Get the free Flexible Fund for Family Services FFFS - otda ny

Show details

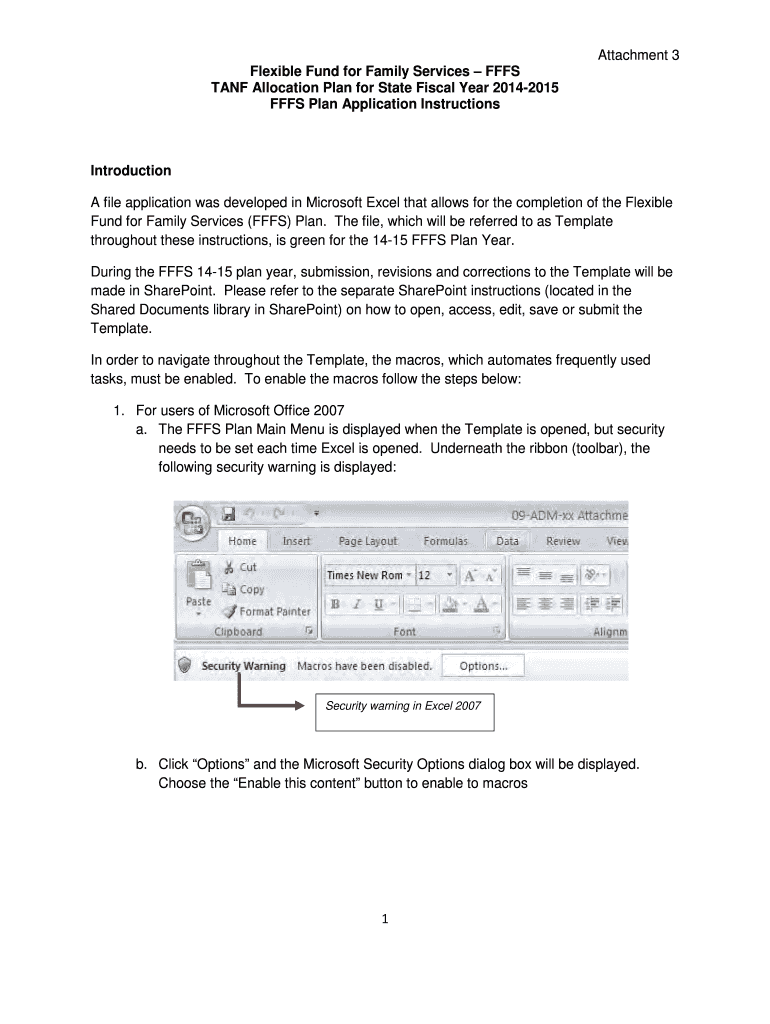

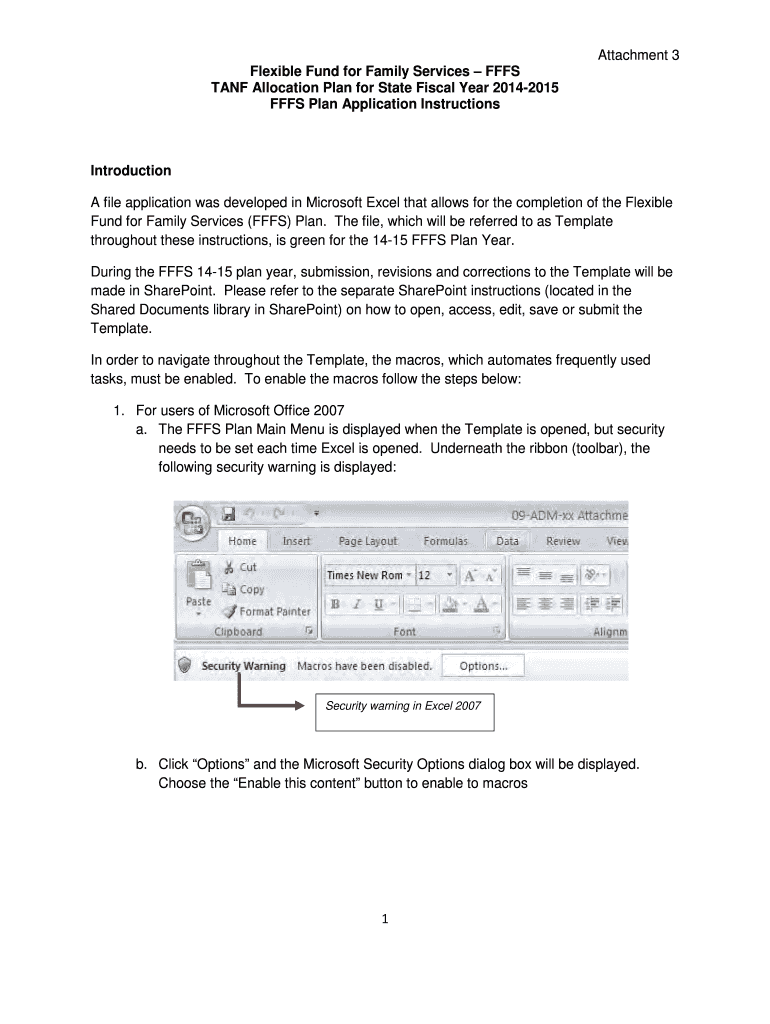

Attachment 3 Flexible Fund for Family Services OFFS TANK Allocation Plan for State Fiscal Year 20142015 OFFS Plan Application Instructions Introduction A file application was developed in Microsoft

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible fund for family

Edit your flexible fund for family form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible fund for family form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexible fund for family online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit flexible fund for family. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible fund for family

How to fill out a flexible fund for family:

01

Determine your budget: Start by assessing your current financial situation and determining how much you can allocate towards your flexible fund. Consider factors such as your monthly income, essential expenses, and any existing savings or investments.

02

Set goals: Identify the specific goals you want your flexible fund to serve. Examples may include emergency expenses, education expenses, travel, or home renovations. Having clear goals will help you allocate your funds effectively.

03

Choose an account: Research different financial institutions and their offerings to find an account that suits your needs. Look for a flexible fund that allows easy access to your funds while also providing the potential for growth through interest or investment options.

04

Fill out the application: Once you have chosen the financial institution and account, fill out the application form accurately. Provide all the necessary personal information and follow any instructions provided by the institution.

05

Deposit funds: After your application is approved, deposit an initial amount into your flexible fund account. This can be done through various methods, such as transferring funds from your existing bank account or setting up automatic deposits from your paycheck.

06

Regular contributions: Make a habit of contributing to your flexible fund on a regular basis. Establish a routine that works for you, whether it's weekly, biweekly, or monthly. Consistent contributions will help you reach your goals faster.

07

Track your progress: Keep a record of your fund's growth and monitor how close you are to achieving your goals. Use online tools or mobile apps provided by your financial institution to easily track your progress and make adjustments if needed.

Who needs a flexible fund for family?

01

Individuals with varying income: A flexible fund is essential for those who have irregular income or multiple sources of income. It helps provide a safety net during lean months or unexpected fluctuations in earnings.

02

Families with financial goals: Families who have specific financial goals, such as saving for their child's education or a down payment on a house, can benefit from a flexible fund. It allows them to allocate funds specifically towards these goals while still maintaining liquidity.

03

Individuals facing uncertain expenses: Life is unpredictable, and unexpected expenses can arise at any time. Having a flexible fund ensures that you are prepared for medical emergencies, car repairs, or other unforeseen circumstances without disrupting your overall budget.

04

Individuals saving for future plans: Whether it's planning for retirement, starting a business, or taking a dream vacation, a flexible fund can help individuals save for their long-term goals. It provides a dedicated account for these aspirations and encourages consistent savings.

Remember, a flexible fund for family can provide financial security and help you achieve your goals. It is important to regularly reassess your financial situation and needs to ensure that your fund aligns with your changing circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get flexible fund for family?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the flexible fund for family. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my flexible fund for family in Gmail?

Create your eSignature using pdfFiller and then eSign your flexible fund for family immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit flexible fund for family on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing flexible fund for family, you can start right away.

What is flexible fund for family?

Flexible fund for family is a financial product that allows families to save and invest for various expenses such as education, healthcare, emergencies, etc.

Who is required to file flexible fund for family?

Families who wish to save and invest for future expenses are required to file flexible fund for family.

How to fill out flexible fund for family?

Flexible fund for family can be filled out by providing personal information, financial goals, investment preferences, etc.

What is the purpose of flexible fund for family?

The purpose of flexible fund for family is to help families save and invest for future expenses and financial goals.

What information must be reported on flexible fund for family?

Information such as personal details, financial status, investment preferences, etc., must be reported on flexible fund for family.

Fill out your flexible fund for family online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Fund For Family is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.