TX Comptroller 50-285 2019 free printable template

Show details

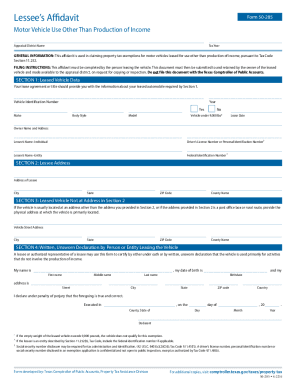

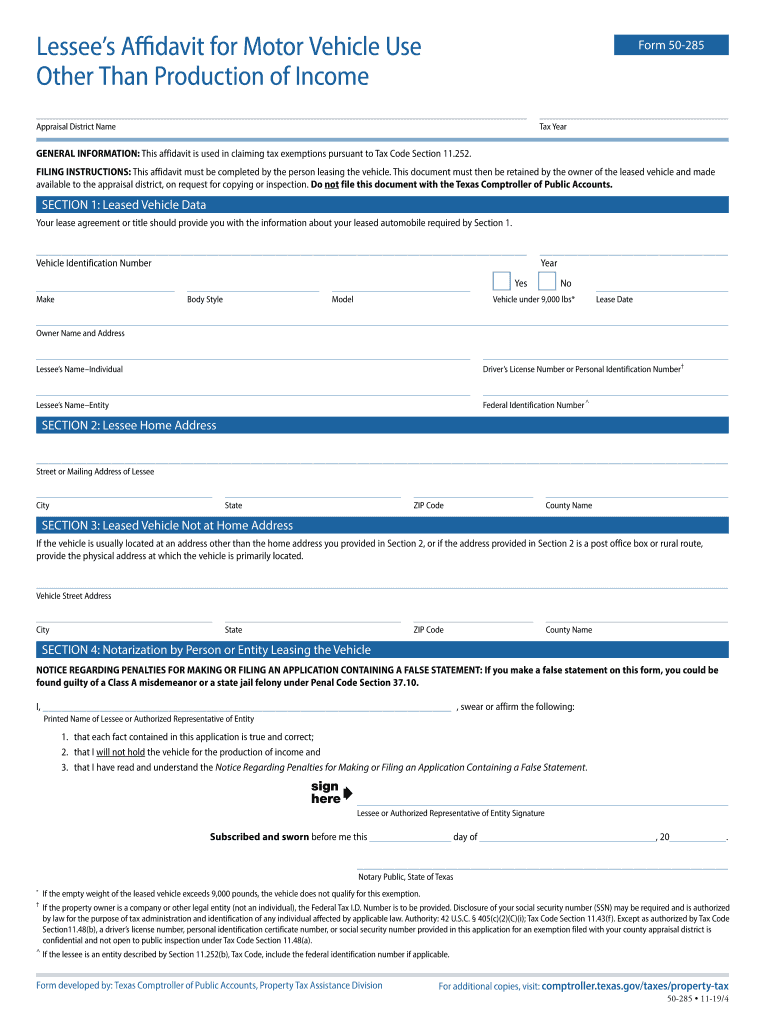

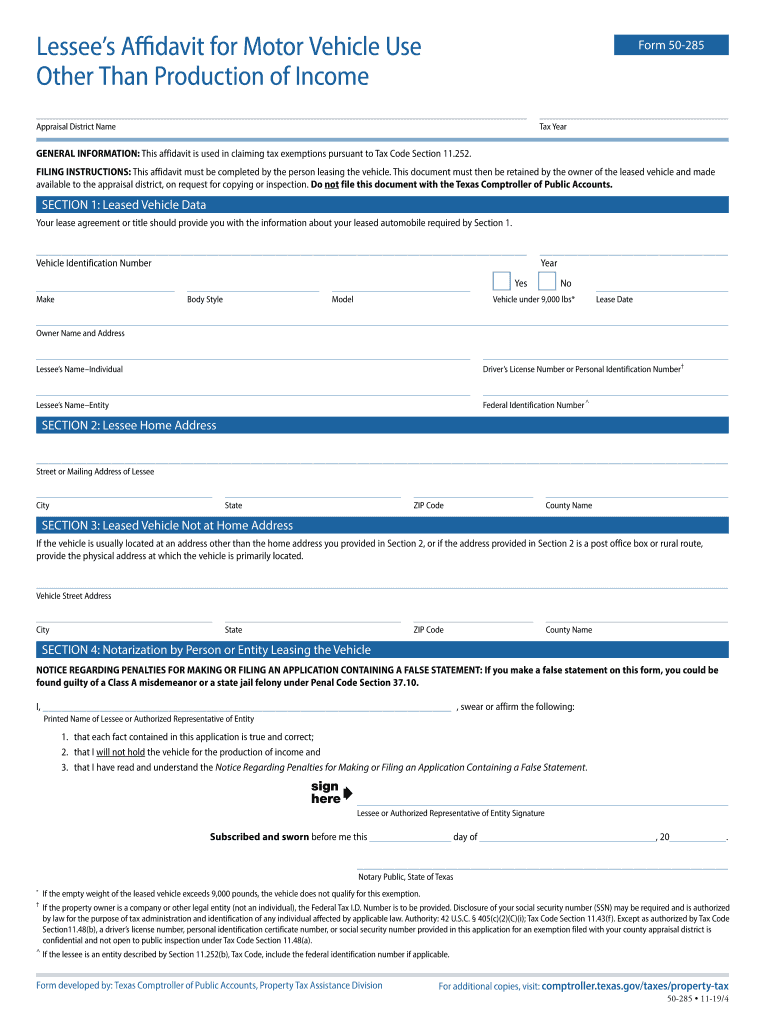

Lessees Affidavit for Motor Vehicle Use Other Than Production of Incomers 50285 Appraisal District Name YearGENERAL INFORMATION: This affidavit is used in claiming tax exemptions pursuant to Tax Code

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-285

Edit your TX Comptroller 50-285 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-285 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-285 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Comptroller 50-285. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-285 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-285

How to fill out TX Comptroller 50-285

01

Download form 50-285 from the Texas Comptroller's website.

02

Provide the name and address of the entity applying for the exemption.

03

Indicate the type of exemption being requested.

04

Detail the specific use of the property for which the exemption is claimed.

05

Enter any applicable Texas Taxpayer Identification Number.

06

Sign and date the form to certify that the information is true and accurate.

07

Submit the completed form to the appropriate local appraisal district.

Who needs TX Comptroller 50-285?

01

Property owners in Texas who wish to apply for an exemption from property taxes for specific types of properties, such as religious, charitable, or educational organizations.

Fill

form

: Try Risk Free

People Also Ask about

How do I transfer my leased car to Texas?

Applying for registration Visit the local Texas tax office. Fill in an Application for Texas Certificate of Title form. You need to provide proof of ID, ownership, car insurance, and vehicle inspection. The registration incurs a standard fee of $51.75 (additional fees may apply)

What is the sales tax on a travel trailer in Texas?

Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Do I have to pay personal property tax on a leased vehicle in Texas?

No tax is due on the lease payments made by the lessee under a lease agreement. Also, no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. Any tax paid by the lessee when the motor vehicle was titled and registered in Texas was paid in the name of and for the lessor.

Do you have to pay taxes on an inherited car in Texas?

Transfers by Heirs First, the heir(s) owes tax (either motor vehicle use tax or gift tax) on acquiring the vehicle from the estate. Second, the person receiving the vehicle from the heir(s) also owes motor vehicle tax.

Do you have to pay property tax on a leased car in Texas?

Leased vehicles in Texas are not subject to property taxes unless they are used primarily to generate income. While Texas starts with the premise that all property is taxable, unless exempt by state or federal law, Texas exempts leased vehicles from property tax, unless they are used primarily to generate income.

Do I owe tax if I bring a leased motor vehicle into Texas from another state?

When a motor vehicle is leased in another state and the lessee is a Texas resident or is domiciled or doing business in Texas and brings the motor vehicle into Texas for use, the lessee (as the operator) owes motor vehicle use tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX Comptroller 50-285 online?

Filling out and eSigning TX Comptroller 50-285 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit TX Comptroller 50-285 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your TX Comptroller 50-285 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete TX Comptroller 50-285 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your TX Comptroller 50-285. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX Comptroller 50-285?

TX Comptroller 50-285 is a form used in the state of Texas for property tax exemption applications, specifically for organizations seeking to qualify for a property tax exemption under Texas law.

Who is required to file TX Comptroller 50-285?

Organizations that claim a property tax exemption based on specific qualifications under Texas law, such as charitable or religious organizations, are required to file TX Comptroller 50-285.

How to fill out TX Comptroller 50-285?

To fill out TX Comptroller 50-285, applicants must provide detailed information about their organization, including its purpose, activities, and financial information, as well as supporting documents that demonstrate eligibility for the exemption.

What is the purpose of TX Comptroller 50-285?

The purpose of TX Comptroller 50-285 is to allow organizations to apply for a property tax exemption by demonstrating their compliance with the necessary criteria set forth by Texas law.

What information must be reported on TX Comptroller 50-285?

The form must report information including the organization's name, address, type of organization, the specific property for which exemption is sought, and details regarding the organization's activities and how they meet the exemption criteria.

Fill out your TX Comptroller 50-285 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-285 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.