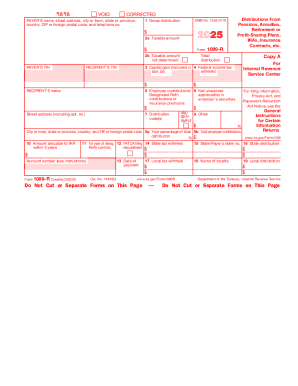

IRS 1099-R 2024 free printable template

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

How to fill out IRS 1099-R

Latest updates to IRS 1099-R

About IRS 1099-R 2024 previous version

What is IRS 1099-R?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1099-R

What should I do if I need to correct a mistake on my IRS 1099-R?

If you discover an error on your IRS 1099-R after submission, you'll need to file a corrected version of the form. This involves preparing a new form with the accurate information and marking it as 'Corrected' in the box provided. Be sure to submit it to both the IRS and the recipient to ensure they have the correct information encountered during processing.

How can I verify the status of my submitted IRS 1099-R?

To verify the status of your submitted IRS 1099-R, you can use the IRS's online tracking tools or contact the agency directly for confirmation. If you filed electronically, be aware of common e-file rejection codes, which you can address promptly to avoid further complications. Keeping records of your submissions is crucial for tracking.

Are there specific legal considerations when filing the IRS 1099-R for nonresidents?

Filing the IRS 1099-R for nonresidents involves unique legal nuances, such as different reporting requirements and possible withholding obligations. It's important to ensure compliance with both federal guidelines and any applicable tax treaties, which can affect how payments to foreign entities are reported and taxed.

What common errors should I avoid when submitting my IRS 1099-R?

When preparing your IRS 1099-R, common errors include incorrect taxpayer identification numbers, wrong amounts paid, and failing to include required information about any distributions. Double-checking the information before submission can help avoid these pitfalls and ensure accurate reporting.

What are the technology requirements for e-filing the IRS 1099-R?

When e-filing the IRS 1099-R, ensure your software is compatible with the IRS's e-file specifications and that your browser is updated to avoid technical issues. Also, be mindful of the data security measures needed to protect sensitive information during the e-filing process.

See what our users say