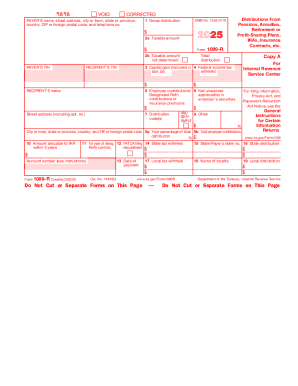

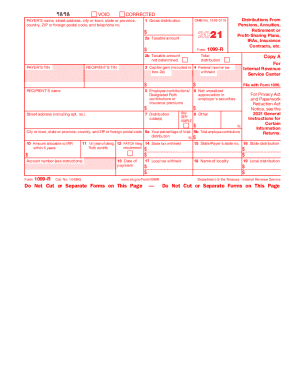

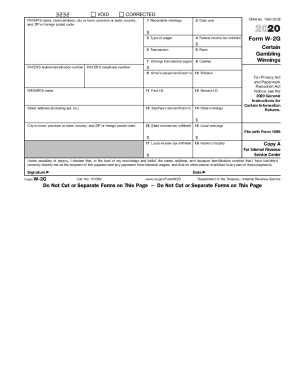

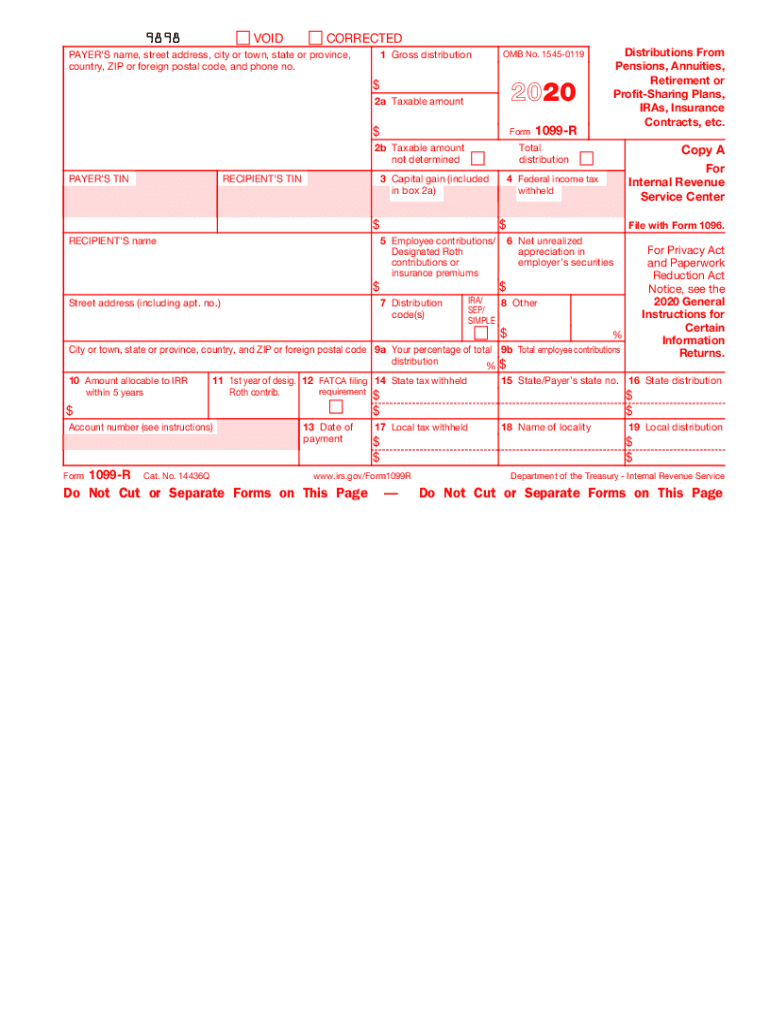

IRS 1099-R 2020 free printable template

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

How to fill out IRS 1099-R

About IRS 1099-R 2020 previous version

What is IRS 1099-R?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-R

What should I do if I notice an error on my submitted IRS 1099-R?

If you find an error on your IRS 1099-R after submission, you can file a corrected form. It’s vital to check if the correction significantly affects the reported amounts. Be sure to include specific details such as the original and corrected figures in the amended submission.

How can I verify if my IRS 1099-R has been received and processed?

You can check the status of your IRS 1099-R by contacting the IRS directly or using their online tools. It's essential to keep your submission confirmation information handy, as it may be required for status inquiries. Additionally, watch out for common e-file rejection codes.

Are electronic signatures acceptable on the IRS 1099-R?

Yes, electronic signatures may be accepted for IRS 1099-R forms submitted electronically, provided they meet IRS regulations. Ensure you are using approved software that complies with e-signature requirements to maintain data security and verify authenticity.

What should I do if I receive an IRS notice regarding my 1099-R?

If you receive a notice related to your IRS 1099-R, carefully read the communication to understand what the IRS is requesting. Gather any relevant documentation you have, and prepare to respond within the specified timeframe to avoid potential penalties or complications.

What are some common errors to avoid when filing an IRS 1099-R?

Common mistakes include incorrect taxpayer Identification Numbers, wrong amounts reported, and filing late. Double-check all numbers and ensure that the payer and payee information matches IRS records to prevent unnecessary delays or rejections.

See what our users say