TX Comptroller 50-285 2020 free printable template

Show details

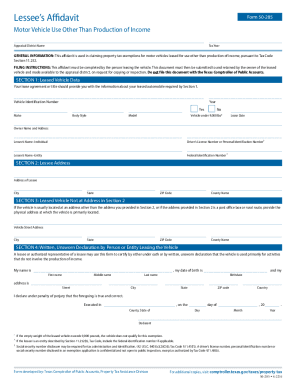

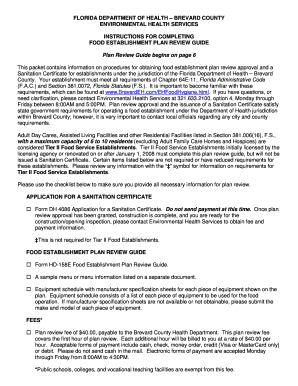

Lessees AffidavitForm 50285Motor Vehicle Use Other Than Production of Income Appraisal District Name YearGENERAL INFORMATION: This affidavit is used in claiming tax property tax exemptions for motor

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-285

Edit your TX Comptroller 50-285 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-285 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-285 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX Comptroller 50-285. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-285 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-285

How to fill out TX Comptroller 50-285

01

Obtain the TX Comptroller 50-285 form from the Texas Comptroller's website.

02

Provide the name and address of the organization seeking the exemption.

03

Fill in the type of exemption being requested and the specific purpose of the organization.

04

Include the organization’s tax identification number.

05

Describe the activities the organization conducts that qualify for the exemption.

06

Provide any supporting documentation, such as bylaws or articles of incorporation.

07

Sign and date the form.

08

Submit the completed form to the appropriate office as instructed.

Who needs TX Comptroller 50-285?

01

Nonprofit organizations seeking tax-exempt status in Texas.

02

Charitable organizations looking for property tax exemptions.

03

Entities involved in educational, religious, or scientific activities.

Fill

form

: Try Risk Free

People Also Ask about

Do I pay car tax on a leased car?

Road tax on a lease car is administered entirely by the funder of your lease deal as they are the registered keeper of the vehicle. Therefore, no action is required from yourself regarding taxing your new vehicle as it is all taken care of by them ahead of delivery.

Do Texans pay personal property tax?

Texas has no state property tax. The Comptroller's office does not collect property tax or set tax rates. That's up to local taxing units, which use tax revenue to provide local services including schools, streets and roads, police and fire protection and many others.

Who pays sales tax on leased vehicle in Texas?

Leased Vehicles Lease payments are not taxed in Texas. The lessor pays 6.25 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas. The taxable value of private-party purchases of leased (used) motor vehicles may be based on 80 percent of the SPV.

How do I register a leased car in CT?

Registering a leased vehicle Please call 860-263-5056 to verify the license and address of the leasing company before presenting the vehicle for registration. The Connecticut Insurance Identification Card may be in the name of the leasing company or the name of the lessee for registration purposes.

Who is responsible for registration on a leased vehicle Texas?

Title to Lessee at the End of an Operating Lease Agreement Motor vehicle tax is due from the lessee at the time of titling and registration on the purchase of the motor vehicle from the lessor, since a new taxable sale (second transaction) has occurred, whether the vehicle was leased in Texas or out of state.

What do I need to register my leased car in Texas?

Take the following with you: Title or out-of-state registration receipt. Completed Application for Texas Title and/or Registration (Form 130-U) Your current driver license or government-issued photo identification. Proof of current vehicle insurance. Proof of current Texas vehicle inspection.

Do you pay sales tax on a leased car in Texas?

Leased Vehicles Lease payments are not taxed in Texas. The lessor pays 6.25 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas.

Do you pay personal property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

How do I get a new number plate on a leased car?

The following steps are the simplest way to add a private registration plate to your new lease vehicle. Ask permission from the finance company. Update the nominee details. Post the documents to the finance provider. Confirm the transfer is complete.

Does CT charge property tax on vehicles?

Motor vehicles are subject to a local property tax under Connecticut state law, whether registered or not. Motor vehicles are assessed ing to State statutes at 70% of the Clean Retail value through the use of the NADA Guides and other resources. The uniform assessment date is October 1st in Connecticut.

Is there personal property tax on cars in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

How do I register a leased vehicle in Texas?

Applying for registration Visit the local Texas tax office. Fill in an Application for Texas Certificate of Title form. You need to provide proof of ID, ownership, car insurance, and vehicle inspection. The registration incurs a standard fee of $51.75 (additional fees may apply)

Do you pay property tax on a leased car in CT?

CT Property Tax on Cars That Are Leased Since the leasing company owns the vehicle you are leasing, they are responsible for these taxes, however, the cost is usually passed on to the lessee.

Who is exempt from Texas motor vehicle tax?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

How does a buyout work on a leased vehicle?

What is a lease buyout? A lease buyout, sometimes referred to as a purchase option, allows you to purchase the car at the end of the lease instead of turning it in if your lease contract permits it. Whether or not buying out a leased car is the right move depends on a lot of factors.

How does a lease car affect my tax?

As explained above, you don't typically need to worry about taxing the vehicle, as this will often be included in your monthly rental. Insurance, however, is usually down to you. Most standard leases don't come with insurance, however you can ask that it be included in the price.

Do I have to pay taxes on my car every year in Texas?

Since the car was in the state as of January 1st, property taxes will still be due. Because the state of Texas is a non-prorate state, all taxes are due for the year, even if the car is moved out of state after January 1st.

How do I avoid paying sales tax on a used car in Texas?

How can I avoid paying sales tax on a used car? You will register the vehicle in a state with no sales tax because you live or have a business there. You plan to move to a state without sales tax within 90 days of the vehicle purchase. The vehicle was made before 1973. You are disabled.

Do you pay sales tax on a lease buyout in Texas?

Leased Vehicles Lease payments are not taxed in Texas. The lessor pays 6.25 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas. The taxable value of private-party purchases of leased (used) motor vehicles may be based on 80 percent of the SPV.

Is lease subject to sales tax?

At the most basic level, rental and lease transactions are generally treated the same as sales transactions in most states – of course there are a few exceptions. A lessor can generally acquire property that will be rented or leased exempt under the resale exemption. Tax is then charged on the rental or lease amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out TX Comptroller 50-285 using my mobile device?

Use the pdfFiller mobile app to complete and sign TX Comptroller 50-285 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out TX Comptroller 50-285 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your TX Comptroller 50-285. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete TX Comptroller 50-285 on an Android device?

Use the pdfFiller mobile app and complete your TX Comptroller 50-285 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is TX Comptroller 50-285?

TX Comptroller 50-285 is a form used by property owners in Texas to apply for a property tax exemption for a residence homestead.

Who is required to file TX Comptroller 50-285?

Homeowners who wish to claim a residence homestead exemption for their primary home in Texas must file TX Comptroller 50-285.

How to fill out TX Comptroller 50-285?

To fill out TX Comptroller 50-285, provide your personal information, details about the property, and the specific exemption being requested. Follow the instructions on the form carefully.

What is the purpose of TX Comptroller 50-285?

The purpose of TX Comptroller 50-285 is to evaluate eligibility for a residence homestead exemption which can reduce the amount of property taxes owed.

What information must be reported on TX Comptroller 50-285?

The form requires information such as the homeowner’s name, address, legal description of the property, and whether the property is the applicant's primary residence.

Fill out your TX Comptroller 50-285 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-285 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.