LA LDR R-1201 2019 free printable template

Show details

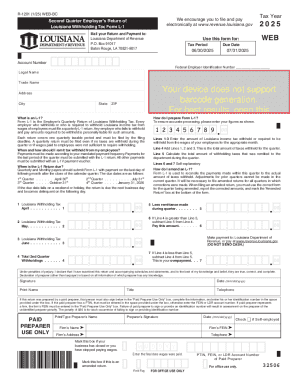

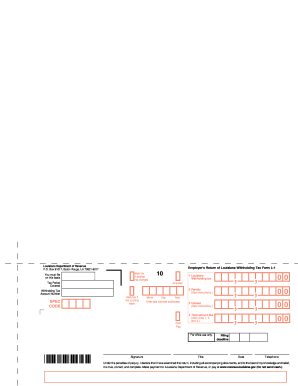

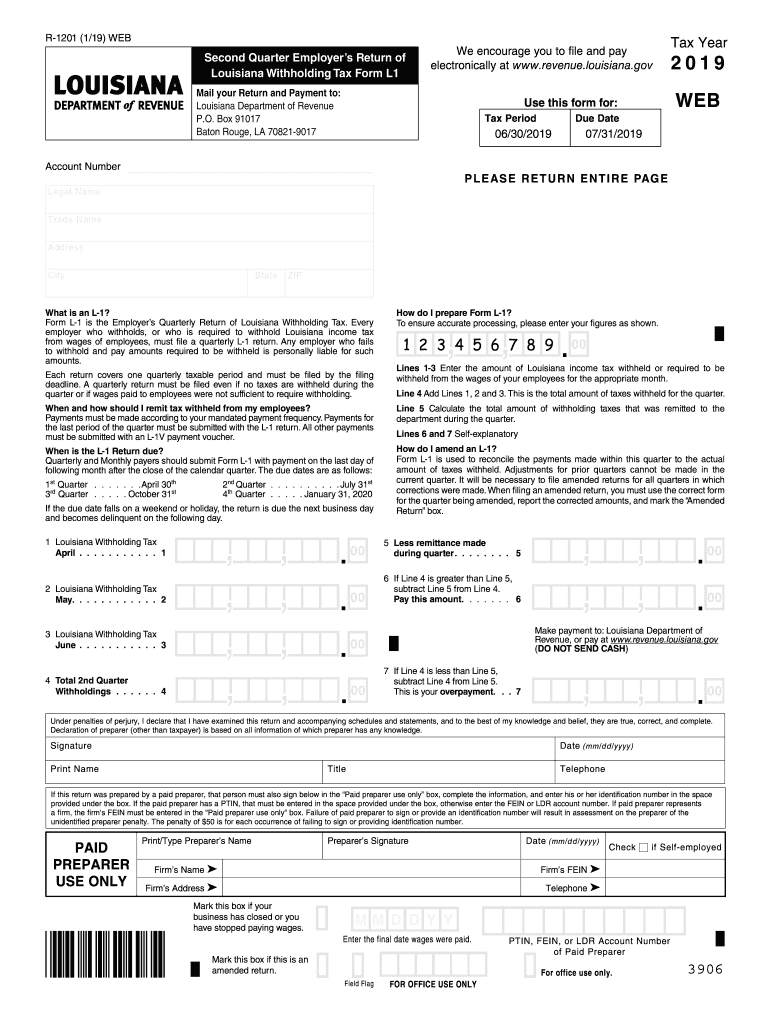

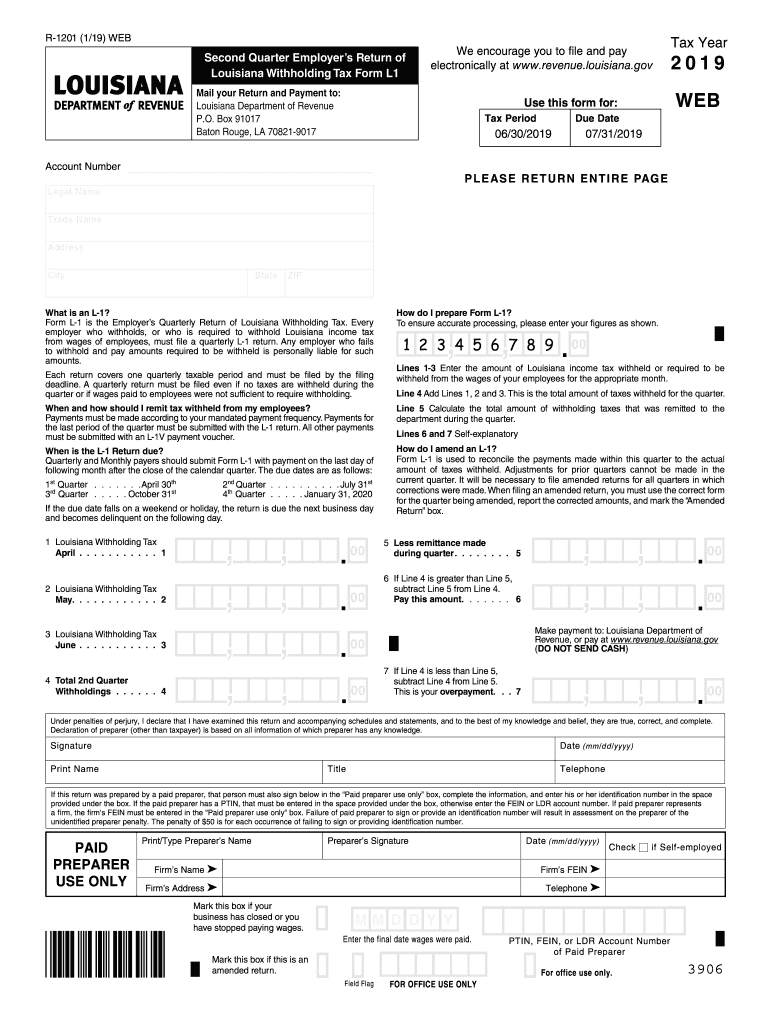

R-1201 1/18 WEB We encourage you to file and pay electronically at www. revenue. louisiana.gov First Quarter Employer s Return of Louisiana Withholding Tax Form L-1 Mail your Return and Payment to Louisiana Department of Revenue P. Every employer who withholds or who is required to withhold Louisiana income tax from wages of employees must file a quarterly L-1 return. Any employer who fails to withhold and pay amounts required to be withheld is personally liable for such amounts. How do I...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA LDR R-1201

Edit your LA LDR R-1201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA LDR R-1201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA LDR R-1201 online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit LA LDR R-1201. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LDR R-1201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA LDR R-1201

How to fill out LA LDR R-1201

01

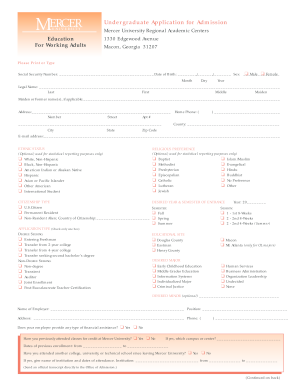

Obtain the LA LDR R-1201 form from the appropriate authorities or download it from the official website.

02

Fill out your personal information, including your name and address, at the top of the form.

03

Provide the details about the property involved, including its address and lot number.

04

Describe the type of land use or zoning change you are requesting.

05

Complete any additional sections as required, providing information related to the impact of your request.

06

Review your entries for accuracy and completeness.

07

Sign and date the form at the specified sections.

08

Submit the completed form to the designated office or online portal as instructed.

Who needs LA LDR R-1201?

01

Individuals or developers seeking to change the land use or zoning of a property in Los Angeles.

02

Property owners who want to apply for a land use entitlement.

03

Businesses looking to establish operations in a zone that requires a change.

Fill

form

: Try Risk Free

People Also Ask about

What is R 1307 exempt?

R-1307 (L-4E) – To be used by employees who incurred no liability for Louisiana income tax for the prior year and who anticipate that they will incur no liability for such income tax for the current year.

Can an employer get in trouble for not withholding federal taxes?

Penalties. Failure to do so will get the attention of the IRS and can result in civil and even criminal penalties. Sometimes the failure to pay is an oversight or a lack of understanding of what legal duties exist.

Should I claim exemption from withholding?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

How do I become tax exempt in Louisiana?

You can apply for federal tax exemption with the IRS. They will in turn send you a Letter of Determination stating your tax exempt status if granted after the long review process. Once you have Federal tax exempt 501c3 status you can work with the Department of Revenue to apply for Louisiana tax exemptions.

Are you exempt from 2023 withholding?

You Can Claim a Withholding Exemption Looking ahead to next year, you qualify for an exemption in 2023 if (1) you had no federal income tax liability in 2022, and (2) you expect to have no federal income tax liability in 2023.

Who must file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send LA LDR R-1201 to be eSigned by others?

When you're ready to share your LA LDR R-1201, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my LA LDR R-1201 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your LA LDR R-1201 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out LA LDR R-1201 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your LA LDR R-1201. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is LA LDR R-1201?

LA LDR R-1201 is a tax form used by certain businesses in Louisiana to report and remit sales and use taxes to the state.

Who is required to file LA LDR R-1201?

Businesses that collect sales and use taxes in Louisiana are required to file LA LDR R-1201.

How to fill out LA LDR R-1201?

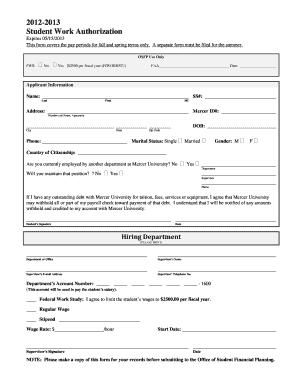

To fill out LA LDR R-1201, businesses need to provide their tax identification information, report total taxable sales, calculate the amount of tax due, and submit the form by the designated filing deadline.

What is the purpose of LA LDR R-1201?

The purpose of LA LDR R-1201 is to ensure businesses accurately report and pay sales and use taxes owed to the state of Louisiana.

What information must be reported on LA LDR R-1201?

The information that must be reported on LA LDR R-1201 includes the business name, address, tax identification number, total sales, taxable sales, tax rate, and total tax due.

Fill out your LA LDR R-1201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA LDR R-1201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.