Get the free SPECIAL REVENUE FUNDS - Town of Glastonbury

Show details

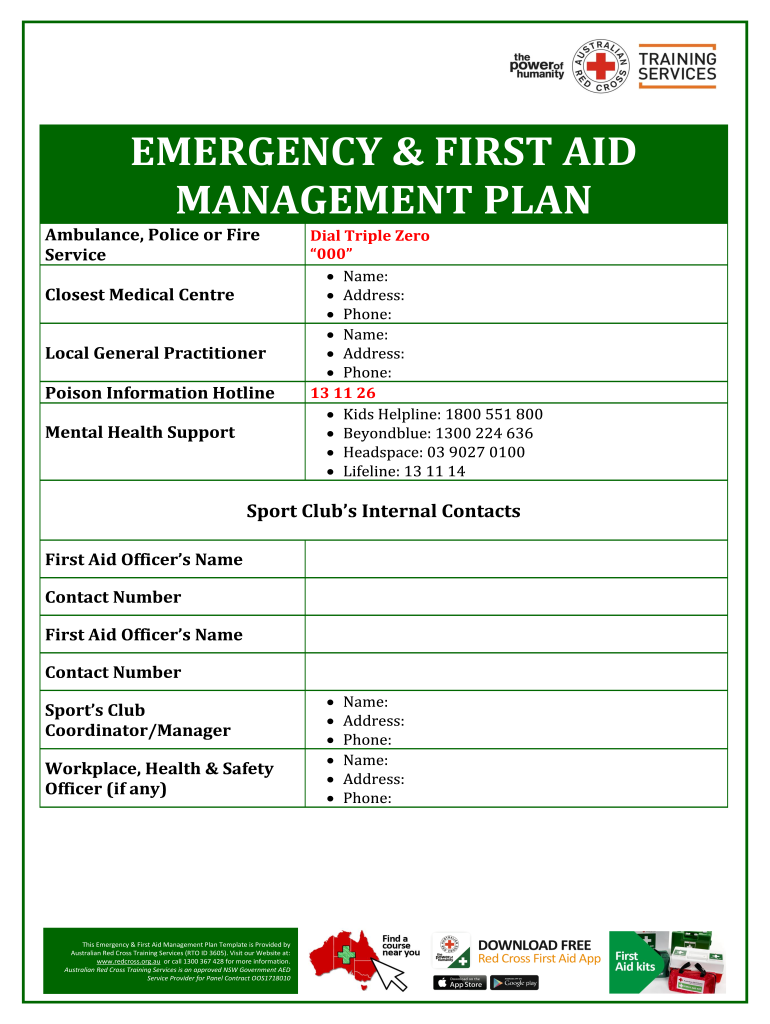

EMERGENCY & FIRST AID MANAGEMENT PLAN Ambulance, Police or Fire Service Closest Medical Center Local General Practitioner Poison Information Hotline Mental Health Support Dial Triple Zero 000 Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special revenue funds

Edit your special revenue funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special revenue funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing special revenue funds online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit special revenue funds. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special revenue funds

How to fill out special revenue funds

01

To fill out special revenue funds, follow these steps:

02

Identify the specific special revenue fund that needs to be filled out.

03

Gather all relevant financial information and documentation related to the fund.

04

Review the guidelines and regulations for the particular special revenue fund.

05

Determine the sources and amounts of revenue that need to be allocated to the fund.

06

Ensure that all revenue collected for the special revenue fund is properly recorded and accounted for.

07

Allocate the revenue to the appropriate categories or accounts within the fund.

08

Keep detailed records of all transactions and changes made to the special revenue fund.

09

Regularly monitor and reconcile the balance of the special revenue fund to ensure accuracy.

10

Prepare periodic reports or statements on the status and usage of the special revenue fund, as required by regulations or stakeholders.

11

Comply with any audit or review processes related to the special revenue fund.

12

Continuously assess and adjust the filling out process of the special revenue fund based on changes in regulations or organizational needs.

Who needs special revenue funds?

01

Special revenue funds are usually needed by governmental or non-profit organizations that receive and allocate revenue for specific purposes.

02

These funds are often used to finance or support specific programs, projects, or services that are separate from the organization's general fund.

03

Examples of entities that may need special revenue funds include government departments, public schools, healthcare organizations, and charitable organizations.

04

They allow these organizations to track and manage revenue that is earmarked for specific uses, ensuring transparency and accountability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute special revenue funds online?

With pdfFiller, you may easily complete and sign special revenue funds online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the special revenue funds electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your special revenue funds.

How do I fill out the special revenue funds form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign special revenue funds and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is special revenue funds?

Special revenue funds are used to account for specific revenue sources that are legally restricted to expenditure for particular purposes. These funds help in ensuring that designated revenues are used appropriately.

Who is required to file special revenue funds?

Entities that collect or utilize funds designated for specific purposes, such as state and local governments or other public agencies, are typically required to file special revenue funds.

How to fill out special revenue funds?

To fill out special revenue funds, entities must detail the specific sources of revenue, the expenditures made from these funds, and ensure compliance with any legal or regulatory mandates governing their use.

What is the purpose of special revenue funds?

The purpose of special revenue funds is to ensure that revenues collected for specific uses are accounted for separately, which helps in transparency and compliance with regulations, thus allowing for accurate tracking and reporting of these funds.

What information must be reported on special revenue funds?

Information that must be reported includes the sources of revenue, the amounts collected, expenditures made from the fund, any restrictions on the use of funds, and the fund's balance at the reporting date.

Fill out your special revenue funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Revenue Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.