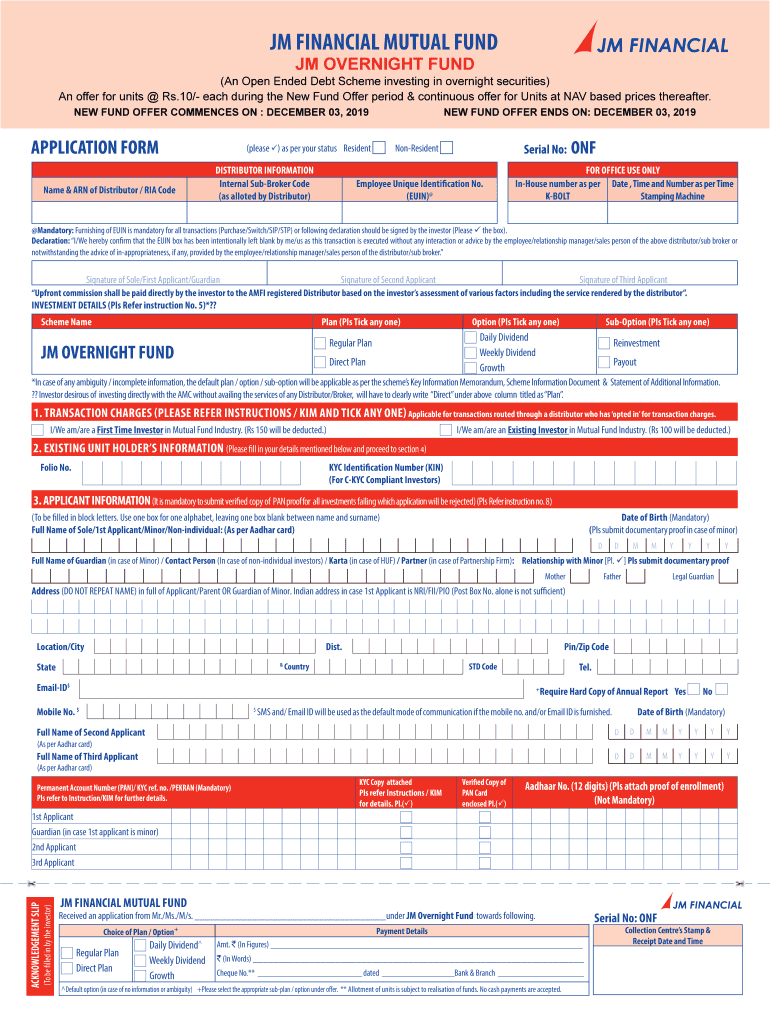

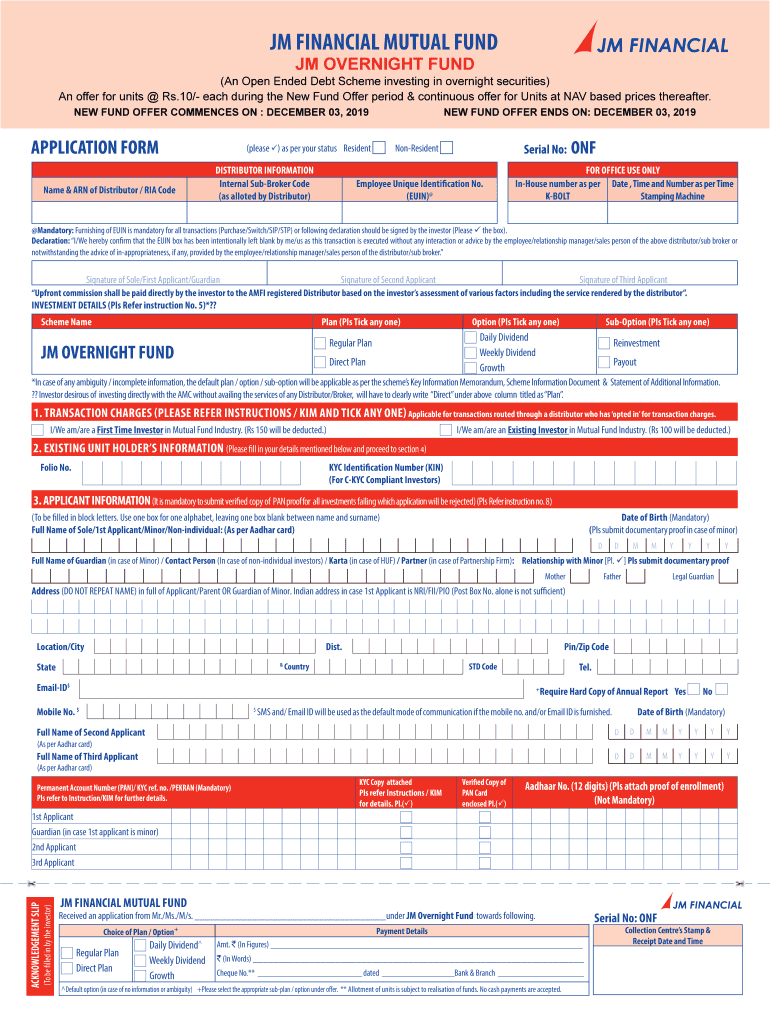

Get the free (An Open Ended Debt Scheme investing in overnight securities)

Show details

JM FINANCIAL MUTUAL FUND JM OVERNIGHT Entrust is always the answer(An Open Ended Debt Scheme investing in overnight securities) An offer for units Rs.10/ each during the New Fund Offer period & continuous

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an open ended debt

Edit your an open ended debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an open ended debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing an open ended debt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit an open ended debt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an open ended debt

How to fill out an open ended debt

01

To fill out an open ended debt, follow these steps:

02

Gather all necessary information about the debt, including the amount owed and any relevant account numbers.

03

Contact the creditor or lender to inquire about the process for filling out an open ended debt. They may provide you with specific forms or instructions.

04

Fill out the required forms accurately and completely. Make sure to provide all requested information, including your personal details and the details of the debt.

05

Review the completed forms to ensure accuracy. Double-check all the information provided before submitting the forms.

06

Sign the forms and make copies for your records. Keep a copy of the completed forms in case of any future disputes or inquiries.

07

Submit the filled-out forms to the appropriate creditor or lender. Follow any specific submission instructions provided by the creditor.

08

Keep track of any confirmation or acknowledgement received from the creditor. This can serve as proof that you have filled out the open ended debt correctly.

09

Remember to seek clarification or guidance from the creditor or a financial advisor if you are unsure about any aspect of filling out an open ended debt.

Who needs an open ended debt?

01

An open ended debt may be needed by individuals or businesses who require ongoing access to credit or loans.

02

Some common examples of individuals who may need an open ended debt include:

03

- Freelancers or self-employed professionals who need a line of credit to manage irregular income or cash flow.

04

- Individuals who anticipate future expenses or investments and want to have access to credit when needed.

05

- Small business owners who need revolving credit to fulfill operational or growth needs.

06

Businesses, both small and large, often require open ended debts to cover ongoing expenses, manage working capital, or invest in projects.

07

It is important to carefully consider the terms, interest rates, and repayment terms associated with an open ended debt before obtaining one.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send an open ended debt to be eSigned by others?

When you're ready to share your an open ended debt, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete an open ended debt on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your an open ended debt, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out an open ended debt on an Android device?

Complete your an open ended debt and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is an open ended debt?

An open ended debt is a type of borrowing that does not have a fixed repayment term or limit, allowing the borrower to continuously access and repay funds up to a certain credit limit.

Who is required to file an open ended debt?

Individuals or entities that have outstanding open ended debts, such as credit cards or lines of credit, and are required to disclose such information for financial or tax purposes.

How to fill out an open ended debt?

To fill out an open ended debt, gather all relevant financial information, complete the required forms with accurate details about the debt amount, creditor information, and repayment terms, then submit to the appropriate agency.

What is the purpose of an open ended debt?

The purpose of an open ended debt is to provide borrowers with flexible access to credit as needed, enabling them to manage cash flow and expenses without a fixed repayment schedule.

What information must be reported on an open ended debt?

Reported information on an open ended debt typically includes the total debt amount, account details, interest rates, repayment terms, and any related fees or charges.

Fill out your an open ended debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Open Ended Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.