UT USTC TC-569A 2020 free printable template

Show details

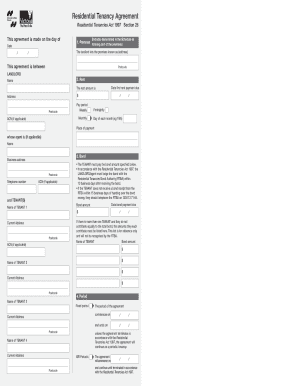

Utah State Tax Commission Clear form TC-569A Rev. 1/13 Ownership Statement Division of Motor Vehicles PO Box 30412 Salt Lake City UT 84130 Telephone 801-297-7780 or 1-800-368-8824 Get forms online - tax. utah. gov Section 1 - Vehicle Information Year Make License plate number Model Vehicle/Hull Identification Number VIN/HIN State last registered Trailer length Body type Watercraft length ft in Section 2 - Owner Information Primary owner s name last first middle initial or business name...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-569A

Edit your UT USTC TC-569A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-569A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-569A online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT USTC TC-569A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-569A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-569A

How to fill out UT USTC TC-569A

01

Obtain a copy of UT USTC TC-569A form from the relevant official website or office.

02

Fill in your personal information at the top of the form, including your full name, address, and contact details.

03

Provide specific details about the transaction or case the form relates to.

04

Attach any required documents or proofs that support the information you are providing.

05

Review the form carefully to ensure all information is accurate and complete.

06

Sign and date the form where indicated.

07

Submit the form as instructed, either online or in person at the appropriate office.

Who needs UT USTC TC-569A?

01

Individuals or organizations involved in transactions that require documentation as specified by UT USTC.

02

Persons filing for claims, appeals, or benefits that necessitate the completion of this specific form.

03

Entities seeking to comply with regulatory requirements related to UT USTC processes.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a title for an abandoned vehicle in Utah?

How do I get a title for an abandoned vehicle in Utah? To claim the vehicle and title it as your own, you'll need to contact the local law enforcement agency that has jurisdiction in that area, and tell them where the vehicle is located. You also have to fill out an Abandoned Vehicle Form.

Can you register a car without a title in Utah?

Transfer Without a Title If you've recently moved to Utah, and your certificate of title is being held by an out-of-state leasing company or lien holder, you will not be required to acquire the certificate of title in order to transfer your vehicle registration to Utah.

Do I need a Utah title to register a car in Utah?

To register and title in Utah for the first time, an Application to Register/Title must be completed and required documenta- tion provided. Required documentation may include a vehicle title, bill of sale, previous registration, emission certificate or safety certificate where required.

What do I need to register a car in Utah?

First-time Registration Required documentation may include a vehicle title, bill of sale, previous registration, emission certificate or safety certificate where required. All vehicles in Utah are subject to either an age-based uniform fee or a 1.5 percent uniform property assessment fee.

How do I register a car I just bought in Utah?

To register a vehicle with the Utah Department of Motor Vehicles (UT DMV), visit the closest office location with the vehicle title, driver's license, proof of insurance, and certificate of inspection if required. The registration fee is based on the vehicle's year and weight, plus the resident's county of residence.

Is it illegal to buy a car without a title in Utah?

It is unwise to rely on a seller's promise to “get the title to you.” Although Utah law requires a seller to provide a title within 48 hours of the transaction, a common-sense approach is to obtain a title at the time of sale, or wait to pay for the vehicle until the seller can provide the title.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-569A without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including UT USTC TC-569A. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit UT USTC TC-569A on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing UT USTC TC-569A right away.

How do I fill out the UT USTC TC-569A form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign UT USTC TC-569A and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is UT USTC TC-569A?

UT USTC TC-569A is a tax form used in Utah for reporting and paying certain taxes as designated by the state.

Who is required to file UT USTC TC-569A?

Individuals or entities that are subject to the specific taxes outlined by the state of Utah must file UT USTC TC-569A.

How to fill out UT USTC TC-569A?

To fill out UT USTC TC-569A, you must provide your personal information, report your taxable income, and indicate any deductions or credits applicable to your situation as instructed on the form.

What is the purpose of UT USTC TC-569A?

The purpose of UT USTC TC-569A is to collect specific tax revenue for the state of Utah and ensure compliance with state tax laws.

What information must be reported on UT USTC TC-569A?

The information that must be reported on UT USTC TC-569A includes your name, address, taxpayer identification number, details of income earned, taxes owed, and any applicable deductions or credits.

Fill out your UT USTC TC-569A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-569a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.