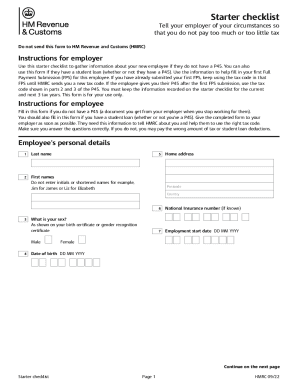

Who Needs Form P46?

According to HMRC, a non-ministerial department in UK, all employers who take on new employees should issue Form P45. It has recently replaced similar Form P46. This form must be filled out by the employees who are going to apply for a new job.

What is Form P45 for?

Form P45 helps employers to get the correct tax code for each employee and set up starter declaration on their payroll software. Form P46 is also completed when an employee doesn’t have Form P45 from their previous job or if they stopped working at their previous job before the 6th of April 2016.

Is Form P45 Accompanied by Other Forms?

An employer will need the following information from their new employees:

- Tax paid for the current tax year

- Existing tax code

- Student loan deduction status

- Date when employee has left their last job

When is Form P45 due?

Employer requires Form P45 before a new employee gets paid for the first time. An employer is supposed to keep Form P45 for the next three tax years.

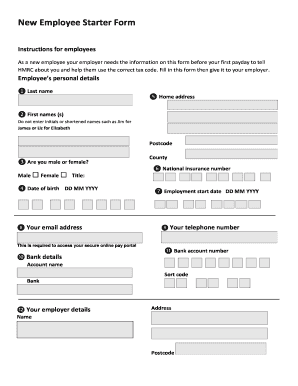

How Do I Fill out Form P45?

Form P45 doesn’t pose any difficulties. It’s brief and easy to fill out. An employee must provide such information:

- Gender

- Address

- Employee statement that tells about employee’s previous job and work status in general

Where Do I Send Form P45?

Once an employee has completed the form, they must submit it to their employer.