Get the free Stopping An Income Withholding Order: The Other Party Wont Sign - coconino az

Show details

Stopping An Income Withholding Order: The Other Party Won't SignSUSPENDER RNA ORDER DE

RETENTION DE INGRESS

LA OKRA PART NO QUIRE FIRMER

SUEDE USER ESTER PAIUTE SLO SI SE COMPLEX TODAY

LAS SIGUIENTES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stopping an income withholding

Edit your stopping an income withholding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stopping an income withholding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stopping an income withholding online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit stopping an income withholding. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

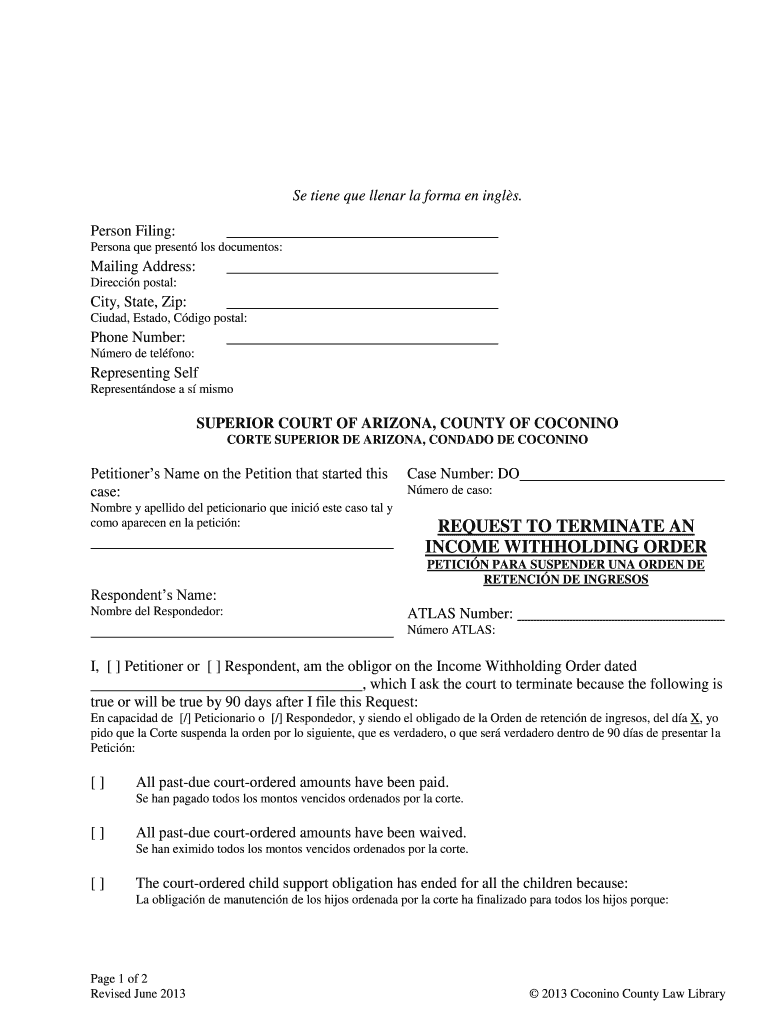

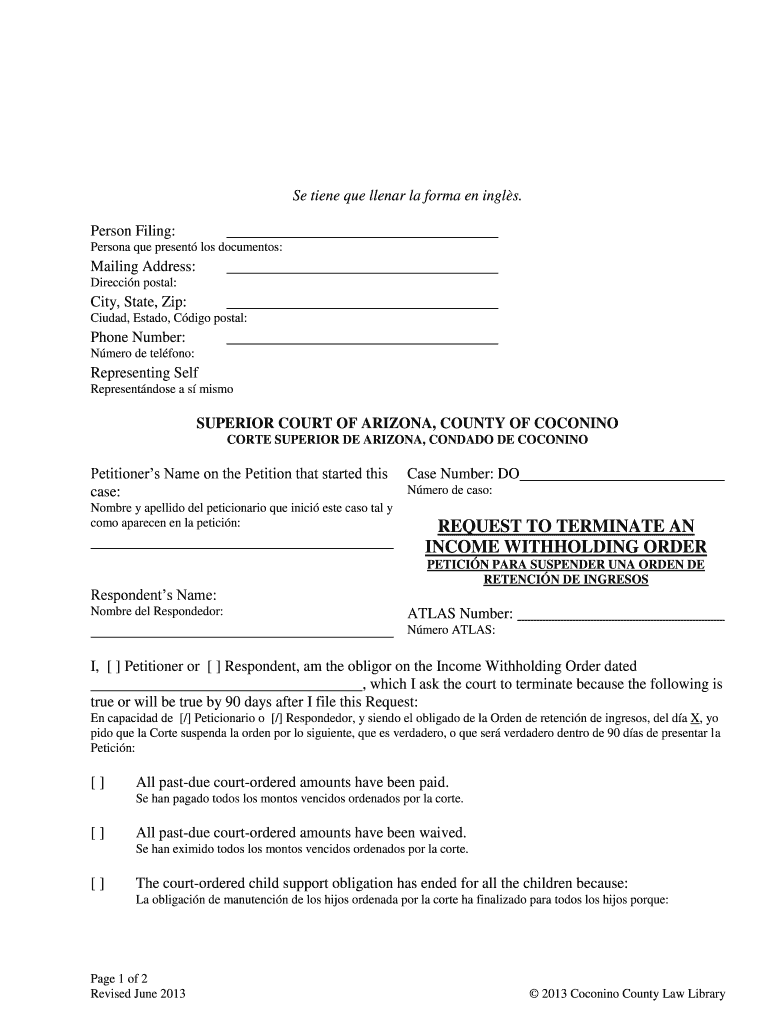

How to fill out stopping an income withholding

How to fill out stopping an income withholding

01

To fill out stopping an income withholding, follow these steps:

02

Download the 'Stopping an Income Withholding' form from the appropriate government website or obtain a physical copy from the local office.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide details about the income withholding order you wish to stop, including the case number and the name of the party requesting the withholding.

05

Indicate the reason for stopping the income withholding and provide any supporting documents if required.

06

Sign and date the form.

07

Submit the completed form to the appropriate office or mailing address as specified on the form or the government website.

08

Keep a copy of the filled form for your records.

Who needs stopping an income withholding?

01

Stopping an income withholding may be needed by individuals who have a valid reason to cease the wage garnishment. This may include:

02

- Individuals who have completed paying off their debts and obligations.

03

- Individuals who can provide evidence of a change in financial circumstances that warrants the termination of income withholding.

04

- Individuals who have reached a settlement agreement with the party requesting the wage garnishment.

05

- Individuals who have successfully contested the court order for income withholding.

06

- Individuals who have proper legal documentation to prove that the income withholding is no longer necessary.

07

It is important to consult with legal professionals and review specific laws and regulations relevant to your jurisdiction to determine if stopping an income withholding is applicable in your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit stopping an income withholding from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your stopping an income withholding into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the stopping an income withholding in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your stopping an income withholding and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit stopping an income withholding on an Android device?

You can make any changes to PDF files, like stopping an income withholding, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is stopping an income withholding?

Stopping an income withholding refers to the process of terminating the deduction of funds from an individual's income, typically due to changes in circumstances such as a change in employment, satisfaction of a debt, or a change in legal obligations.

Who is required to file stopping an income withholding?

The individual whose income is being withheld, or their legal representative, is typically required to file the necessary documents to stop the income withholding.

How to fill out stopping an income withholding?

To fill out a stopping an income withholding form, one must provide their personal information, details regarding the income source, the reason for stopping the withholding, and any supporting documentation as required by the specific jurisdiction or agency.

What is the purpose of stopping an income withholding?

The purpose of stopping an income withholding is to cease the deductions from an individual's income for specific debts or obligations, thereby allowing them to retain more of their earnings and preventing undue financial hardship.

What information must be reported on stopping an income withholding?

The information that must be reported includes the individual's name, contact information, details of the income provider, reason for stopping the withholding, as well as any relevant case or docket numbers.

Fill out your stopping an income withholding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stopping An Income Withholding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.