PR 482.0(C) 2019 free printable template

Show details

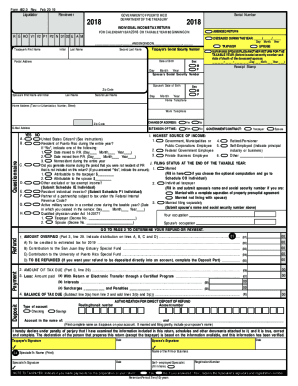

Form 482.0© Rev. 10.19 Reviewer: Liquidator: Field audited by:Date / / R M N2019Serial Number2019GOVERNMENT OF PUERTO RICO DEPARTMENT OF THE TREASURYCOMPOSITE RETURN PARTNERS AND INDIVIDUAL MEMBERS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR 4820C

Edit your PR 4820C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR 4820C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PR 4820C online

Follow the steps below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PR 4820C. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR 482.0(C) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR 4820C

How to fill out PR 482.0(C)

01

Gather all necessary documentation such as identification and relevant previous tax filings.

02

Carefully read the instructions provided with PR 482.0(C) form to understand specific requirements.

03

Begin filling out the form from the top, ensuring that all fields are completed accurately.

04

Provide your personal information including name, address, and social security number in the designated sections.

05

Fill in the details regarding your financial situation as required by the form.

06

Review all entries for accuracy before proceeding to the next section.

07

Complete any additional sections as necessary based on your unique situation.

08

Sign and date the form where indicated.

09

Make copies of the completed form for your records before submission.

10

Submit the form according to the instructions provided (via mail or electronically).

Who needs PR 482.0(C)?

01

Individuals applying for tax benefits or exemptions as outlined in the form.

02

Those who have experienced changes in financial status that require reporting.

03

Anyone who is required by law or regulation to submit PR 482.0(C) for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What can I do with a merchant ID?

This code uniquely identifies you as a business when a customer makes a credit or debit card purchase. It basically enables merchants to securely accept card payments and process transactions through their merchant account - and also verifies the legitimacy of your business to the customer's card issuer.

Can you look up a merchant ID?

Unfortunately, that is not possible. The reason is that a Merchant ID is considered sensitive information that merchants obtain from their payment processor, or bank, and should not be disclosed lightly. This Quora thread summarizes well the topic: getting a list of Merchant IDs is not possible.

Is a merchant account the same as a bank account?

A merchant account is a bank account specifically established for business purposes where companies can make and accept payments. Merchant accounts allow, for instance, a business to accept credit cards or other forms of electronic payment.

Where can I find my merchant terminal ID?

You'll find both numbers at the top of your transaction and settlement receipts. Depending on your payment processor, your terminal ID number might be listed as a TID, TIF, or TSP number. In any case, your terminal ID number is usually located just below your merchant ID (MID) number.

How do I find merchant information?

You should be able to look up your Merchant ID Number on any transaction receipts or statements. It may also be printed on business cards or correspondence, depending on the merchant services company you use.

What is merchant ID in Mastercard?

Merchant Identifier is a proprietary match and append technology that addresses the challenge of unrecognizable merchants found in credit card transactions by allowing Issuers to match their transaction information to the actual merchant acceptance points.

Is merchant ID the same as account number?

The easiest way to think of a merchant ID is like an account number. It's shared with several different service providers and is ultimately used to transfer payments from a consumer account to your merchant account. Not every business has a merchant ID.

Is a gateway ID the same as a merchant ID?

There are also “gateway IDs” for online payment processing. Neither of these is a merchant ID. Instead, these numbers are typically used to troubleshoot software or hardware problems. But they have nothing to do with the way money gets transferred to your merchant account.

Is merchant number the same as account number?

The easiest way to think of a merchant ID is like an account number. It's shared with several different service providers and is ultimately used to transfer payments from a consumer account to your merchant account. Not every business has a merchant ID.

Can you look up a merchant ID number?

Merchant IDs are not public information and cannot be searched as such. So if you're not involved with the business you're trying to find, there's no merchant ID number lookup system you can take advantage of. Again, these numbers are private and used for routing money, sort of like a bank account.

How do I find merchant details?

You should be able to look up your Merchant ID Number on any transaction receipts or statements. It may also be printed on business cards or correspondence, depending on the merchant services company you use.

Is merchant ID same as tax ID?

Merchant ID numbers are issued by payment processors to any businesses that open a merchant account. In order to get this number, your processing provider will usually require you to verify your business by asking for various proofs that your business is legitimate (like a Taxpayer Identification Number).

Is merchant account same as bank account?

A merchant account is a bank account specifically established for business purposes where companies can make and accept payments. Merchant accounts allow, for instance, a business to accept credit cards or other forms of electronic payment.

What is a merchant ID number?

A merchant identification number (MID) is a unique identifier given to you by your payment processing provider. This code uniquely identifies you as a business when a customer makes a credit or debit card purchase.

What is a merchant registration number Puerto Rico?

What is the Merchant's Registration Certificate? The Merchant's Registration Certificate is the authorization granted by the Treasury Department for doing business in Puerto Rico. The Merchant's Registration Certificate authorizes the sale of taxable items, including goods and services, subject to the SUT.

How do I find my merchant ID?

Your merchant ID number is: The 15-digit code located in the upper right hand corner of your monthly merchant statement. On your credit card terminal, usually on a sticker or label. At the top of your credit card receipts, after 'terminal'

How do I find my merchant account number?

Your merchant ID number is: The 15-digit code located in the upper right hand corner of your monthly merchant statement. On your credit card terminal, usually on a sticker or label. At the top of your credit card receipts, after 'terminal'

What is a merchant number?

A merchant identification number (MID) is a unique identifier given to you by your payment processing provider. This code uniquely identifies you as a business when a customer makes a credit or debit card purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in PR 4820C without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your PR 4820C, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit PR 4820C on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing PR 4820C, you need to install and log in to the app.

How do I fill out PR 4820C on an Android device?

Use the pdfFiller app for Android to finish your PR 4820C. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is PR 482.0(C)?

PR 482.0(C) is a specific form used for reporting certain financial and operational information as required by a particular jurisdiction or authority.

Who is required to file PR 482.0(C)?

Entities or individuals who meet specific regulatory criteria set forth by the governing body or authority are required to file PR 482.0(C).

How to fill out PR 482.0(C)?

To fill out PR 482.0(C), individuals or entities need to provide the required personal and business information, financial data, and any other relevant details as instructed in the guidelines accompanying the form.

What is the purpose of PR 482.0(C)?

The purpose of PR 482.0(C) is to ensure compliance with regulatory requirements by collecting necessary data for analysis, monitoring, or enforcement purposes.

What information must be reported on PR 482.0(C)?

The information that must be reported on PR 482.0(C) typically includes financial statements, operational metrics, compliance information, and any other data specified by the governing authority.

Fill out your PR 4820C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR 4820c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.