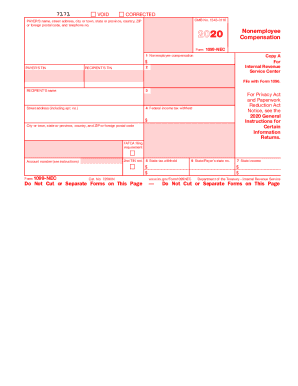

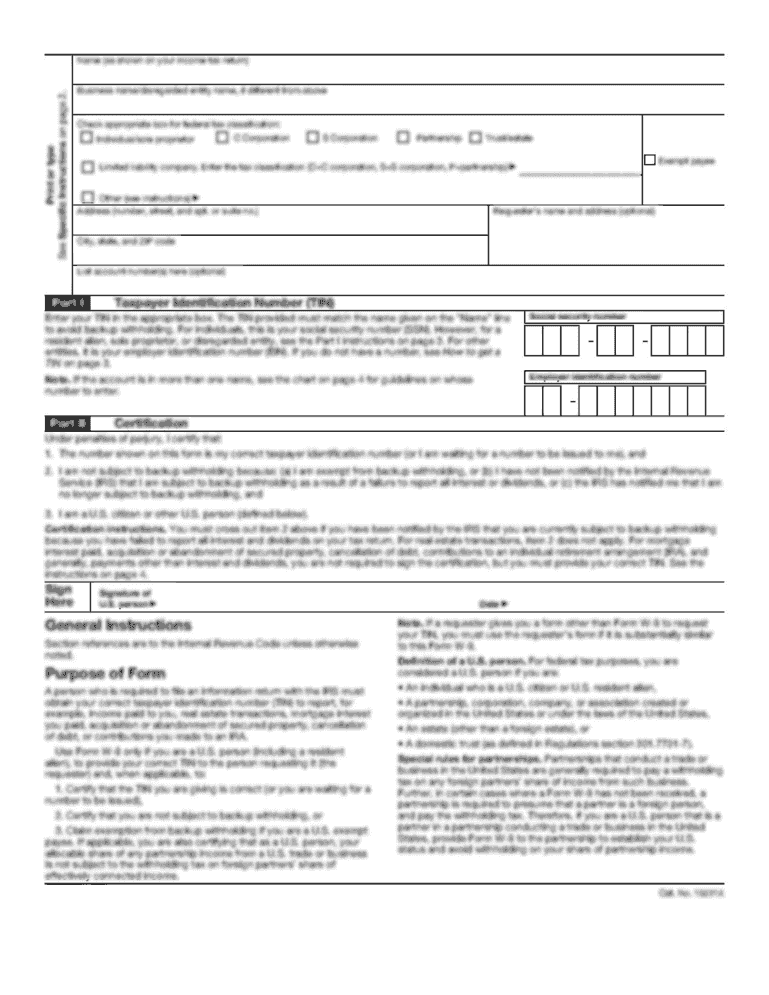

IRS General Instructions for Certain Information Returns 2020 free printable template

Get, Create, Make and Sign IRS General Instructions for Certain Information Returns

How to edit IRS General Instructions for Certain Information Returns online

Uncompromising security for your PDF editing and eSignature needs

IRS General Instructions for Certain Information Returns Form Versions

How to fill out IRS General Instructions for Certain Information Returns

How to fill out IRS General Instructions for Certain Information Returns

Who needs IRS General Instructions for Certain Information Returns?

Instructions and Help about IRS General Instructions for Certain Information Returns

Laws calm legal forms guide the form 1096 is a United States internal revenue service tax form used by a corporation who is filing paper forms instead of electronically filing the 10 96 serves as a summary of informational returns that have been sent to the IRS a form 1096 can be obtained through the IRS's website or by obtaining the documents through a local tax office the form is to be used in conjunction with informational forms such as the 1098 1099 3921 and W dash 2 G forms in the top left box supply your company's name and complete address you must supply a person to contact in regard to your form 1096 filings provide all contact information for the representative you listed above give a phone number where they can be reached as well as their email address and fax number provide either the employer identification number in box 1 or the social security number of the employer in boxes one or two go through all filings that are being covered by your form 1096 count how many total forms have been sent to the IRS and list that number in box three state the local federal income tax withheld in box for in box five provide the total amount that is reported on the form 1096 from the list provided in box six select the type of form that you are sending in to the IRS and that the form 1096 is covering you may only select one type of form if you file additional forms you must fill out an additional form 1096 for each type if this is your final form 1096 select box 7 once completed submit the form 1096 to the IRS keep a copy for your own records this form must be submitted on a yearly basis to watch more videos please make sure to visit laws calm

People Also Ask about

Do I have to send the IRS my 1099?

Do I need to submit 1099 to IRS?

How much can you make on a 1099 before you have to claim it?

What is the deadline for filing 1099's to IRS?

How to fill out 1099 form?

How do I fill out a Schedule 1?

What is a Schedule 1 example?

How to fill out Schedule 1 Line 1?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS General Instructions for Certain Information Returns directly from Gmail?

How do I make edits in IRS General Instructions for Certain Information Returns without leaving Chrome?

Can I sign the IRS General Instructions for Certain Information Returns electronically in Chrome?

What is IRS General Instructions for Certain Information Returns?

Who is required to file IRS General Instructions for Certain Information Returns?

How to fill out IRS General Instructions for Certain Information Returns?

What is the purpose of IRS General Instructions for Certain Information Returns?

What information must be reported on IRS General Instructions for Certain Information Returns?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.