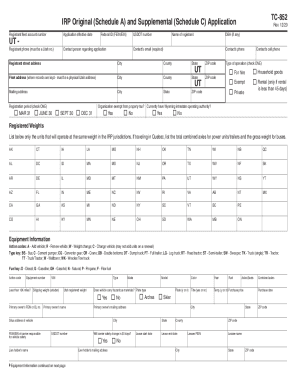

UT USTC TC-569A 2001 free printable template

Show details

Division of Motor Vehicles UTAH STATE TAX COMMISSION TC-569A MVA Rev. 9/01 Clear form 210 North 1950 West Salt Lake City, Utah 84134 Telephone (801) 297-7780 or 1-800-DMV-UTAH Ownership Statement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc 569a - towkars

Edit your tc 569a - towkars form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 569a - towkars form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc 569a - towkars online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tc 569a - towkars. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-569A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tc 569a - towkars

01

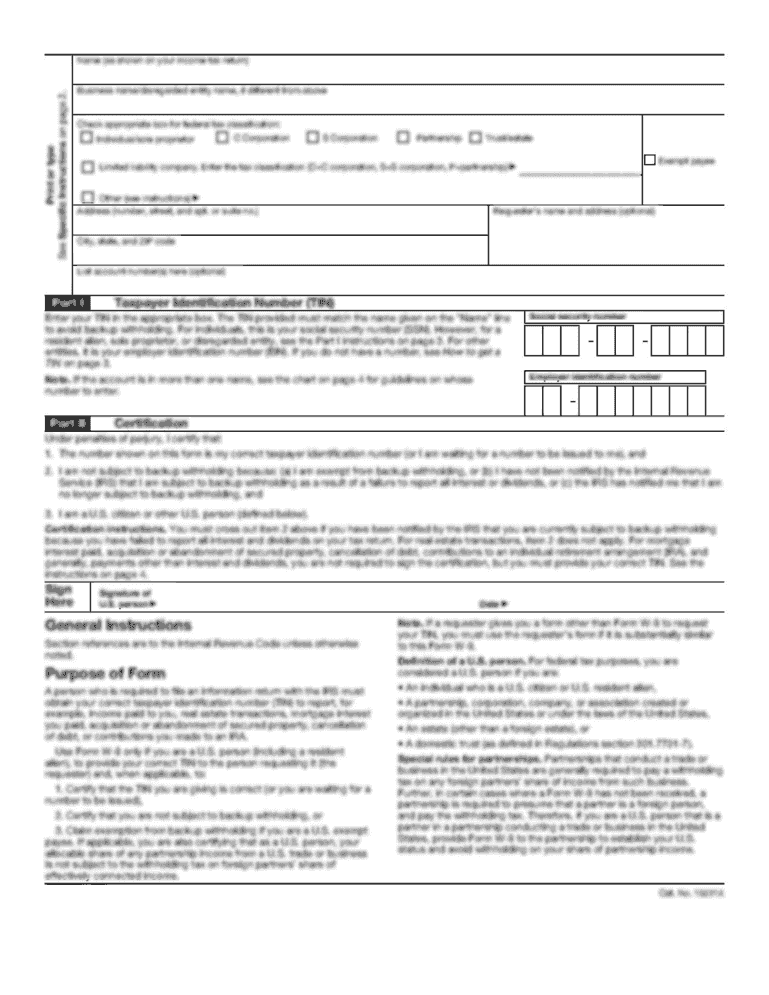

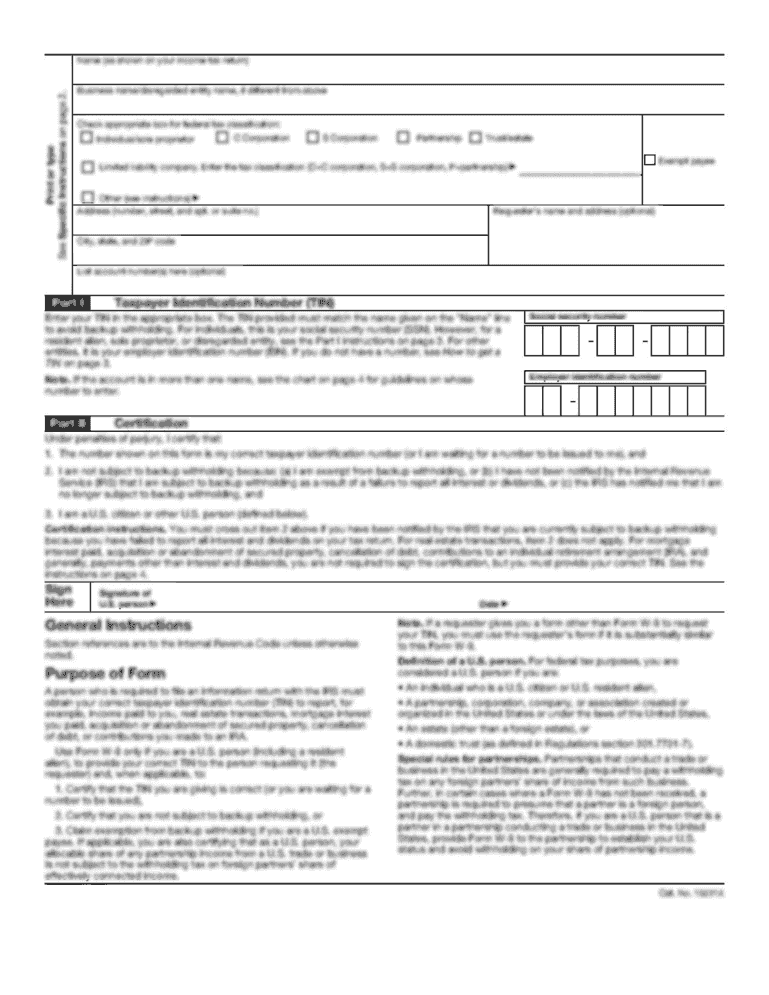

To fill out TC 569A, you need to gather all the necessary information and documentation. This form is used for filing a request for an Offer in Compromise (OIC) with the Internal Revenue Service (IRS).

02

Start by providing your personal information on the form, such as your full name, address, social security number, and contact details.

03

Next, you will need to indicate the tax periods for which you are requesting the OIC. This includes the tax years and the type of tax (e.g., individual income tax, corporate tax, etc.). Make sure to accurately input this information to avoid any complications.

04

In Section 1 of the form, you need to provide details about your financial situation. This includes your assets, liabilities, income, and expenses. You may need to attach supporting documentation, such as bank statements, property valuations, and proof of other sources of income.

05

Section 2 of the form requires you to disclose any previous OIC requests you have made with the IRS. If this is your first time applying, you can skip this section.

06

In Section 3, you need to provide a detailed explanation of the circumstances that have led to your financial hardship and why you believe an Offer in Compromise is necessary. Be honest and provide any relevant supporting documentation to strengthen your case.

07

Once you have completed all sections of the form, review it carefully to ensure accuracy. Any errors or missing information could delay the processing of your request.

08

If you are unsure about how to fill out certain parts of the form or have specific questions, you can refer to the IRS website or seek assistance from a tax professional.

Now, let's move on to who needs TC 569A.

01

Individuals or businesses who are facing significant financial hardship and are unable to pay their tax debts in full may need TC 569A.

02

This form can be used by taxpayers who wish to negotiate a settlement with the IRS through an Offer in Compromise. It provides an opportunity to settle the tax debt for less than the full amount owed.

03

TC 569A is particularly relevant for individuals or businesses with limited income, assets, and little chance of being able to repay their tax debt in a reasonable time frame.

Remember, consulting with a tax professional or seeking guidance from the IRS can help ensure that you meet all the necessary requirements and accurately fill out the form.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a title for an abandoned vehicle in Utah?

How do I get a title for an abandoned vehicle in Utah? To claim the vehicle and title it as your own, you'll need to contact the local law enforcement agency that has jurisdiction in that area, and tell them where the vehicle is located. You also have to fill out an Abandoned Vehicle Form.

Can you register a car without a title in Utah?

Transfer Without a Title If you've recently moved to Utah, and your certificate of title is being held by an out-of-state leasing company or lien holder, you will not be required to acquire the certificate of title in order to transfer your vehicle registration to Utah.

Do I need a Utah title to register a car in Utah?

To register and title in Utah for the first time, an Application to Register/Title must be completed and required documenta- tion provided. Required documentation may include a vehicle title, bill of sale, previous registration, emission certificate or safety certificate where required.

What do I need to register a car in Utah?

First-time Registration Required documentation may include a vehicle title, bill of sale, previous registration, emission certificate or safety certificate where required. All vehicles in Utah are subject to either an age-based uniform fee or a 1.5 percent uniform property assessment fee.

How do I register a car I just bought in Utah?

To register a vehicle with the Utah Department of Motor Vehicles (UT DMV), visit the closest office location with the vehicle title, driver's license, proof of insurance, and certificate of inspection if required. The registration fee is based on the vehicle's year and weight, plus the resident's county of residence.

Is it illegal to buy a car without a title in Utah?

It is unwise to rely on a seller's promise to “get the title to you.” Although Utah law requires a seller to provide a title within 48 hours of the transaction, a common-sense approach is to obtain a title at the time of sale, or wait to pay for the vehicle until the seller can provide the title.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the tc 569a - towkars in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your tc 569a - towkars.

Can I edit tc 569a - towkars on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign tc 569a - towkars. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete tc 569a - towkars on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your tc 569a - towkars, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is tc 569a?

TC 569A is a tax form used by certain taxpayers to report specific income and deductions related to the taxation of individuals.

Who is required to file tc 569a?

Individuals who meet certain income thresholds or have specific types of income that require additional reporting are mandated to file TC 569A.

How to fill out tc 569a?

To fill out TC 569A, gather relevant financial documents, complete each section accurately, and ensure that all required information is included before submission.

What is the purpose of tc 569a?

The purpose of TC 569A is to provide the tax authorities with a comprehensive account of income and deductions, ensuring compliance with tax regulations.

What information must be reported on tc 569a?

TC 569A requires reporting of income details, specific deductions, tax credits, and other pertinent financial information relevant to the taxpayer's situation.

Fill out your tc 569a - towkars online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tc 569a - Towkars is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.