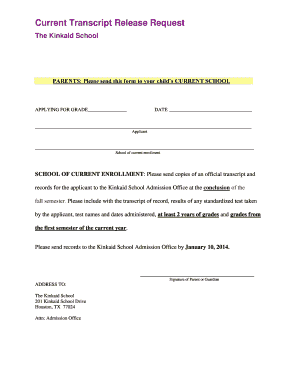

Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate 2020-2025 free printable template

Show details

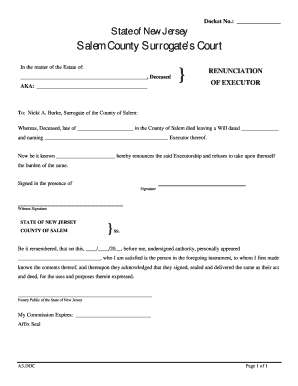

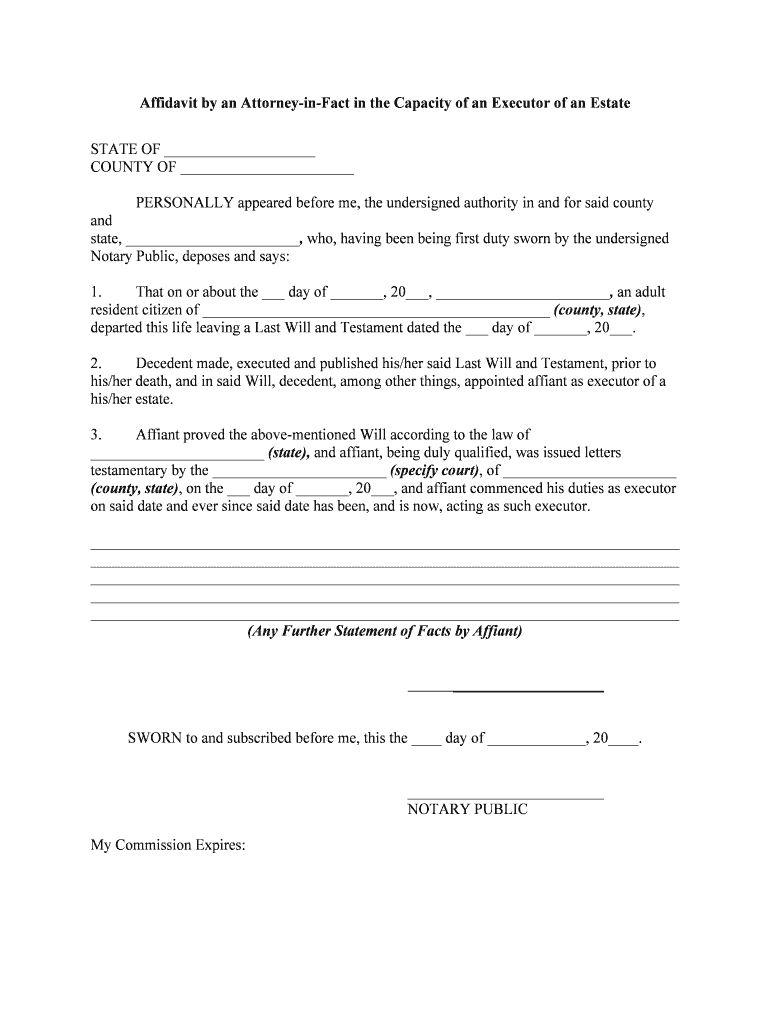

Affidavit by an AttorneyinFact in the Capacity of an Executor of an Estate STATE OF COUNTY OF PERSONALLY appeared before me, the undersigned authority in and for said county and state, , who, having

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate

Edit your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate

How to fill out Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

01

Begin by obtaining the Affidavit form specific to your jurisdiction.

02

Fill in the title of the document, typically 'Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate'.

03

Include the full name and contact information of the Attorney-in-Fact.

04

Provide the decedent's full name and details about the estate.

05

Clearly state your authority to act on behalf of the executor as outlined in the power of attorney.

06

List the acts and decisions you are authorized to undertake in the probate process.

07

Include a declaration that the information provided is true and correct.

08

Sign the affidavit in the presence of a notary public.

09

Have the notary public acknowledge your signature.

10

Make copies of the completed affidavit for your records and to submit to the court.

Who needs Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

01

Individuals who are designated as an Attorney-in-Fact under a power of attorney.

02

Executors who require authority to manage the estate on behalf of the decedent.

03

Beneficiaries of the estate seeking to establish legal authority in administrative processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can a POA also be a beneficiary?

Changing Beneficiary Designations Some power of attorney documents may be drawn so broadly as to give an agent the power to change beneficiaries on life insurance policies, bank accounts and retirement policies. However, the agent has a fiduciary duty to act in good faith.

Can you be power of attorney and beneficiary?

Policies vary, but as a rule a power of attorney may not sign a beneficiary designation form, although some insurance programs allow it. However, for your power of attorney to complete your beneficiary designation form or make changes to it, you must specifically assign the individual that right.

Can a POA change the beneficiary on an IRA?

Changing the RRIF beneficiary designation The general consensus is that a beneficiary designation on life insurance policies, pensions, RRSPs, RRIFs and TFSAs is a testamentary disposition, and thus cannot be completed by a PoA in any circumstances.

Can someone with power of attorney override a will?

Does Power of Attorney Override a Will? Death is the point at which the powers cease under a power of attorney and property passes into an estate, provided other estate planning provisions haven't been made. If the deceased died testate, or with a will, the terms of her will become effective once admitted to probate.

Is attorney in fact the same as executor?

An Executor is the person you name in your Will to take care of your affairs after you die. A Power of Attorney names a person, often called your agent or attorney-in-fact, to handle matters for you while you are alive. Generally speaking, your Power of Attorney ceases to be effective at the moment of your death.

Is durable power of attorney same as executor of will?

An individual can designate power of attorney to his attorney, family member or friend and also name that same person as executor of the estate. A durable power of attorney with broad authority and specific prohibitions helps protect the individual's estate during his lifetime.

Can executor of will be power of attorney?

Powers of attorney do not survive death. After death, the executor of the estate handles all financial and legal matters, according to the provisions of the will. An individual can designate power of attorney to his attorney, family member or friend and also name that same person as executor of the estate.

Who should you choose as executor of your will?

Anyone aged 18 or above can be an executor of your will. There's no rule against people named in your will as beneficiaries being your executors. In fact this is very common. Many people choose their spouse or civil partner or their children to be an executor.

Does lasting power of attorney override a will?

If your loved one made an Advance Decision (Living Will) after you were appointed as their attorney, you can't override the decisions made in their Advance Decision.

Can an executor appoint a power of attorney?

Answer: An executor may appoint an agent to carry out certian acts. However, a power of attorney may not be used to make a court appearance for the executor.

How do I edit Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

An Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate is a legal document that affirms the authority of an attorney-in-fact to act on behalf of an executor, typically in matters related to the administration of a deceased person's estate.

Who is required to file Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

The executor of an estate or their designated attorney-in-fact is required to file this affidavit, especially if the executor is unable to manage the estate personally or has granted the attorney-in-fact the authority to do so.

How to fill out Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

To fill out the affidavit, you must provide the names and addresses of the executor and the attorney-in-fact, specify the authority being granted, include any relevant estate information, and sign the document in the presence of a notary public.

What is the purpose of Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

The purpose of this affidavit is to provide a legal affirmation that the attorney-in-fact has the authority to act on behalf of the executor and to ensure that the estate administration process can proceed smoothly in the executor's absence.

What information must be reported on Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate?

The affidavit must report the names and addresses of the executor and attorney-in-fact, the date of the power of attorney, detailed descriptions of the powers granted, specifics related to the estate, and notarized signatures.

Fill out your Affidavit by an Attorney-in-Fact in form Capacity of an Executor of an Estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit By An Attorney-In-Fact In Form Capacity Of An Executor Of An Estate is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.