IRS 1040-ES 2020 free printable template

Show details

2020Department of the Treasury Internal Revenue ServiceNow 1040ES Estimated Tax for IndividualsPurpose of This PackageFarmers and fishermen. If at least two thirds of your gross income for 2019 or.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

To edit the IRS 1040-ES form, you can use the online PDF editing tools available on pdfFiller. This allows you to make necessary changes directly on the PDF document. Simply upload your IRS 1040-ES form, make desired edits, and ensure all information is accurate. Once completed, you can save, print, or submit the form as needed.

How to fill out IRS 1040-ES

Filling out the IRS 1040-ES involves several steps to ensure accuracy. First, gather your financial information, including income sources and deductions. Next, use the following steps to complete the form:

01

Determine your estimated tax liability for the year.

02

Complete the provided sections with your personal information.

03

Calculate your quarterly payments based on your estimated tax.

04

Sign and date your completed form.

05

Submit your payments according to the provided due dates.

Be meticulous when entering your data to prevent errors that could lead to penalties.

About IRS 1040-ES 2020 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-ES 2020 previous version

What is IRS 1040-ES?

IRS 1040-ES is a tax form used by individuals to report estimated taxes owed on income not subject to withholding, such as self-employment income, rental income, or interest income. This form is crucial for taxpayers who expect to owe tax on income not covered by standard paycheck withholdings.

What is the purpose of this form?

The purpose of the IRS 1040-ES is to facilitate the payment of estimated tax amounts throughout the year, rather than through a lump sum at year-end. It helps taxpayers avoid underpayment penalties by ensuring regular payments based on anticipated tax obligations.

Who needs the form?

Individuals who earn income without withholding, such as freelancers, self-employed individuals, or those with significant investment income, typically need to file IRS 1040-ES. If you expect your tax liability to be $1,000 or more after subtracting withholding and refundable credits, this form is necessary.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040-ES if you had no tax liability in the prior year and were a U.S. citizen or resident for the entire year. Additionally, if your income is below a certain threshold, you might not owe estimated taxes.

Components of the form

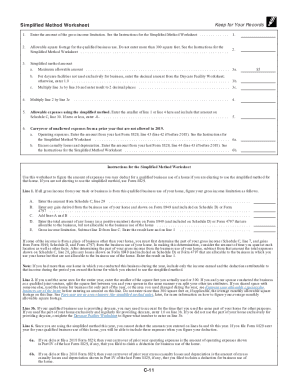

The IRS 1040-ES consists of several key components that include your name, address, Social Security number, and a series of worksheets to estimate your tax liability. It also features payment vouchers that you can submit with each estimated tax payment to the IRS.

What are the penalties for not issuing the form?

If you fail to pay estimated taxes when required, the IRS may impose penalties for underpayment. This can amount to interest charges on the unpaid balance, which increases the amount owed. Regularly filing and paying your estimated taxes can help mitigate these penalties.

What information do you need when you file the form?

When filing IRS 1040-ES, you will need crucial information such as your estimated income, applicable deductions, and credits. Having detailed financial records will facilitate accurate calculations of your estimated taxes.

Is the form accompanied by other forms?

The IRS 1040-ES can be submitted alongside other forms related to income reporting or adjustments. Typically, it stands alone but may be reviewed with the completed IRS Form 1040 during the annual tax filing process.

Where do I send the form?

You must send your IRS 1040-ES to the appropriate address specified in the form’s instructions based on your state of residence. Make sure to check for the latest mailing addresses to ensure timely processing of your payments.

See what our users say