Last updated on Feb 17, 2026

Get the free Chapter 13 Plan template

Show details

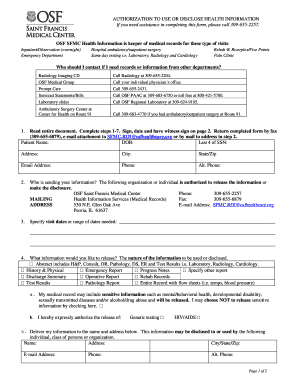

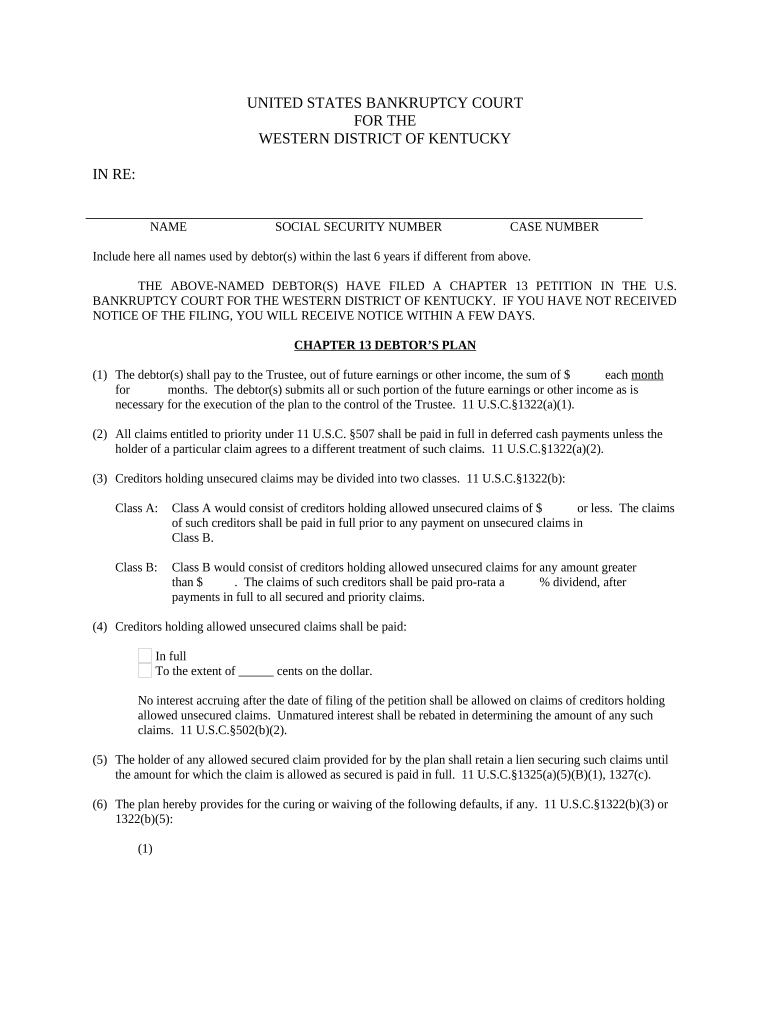

This form, a Chapter 13 Plan, is for use in a federal bankruptcy proceeding in the designated state and district. Available in Word or pdf format.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is chapter 13 plan

A chapter 13 plan is a legal document that outlines how a debtor proposes to pay back their creditors over a specified period, typically three to five years.

pdfFiller scores top ratings on review platforms

Just what I've been looking for! So happy its free

so easy to use, im able to get my document filled in before i print them out. saves me time and money.

the application runs really smooth.thanks

I like that you can edit a document as well as sign it! Also you can add signatures afterwards if you forgot the first time!Easy to use and a nice set out.

pdfFiller is an absolute lifesaver in my industry for contracts as a professional writer.

MADE IT EASIER FOR MY TEACHER AND CLASSMATES

Who needs chapter 13 plan template?

Explore how professionals across industries use pdfFiller.

Your guide to filling out a Chapter 13 plan form

Filling out a Chapter 13 plan form can seem daunting, but understanding the process is crucial for debt restructuring. In this guide, we will walk you through the essential steps required to complete the Chapter 13 plan form, ensuring that you submit an accurate document to the bankruptcy court.

What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy is a legal procedure that allows individuals to reorganize their debts while keeping their assets. This type of bankruptcy is specifically designed for debtors with a regular income, making it possible for them to pay back a portion of what they owe over a specified period, typically three to five years.

-

To be eligible for Chapter 13, debtors must have a regular income and unsecured debts below $419,275 and secured debts below $1,257,850.

-

Chapter 13 offers benefits like the ability to retain your home and vehicles while making manageable payments, which can differ significantly from Chapter 7 bankruptcy.

How do you fill out the Chapter 13 plan form?

Filling out the Chapter 13 plan form involves several steps. You’ll need to include essential personal information as well as details about your financial situation. It's crucial to input accurate information to avoid any delays or complications during the bankruptcy process.

-

These details confirm your identity and help keep your case organized.

-

This unique identifier relates to your bankruptcy filing and keeps your paperwork linked.

-

Including this helps the court review your past financial history accurately.

Be mindful of common mistakes when filling out the form, such as omission of information or discrepancies in the figures provided. Using interactive tools available on pdfFiller can significantly streamline this process.

What are the key sections of a Chapter 13 plan?

The Chapter 13 plan is structured into specific sections, each addressing different facets of your financial commitments.

-

This explains how you plan to pay your debts to the Trustee, including monthly payments and allocated amounts.

-

Details about how you will dedicate your income towards the repayment plan must be highlighted.

-

Understanding how priority claims affect your payment is critical since they must be paid before most unsecured claims.

-

Be aware of the distinctions between Class A and Class B unsecured claims, as they may impact the repayment process.

What is the role of the Trustee in the Chapter 13 process?

The Trustee plays an essential role in facilitating the Chapter 13 bankruptcy process. They are responsible for managing your payment plan and ensuring that your creditors are paid according to the terms laid out in your plan.

-

After filling out your form, a confirmation hearing is scheduled to review your plan and finalize the repayment structure.

-

Trustees often handle the collection of payment and disbursement to creditors, minimizing unnecessary complexities during the repayment term.

-

Common issues may arise, but being proactive with documentation and transparency helps mitigate risks.

How can interactive tools enhance Chapter 13 planning?

Utilizing interactive tools for your Chapter 13 planning can significantly improve the experience of managing your bankruptcy process. pdfFiller offers a suite of tailored document templates that simplify the form-filling and submitting process.

-

These templates are specifically designed for Chapter 13 forms to make filling out details more intuitive.

-

This feature allows you to secure necessary approvals quickly and efficiently without needing to print or manually sign documents.

-

Teams can collaborate on document preparation, allowing for a comprehensive approach to the filing process.

Conclusion and next steps

In summary, filling out a Chapter 13 plan form requires careful attention to detail and the use of resources available to facilitate the process. Users can benefit significantly by engaging with pdfFiller's interactive tools for optimal outcomes.

Start your Chapter 13 journey with confidence by leveraging our platform, which empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based solution.

How to fill out the chapter 13 plan template

-

1.Gather necessary financial documents including income statements and debt information.

-

2.Visit pdfFiller and search for the Chapter 13 plan form.

-

3.Download and open the form in the pdfFiller editor.

-

4.Begin filling in your personal information, including your name, address, and other identifying details.

-

5.Provide a summary of your income, detailing all sources and amounts on a monthly basis.

-

6.List all your expenses, such as housing, utilities, transportation, and other essential costs.

-

7.Outline your proposed payment plan, specifying how much you will pay each month and the duration of the plan.

-

8.Include a detailed list of all creditors, along with the amounts owed and the payment terms for each.

-

9.Review your plan for accuracy, ensuring all calculations are correct and that the plan meets necessary legal requirements.

-

10.Once completed, save the document and follow pdfFiller's instructions to submit your Chapter 13 plan to the bankruptcy court.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.