HI DoT BB-1 2019 free printable template

Show details

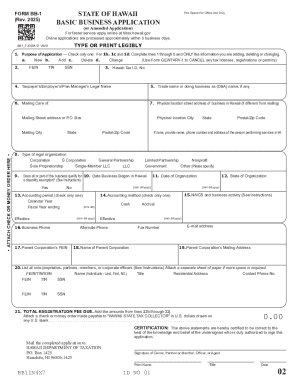

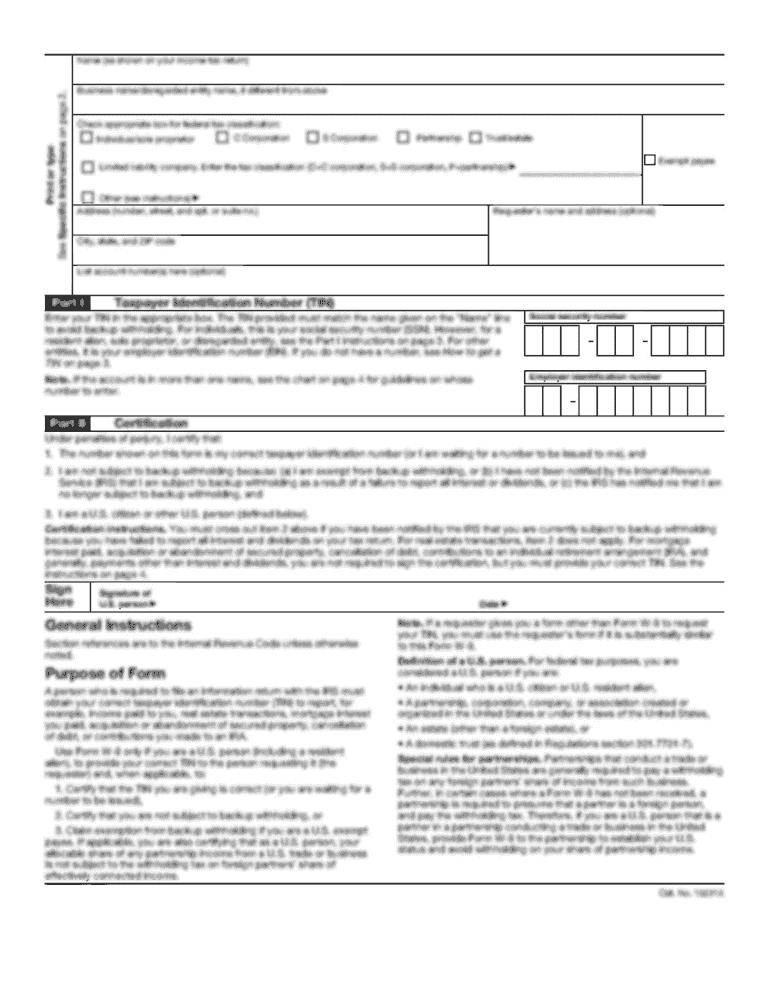

STATE OF HAWAII BASIC BUSINESS APPLICATION FORM BB-1 Rev. 2017 Clear Form This Space For Office Use Only or Amended Application For faster service apply online at tax. The filing frequency cannot be changed retroactively. Form BB-1 Rev. 2017 Instructions Form BB-1 INSTRUCTIONS FOR FORM BB-1 ABOUT THIS FORM Form BB-1 is designed for electronic scanning that permits faster processing with fewer errors. If you are filing Form BB-1 attach your payment and Form VP-1 to the front of your form and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT BB-1

Edit your HI DoT BB-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT BB-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT BB-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT BB-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT BB-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT BB-1

How to fill out HI DoT BB-1

01

Start by downloading the HI DoT BB-1 form from the official website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information including your name, address, and contact details.

04

Provide any required identification numbers as specified.

05

Describe the purpose of the form and any relevant details related to your situation.

06

Review the form for completeness and accuracy before submission.

07

Submit the form through the designated channels, either online or via mail.

Who needs HI DoT BB-1?

01

Individuals or organizations involved in transportation activities in Hawaii.

02

Businesses applying for permits related to motor carrier operations.

03

Anyone requiring compliance with state transportation regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a bb1 form in Hawaii?

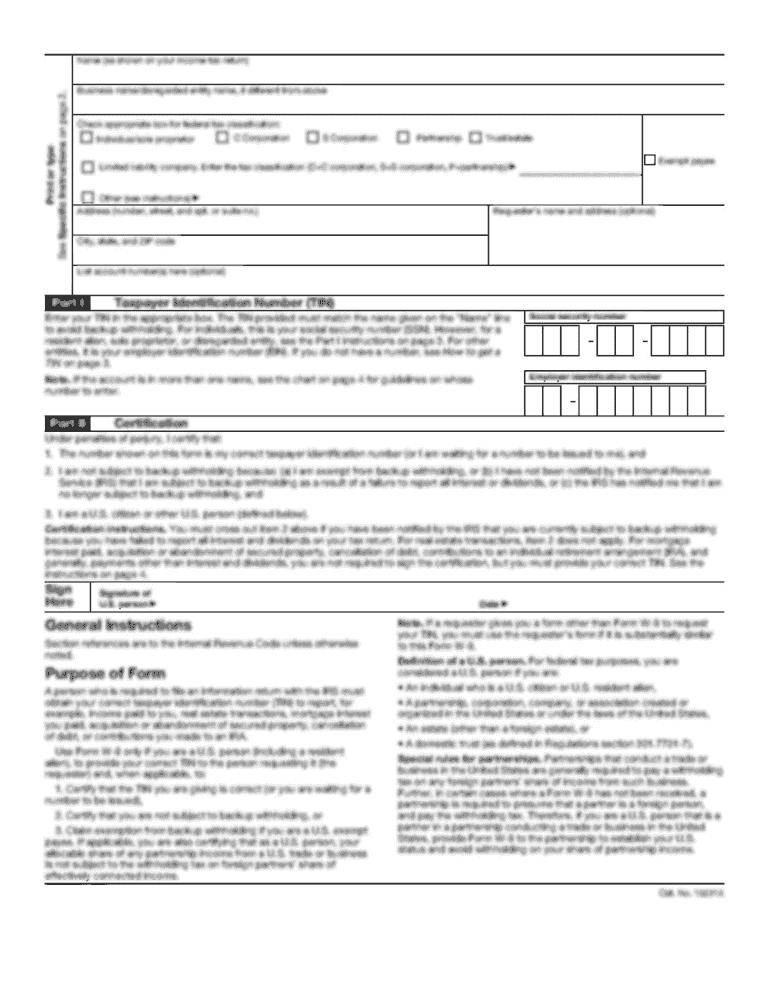

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number (BB-1), file tax returns, make payments, manage your accounts, and conduct other common transactions online with the Hawaiʻi Department of Taxation.

Who must pay Hawaii general excise tax?

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Where do I find my Hawaii tax ID number?

How do I find my tax license number(s)? Use “Search Tax Licenses” on Hawaii Tax Online.

What is the tax bracket in Hawaii?

The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax. Hawaii offers tax deductions and credits to reduce your tax liability, including a deduction for medical and dental expenses, a deduction for home mortgage interest, and a tax credit for child and dependent care costs.

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send HI DoT BB-1 for eSignature?

When you're ready to share your HI DoT BB-1, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in HI DoT BB-1 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your HI DoT BB-1, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete HI DoT BB-1 on an Android device?

Use the pdfFiller mobile app and complete your HI DoT BB-1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is HI DoT BB-1?

HI DoT BB-1 is a form used in Hawaii to report certain business activities and tax information to the Department of Taxation.

Who is required to file HI DoT BB-1?

Businesses operating in Hawaii that meet specific criteria related to income and activities are required to file HI DoT BB-1.

How to fill out HI DoT BB-1?

To fill out HI DoT BB-1, businesses should provide accurate information regarding their business activities, income, and other required financial details as specified in the form instructions.

What is the purpose of HI DoT BB-1?

The purpose of HI DoT BB-1 is to ensure compliance with Hawaii tax laws by collecting necessary information from businesses for tax assessment and record-keeping.

What information must be reported on HI DoT BB-1?

The information that must be reported on HI DoT BB-1 includes details about the business entity, gross income, deductions, and other financial information pertinent to tax calculations.

Fill out your HI DoT BB-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT BB-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.