PR 482.0(C) 2021 free printable template

Show details

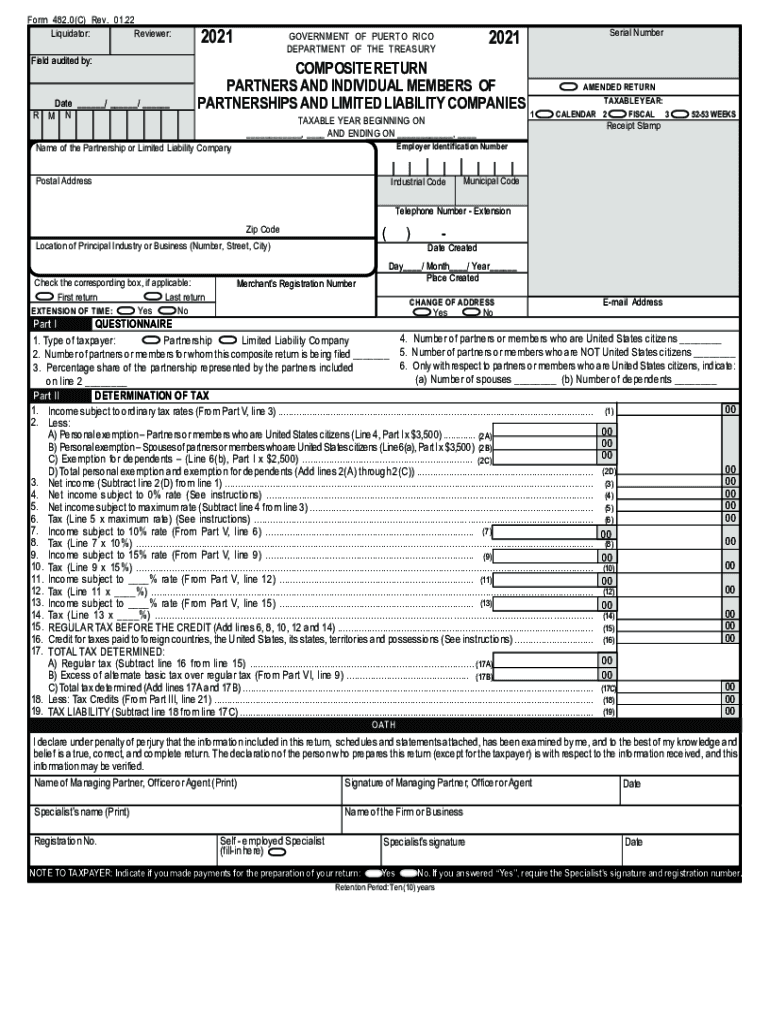

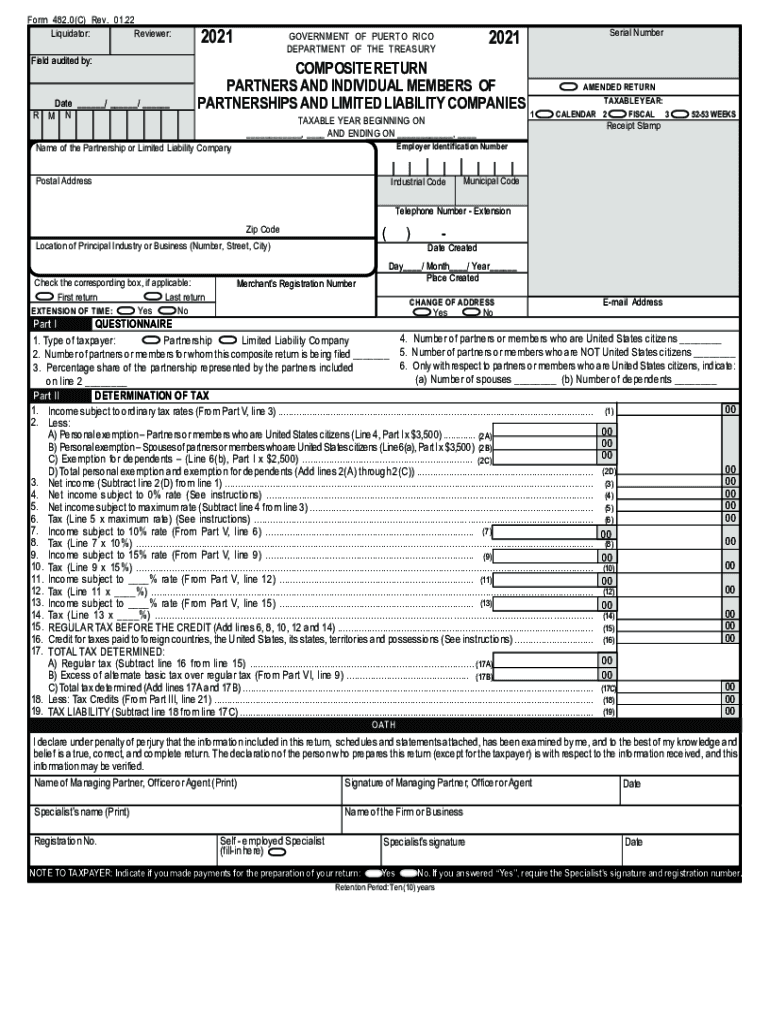

Form 482.0×C) Rev. 01.22

Reviewer:

Liquidator:

Field audited by:Date ___/ ___/ ___

R M N2021Serial Number2021GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURYCOMPOSITE RETURN

PARTNERS AND INDIVIDUAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign puerto rico composite partnerships latest form

Edit your puerto rico composite partners latest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR 4820C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PR 4820C online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PR 4820C. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR 482.0(C) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR 4820C

How to fill out PR 482.0(C)

01

Obtain the PR 482.0(C) form from the relevant government website or office.

02

Refer to the instructions provided with the form for guidance.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Provide the required information regarding your project or request, making sure to be clear and concise.

05

If applicable, attach any supporting documents that are required for your submission.

06

Review the completed form for any errors or missing information.

07

Sign and date the form at the designated area.

08

Submit the form either online or by mailing it to the appropriate authority.

Who needs PR 482.0(C)?

01

Individuals or businesses applying for a specific program or service related to the form's purpose.

02

Applicants seeking permits, licenses, or approvals that require the PR 482.0(C) submission.

Fill

form

: Try Risk Free

People Also Ask about

What can I do with a merchant ID?

This code uniquely identifies you as a business when a customer makes a credit or debit card purchase. It basically enables merchants to securely accept card payments and process transactions through their merchant account - and also verifies the legitimacy of your business to the customer's card issuer.

Can you look up a merchant ID?

Unfortunately, that is not possible. The reason is that a Merchant ID is considered sensitive information that merchants obtain from their payment processor, or bank, and should not be disclosed lightly. This Quora thread summarizes well the topic: getting a list of Merchant IDs is not possible.

Is a merchant account the same as a bank account?

A merchant account is a bank account specifically established for business purposes where companies can make and accept payments. Merchant accounts allow, for instance, a business to accept credit cards or other forms of electronic payment.

Where can I find my merchant terminal ID?

You'll find both numbers at the top of your transaction and settlement receipts. Depending on your payment processor, your terminal ID number might be listed as a TID, TIF, or TSP number. In any case, your terminal ID number is usually located just below your merchant ID (MID) number.

How do I find merchant information?

You should be able to look up your Merchant ID Number on any transaction receipts or statements. It may also be printed on business cards or correspondence, depending on the merchant services company you use.

What is merchant ID in Mastercard?

Merchant Identifier is a proprietary match and append technology that addresses the challenge of unrecognizable merchants found in credit card transactions by allowing Issuers to match their transaction information to the actual merchant acceptance points.

Is merchant ID the same as account number?

The easiest way to think of a merchant ID is like an account number. It's shared with several different service providers and is ultimately used to transfer payments from a consumer account to your merchant account. Not every business has a merchant ID.

Is a gateway ID the same as a merchant ID?

There are also “gateway IDs” for online payment processing. Neither of these is a merchant ID. Instead, these numbers are typically used to troubleshoot software or hardware problems. But they have nothing to do with the way money gets transferred to your merchant account.

Is merchant number the same as account number?

The easiest way to think of a merchant ID is like an account number. It's shared with several different service providers and is ultimately used to transfer payments from a consumer account to your merchant account. Not every business has a merchant ID.

Can you look up a merchant ID number?

Merchant IDs are not public information and cannot be searched as such. So if you're not involved with the business you're trying to find, there's no merchant ID number lookup system you can take advantage of. Again, these numbers are private and used for routing money, sort of like a bank account.

How do I find merchant details?

You should be able to look up your Merchant ID Number on any transaction receipts or statements. It may also be printed on business cards or correspondence, depending on the merchant services company you use.

Is merchant ID same as tax ID?

Merchant ID numbers are issued by payment processors to any businesses that open a merchant account. In order to get this number, your processing provider will usually require you to verify your business by asking for various proofs that your business is legitimate (like a Taxpayer Identification Number).

Is merchant account same as bank account?

A merchant account is a bank account specifically established for business purposes where companies can make and accept payments. Merchant accounts allow, for instance, a business to accept credit cards or other forms of electronic payment.

What is a merchant ID number?

A merchant identification number (MID) is a unique identifier given to you by your payment processing provider. This code uniquely identifies you as a business when a customer makes a credit or debit card purchase.

What is a merchant registration number Puerto Rico?

What is the Merchant's Registration Certificate? The Merchant's Registration Certificate is the authorization granted by the Treasury Department for doing business in Puerto Rico. The Merchant's Registration Certificate authorizes the sale of taxable items, including goods and services, subject to the SUT.

How do I find my merchant ID?

Your merchant ID number is: The 15-digit code located in the upper right hand corner of your monthly merchant statement. On your credit card terminal, usually on a sticker or label. At the top of your credit card receipts, after 'terminal'

How do I find my merchant account number?

Your merchant ID number is: The 15-digit code located in the upper right hand corner of your monthly merchant statement. On your credit card terminal, usually on a sticker or label. At the top of your credit card receipts, after 'terminal'

What is a merchant number?

A merchant identification number (MID) is a unique identifier given to you by your payment processing provider. This code uniquely identifies you as a business when a customer makes a credit or debit card purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PR 4820C to be eSigned by others?

When your PR 4820C is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get PR 4820C?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific PR 4820C and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my PR 4820C in Gmail?

Create your eSignature using pdfFiller and then eSign your PR 4820C immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is PR 482.0(C)?

PR 482.0(C) is a specific tax form used to report certain types of financial information to tax authorities.

Who is required to file PR 482.0(C)?

Individuals or entities that meet specific criteria outlined by tax regulations, usually involving income thresholds or particular financial activities, are required to file PR 482.0(C).

How to fill out PR 482.0(C)?

To fill out PR 482.0(C), follow the instructions provided on the form, ensuring all required fields are completed accurately, including personal information, income details, and any other necessary disclosures.

What is the purpose of PR 482.0(C)?

The purpose of PR 482.0(C) is to ensure transparency in financial activities and compliance with tax laws, allowing authorities to assess tax obligations accurately.

What information must be reported on PR 482.0(C)?

Information that must be reported on PR 482.0(C) includes personal identification details, income earned, deductions claimed, and any other financial transactions required by tax regulations.

Fill out your PR 4820C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR 4820c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.