02

Government agencies and regulatory bodies often require certain organizations to submit audited reports for transparency and compliance purposes.

03

Financial institutions and lenders may request audited reports from businesses to assess creditworthiness and make informed lending decisions.

04

Investors and shareholders rely on audited reports to evaluate the financial health, performance, and risks associated with a company before making investment decisions.

05

Potential business partners or buyers may request audited reports to assess the reliability and credibility of a company's financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual audited rerort part from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your annual audited rerort part into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send annual audited rerort part to be eSigned by others?

When your annual audited rerort part is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete annual audited rerort part on an Android device?

Use the pdfFiller mobile app and complete your annual audited rerort part and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is annual audited report part?

Annual audited report part is a section of a company's financial report that has been reviewed by an external auditor to ensure accuracy and compliance with accounting standards.

Who is required to file annual audited report part?

Publicly traded companies and certain other entities, such as non-profit organizations, are required to file annual audited report part.

How to fill out annual audited report part?

To fill out annual audited report part, companies typically provide their financial statements, including balance sheets, income statements, and cash flow statements, to an external auditor for review.

What is the purpose of annual audited report part?

The purpose of annual audited report part is to provide stakeholders, such as investors and creditors, with an independent assessment of a company's financial performance and position.

What information must be reported on annual audited report part?

Annual audited report part must include financial statements, notes to the financial statements, and the auditor's report, which provides an opinion on the accuracy and compliance of the financial statements.

Fill out your annual audited rerort part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Rerort Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.