Get the free 497332453

Show details

Revenue Sharing Agreement This Revenue Sharing Agreement this Agreement is effective as of date the Effective Date by and among the Name Foundation a Name of State not-for-profit corporation with its principal place of business at the Foundation and Name of Inventor of hereinafter called the Inventor. Whereas the Foundation has provided and is providing financial support to the to Inventor in the form of a Grant to support the research of the Inventor subject to the Foundation s Invention Policy...the Policy attached hereto as Appendix A and Whereas in the course of his research at the laboratory facilities of Foundation the Inventor was an inventor of the Invention as hereinafter defined which may be of commercial value and Whereas pursuant to the policies of the Foundation ownership of such Invention has vested in or shall be or has been assigned by the Inventor to the Foundation and Whereas the research leading to the Invention has been supported wholly or in part by the resources of...the Foundation and Whereas as a condition to the Foundation s granting of the Grant to Inventor for the support of the research of the Inventor the parties agreed that Net Income as hereinafter defined must be shared with the Foundation in the manner set forth herein and Income to further its charitable purposes in accordance with the Foundation s charitable mission Now therefore for and in consideration of the mutual covenants contained in this Agreement and other good and valuable...consideration the receipt and sufficiency of which is hereby acknowledged the parties agree as follows Definitions A. Direct Costs are expenses related solely to the research out of which the Invention was derived including salary or other compensation or stipend support supplies but specifically excluding indirect or overhead or administrative costs or expenses and the cost of any capital equipment other than capital equipment purchased specifically in connection with the Inventor s research....B. Invention shall mean give brief description of Invention as more fully described in Appendix B whether patentable or not together with any improvements thereto that are conceived during any period of financial support from the Foundation and of which the Inventor is or is deemed to be an inventor which is deemed to be a work for hire within the meaning of the U*S* Copyright Act. C. Income shall include all amounts or items of value or worth of any nature paid or payable to the Inventor in...consideration of an assignment or license of rights in the Invention including without limitation assignment or upfront licensing fees or royalties milestone payments advanced royalties royalties on sales of products incorporating or utilizing the Invention other running royalties sublicensing fees equity and options to equity. In the event that the Inventor commercializes the Invention or in any way exploits the Invention or derives revenues otherwise than through an assignment or license...Income shall also include compensation based on sales made by the Inventor.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

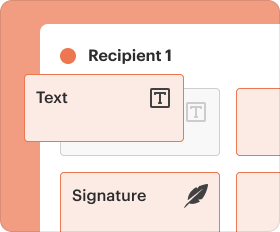

All-in-one solution

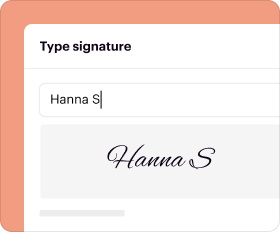

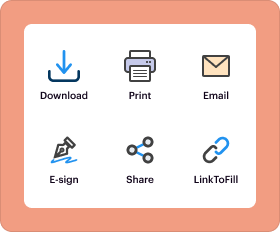

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revenue sharing agreement

A revenue sharing agreement is a contract between parties outlining how revenue generated from a particular venture will be divided among stakeholders.

pdfFiller scores top ratings on review platforms

This program/website makes contract signing much easier and expedient.

This program is so easy to use for PDF documents

Works great and has all the features I required. I have found the customer support to be really prompt when I have had inquiries. Definitely going to keep this past my trial period.

so far so good! Did crash on me once but im giving it a second shot!

Preview image didn't change after I saved form with changes. Form has correct image so ok for now.

Love it. Makes sending government forms and documents so easy!

Who needs 497332453 template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Revenue Sharing Agreement Form

How to fill out a revenue sharing agreement form

To fill out a revenue sharing agreement form, start by gathering all required information, such as the parties involved, definitions of roles, and details about financial contributions. Ensure you clearly outline revenue-sharing terms, including definitions of 'Net Income' and 'Direct Costs'. Finally, use tools like pdfFiller to draft, sign, and manage the agreement efficiently.

What are revenue sharing agreements?

A revenue sharing agreement is a contract between two or more parties outlining how revenue generated from a specific project will be allocated among them. These agreements play a vital role in collaborative projects where multiple stakeholders contribute resources or expertise. By clearly defining each party's share, such agreements help foster cooperation and ensure transparency.

-

Revenue sharing agreements are designed to define how profits from a business endeavor will be split among the parties involved.

-

Essential elements include the effective date, parties involved, and the percentage of revenue each party will receive.

-

They are crucial for establishing trust and accountability in collaborative financial arrangements.

What details should be included in the revenue sharing agreement?

Including comprehensive details in your revenue sharing agreement is essential for mitigating misunderstandings later on. The agreement should specify the effective date and define the parties involved, such as the Foundation and Inventor roles. Additionally, clarity on financial support, grants, and important terms like 'Net Income' and 'Direct Costs' will aid in ensuring a smooth operational process.

-

Indicate when the agreement comes into effect.

-

Clarify roles, like who the Foundation and Inventor are.

-

Detail the grants and support each party is investing into the project.

-

Clearly explain financial terms essential for transactions.

How should your revenue sharing agreement be structured?

An effective structure in revenue sharing agreements can boost collaboration and reduce conflict. Start by outlining the steps to create a solid structure focusing on clear definitions of terms and conditions. Furthermore, establish methods for calculating revenue and defining how income will be distributed among the parties involved.

-

Start with a clear framework, outlining key sections of the agreement.

-

Ensure the contract includes all major terms and conditions applicable to revenue sharing.

-

Agree beforehand on how revenue will be calculated to avoid disputes.

-

Clarify how the agreed revenue will be distributed among the parties.

What are the pros and cons of revenue sharing arrangements?

Revenue sharing models can offer numerous advantages. They provide mutual benefits by giving all parties a stake in the project's success. However, revenue-sharing agreements also have drawbacks, such as complexities in negotiating terms and potential conflicts during revenue distribution, which must be carefully navigated.

-

Foster collaboration between parties and align their incentives for project success.

-

Potential for disputes over revenue calculation or distribution if not clearly stated.

-

Benefits may include less risk than profit-sharing arrangements because revenue is often more predictable.

How do you negotiate revenue sharing terms?

Negotiating revenue sharing terms requires careful consideration and strategic communication. Start with best practices that emphasize clarity and fairness. Analyzing successful case studies can provide insights into effective negotiation strategies, while utilizing tools available for collaboration will facilitate smooth discussions.

-

Always prioritize clear communication and transparency during negotiations.

-

Review successful negotiations in similar contexts to apply effective strategies.

-

Leverage modern negotiation resources for collaboration and documentation.

Why is tracking and managing revenue sharing agreements crucial?

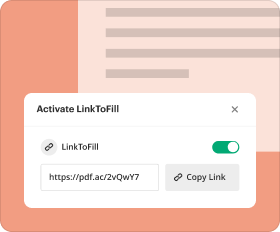

Accurate tracking and management of revenue-sharing agreements are paramount for sustained success. Regularly monitoring distributions minimizes conflicts and ensures compliance with agreed-upon terms. Using tools like pdfFiller can significantly improve how you document and manage these agreements across multiple parties.

-

Good tracking practices help document revenue flows and ensure accountability.

-

Using platforms like pdfFiller allows for smooth documentation and management.

-

Scheduled reviews can help maintain adherence to the agreement and avoid breaches.

What preparations are needed for a revenue sharing agreement?

Preparing adequately for a revenue sharing agreement maximizes its efficiency. Begin by gathering all necessary documentation and templates that will support the contractual process. Utilizing a checklist ensures that you have all required forms, while platforms like pdfFiller enable customization of your revenue sharing agreement form for better alignment with your project needs.

-

Collect all relevant documents and templates to facilitate the agreement drafting process.

-

Compile a checklist for all required data and forms to ensure none are missed.

-

Use pdfFiller to create and modify the revenue sharing agreement form to suit specific requirements.

Conclusion: How to enhance your revenue sharing arrangements

In conclusion, a well-crafted revenue sharing agreement form is crucial for clarifying roles and responsibilities in collaborative projects. By summarizing key components, preparing through adequate documentation, and leveraging platforms like pdfFiller, you can ensure better management of your agreements. Optimizing your revenue sharing arrangements will not only streamline processes but also position you well for future growth.

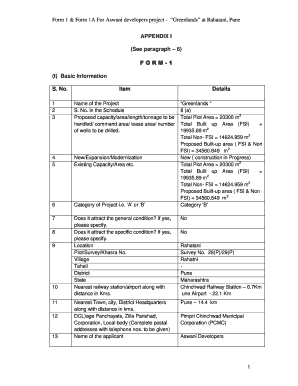

How to fill out the 497332453 template

-

1.Start by gathering necessary information like the names and addresses of all parties involved.

-

2.Open the revenue sharing agreement template on pdfFiller.

-

3.Fill in the title section with the name of the agreement, specifying the purpose of revenue sharing.

-

4.Enter the names and roles of all parties involved, ensuring accuracy in spelling and titles.

-

5.Detail the revenue sources that will be shared, defining how revenue is generated.

-

6.Clearly define the percentage or method of distribution for each party involved in the revenue sharing.

-

7.Include timelines for revenue reports and distributions, specifying frequency and conditions.

-

8.Add any additional clauses or conditions relevant to the agreement, such as dispute resolution procedures.

-

9.Review the filled details for accuracy, ensuring all information is complete and correct.

-

10.Once satisfied, save the document and proceed to e-sign if required, or share with all parties for their signatures.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.