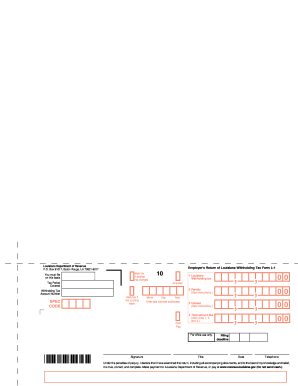

LA LDR R-1201 2020 free printable template

Show details

R-1201 1/18 WEB We encourage you to file and pay electronically at www. revenue. louisiana.gov First Quarter Employer s Return of Louisiana Withholding Tax Form L-1 Mail your Return and Payment to Louisiana Department of Revenue P. Every employer who withholds or who is required to withhold Louisiana income tax from wages of employees must file a quarterly L-1 return. Any employer who fails to withhold and pay amounts required to be withheld is personally liable for such amounts. How do I...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign l 1 tax

Edit your l 1 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l 1 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing l 1 tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit l 1 tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LDR R-1201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out l 1 tax

How to fill out LA LDR R-1201

01

Gather all necessary personal and business information before starting the form.

02

Start by filling out the header sections, including name, address, and contact details.

03

Provide details regarding the type of filing (e.g., individual, partnership, corporation).

04

Complete the financial information section accurately with the required figures.

05

Fill out any additional sections as prompted, depending on the specifics of your case.

06

Review all entries for completeness and accuracy before submitting.

07

Sign and date the form at the designated area.

Who needs LA LDR R-1201?

01

Individuals or businesses seeking to report their income or financial status to the Louisiana Department of Revenue.

02

Taxpayers who have specific income types requiring reporting via the LA LDR R-1201 form.

03

Any entity or person needing to comply with state tax regulations in Louisiana.

Fill

form

: Try Risk Free

People Also Ask about

How hard is it to get an L1 visa?

The application process for the L1 visa is however complex and highly involved. For an application to succeed, substantial and comprehensive supporting documentation will be critical. It will be better to over-document and ensure the adjudicator has all the information required to make a decision on the application.

Is L1 considered non resident alien?

The L1-A and L1-B visas are nonimmigrant visas (meaning that the foreign national must have an intent to return to his or her country of citizenship); however, obtaining an L1-A or L1-B visa is also permissible for foreign nationals who have dual intent to work in the U.S. temporarily and eventually secure lawful

Do you pay taxes on L1 visa?

L-1 Visa, FBAR & FATCA Form 8938 When an L-1 visa holder meets the Substantial Presence Test, not only are they subject to US tax on their worldwide income, but they are also subject to offshore reporting of their foreign assets, accounts, and investments.

What are the requirements to file L1 visa?

Eligibility They have a physical location for the new office; The employee has been employed as an executive or manager for one continuous year in the three years before filing the petition; and. The new office will support an executive or managerial position within one year of the approval of the petition.

How do I file an L-1?

How to Apply for the L1 Visa? Get a transfer offer. Filing Form I-129. Employer must pay the fees. File Form DS-160. Pay the L1 visa application fee. Schedule your L1 visa interview. Submit your L1 visa documents. Attend your interview.

How do I file taxes on my L1 visa?

As a nonimmigrant on an L-1 visa, you and any dependents claimed on your tax return must have an ITIN in order to file your income tax. Otherwise, your tax return will not be accepted by the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send l 1 tax to be eSigned by others?

When your l 1 tax is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my l 1 tax in Gmail?

Create your eSignature using pdfFiller and then eSign your l 1 tax immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out l 1 tax using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign l 1 tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is LA LDR R-1201?

LA LDR R-1201 is a specific tax form used in Louisiana, designed for reporting certain tax-related information to the Louisiana Department of Revenue.

Who is required to file LA LDR R-1201?

Individuals and businesses that have specific tax obligations or transactions, as defined by Louisiana state tax law, are required to file LA LDR R-1201.

How to fill out LA LDR R-1201?

To fill out LA LDR R-1201, gather the required financial information and follow the instructions provided on the form, ensuring all sections are completed accurately before submission.

What is the purpose of LA LDR R-1201?

The purpose of LA LDR R-1201 is to ensure compliance with state tax laws and to provide the Louisiana Department of Revenue with necessary information to assess tax liabilities accurately.

What information must be reported on LA LDR R-1201?

LA LDR R-1201 requires reporting of income, deductions, credits, and any other relevant financial details that pertain to an individual's or business's tax situation.

Fill out your l 1 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

L 1 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.