Get the free BUSINESS LOAN/LINE OF CREDIT APPLICATION ($5000 to ...

Show details

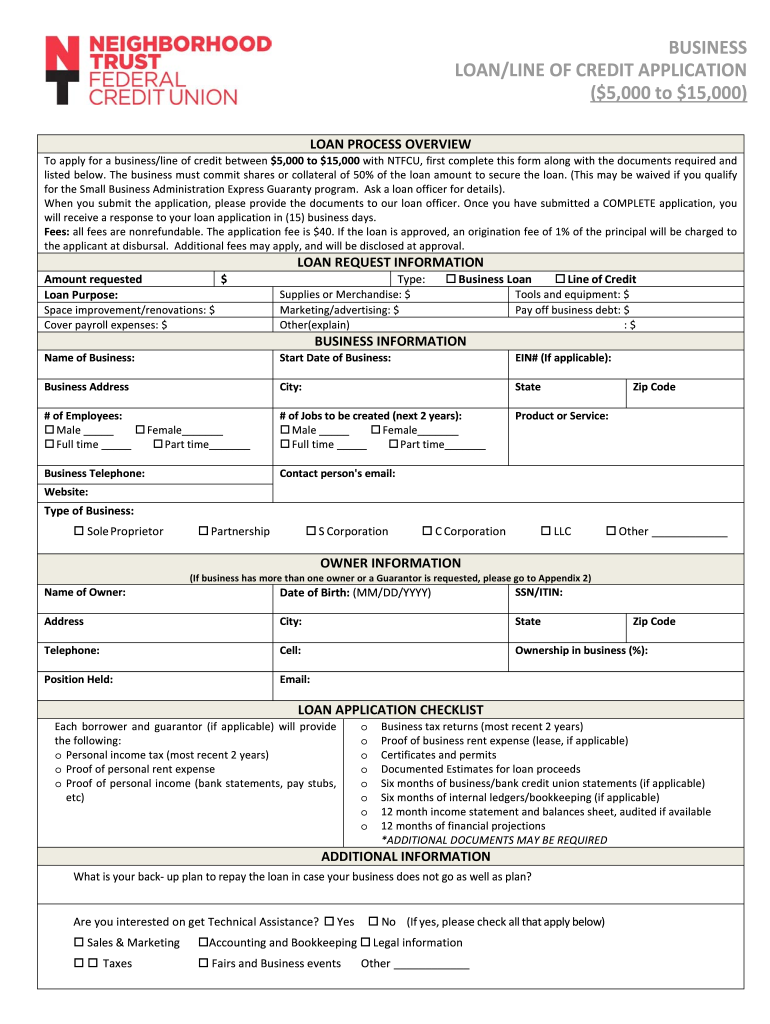

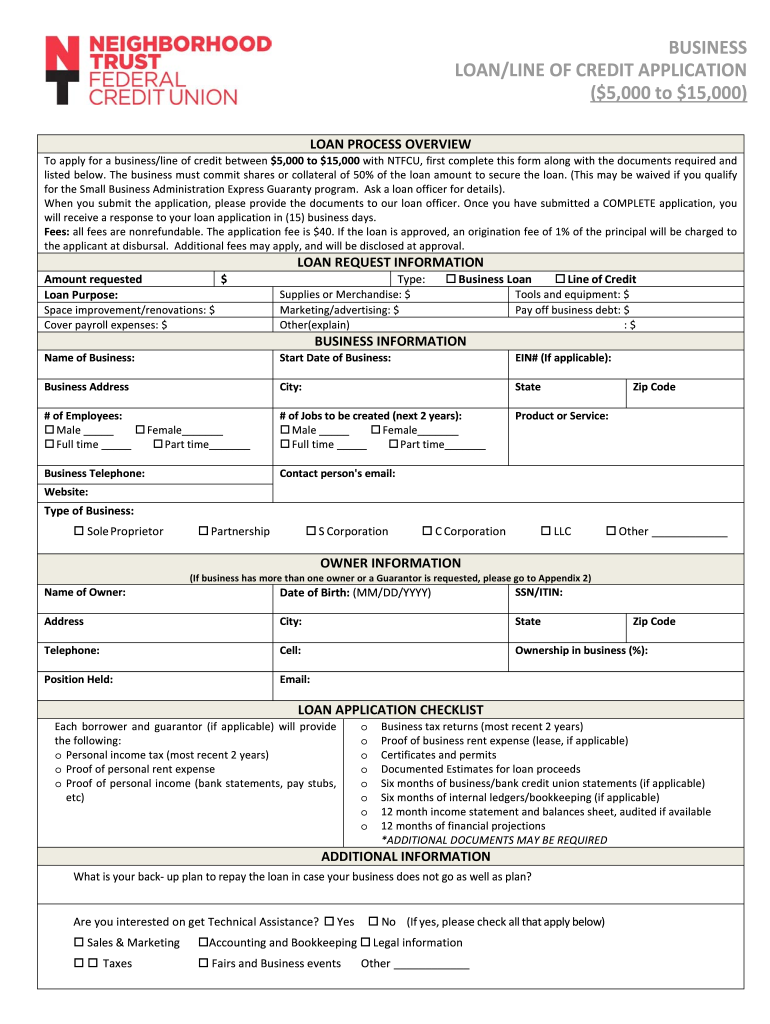

BUSINESS

LOAN/LINE OF CREDIT APPLICATION

($5,000 to $15,000)

LOAN PROCESS OVERVIEW

To apply for a business/line of credit between $5,000 to $15,000 with NFC, first complete this form along with the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loanline of credit

Edit your business loanline of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loanline of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loanline of credit online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business loanline of credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loanline of credit

How to fill out business loanline of credit

01

Gather all necessary documents and information for the loan application, such as financial statements, tax returns, business plan, and credit history.

02

Research different lenders and compare their terms, interest rates, and repayment options.

03

Contact the chosen lender and request a loan application form.

04

Fill out the loan application form accurately and provide all requested information.

05

Include a detailed explanation of why your business needs the loanline of credit and how it will be used.

06

Submit the completed application along with all required documents to the lender.

07

Wait for the lender to review your application and process it.

08

If approved, carefully review the loan agreement and ensure you understand all terms and conditions.

09

Sign and return the loan agreement to the lender.

10

Once the loanline of credit is active, use it responsibly and make regular payments to maintain a good credit history.

Who needs business loanline of credit?

01

Business owners who require financial flexibility and access to funds on an as-needed basis.

02

Startups or small businesses that need working capital to cover operational expenses or unexpected costs.

03

Companies looking to finance expansion plans, purchase inventory, or invest in new equipment or technology.

04

Entrepreneurs who want to take advantage of business opportunities quickly.

05

Businesses with seasonal fluctuations or uneven cash flow that require additional funds during low periods.

06

Owners who want to establish or improve their business credit.

07

Companies that want to consolidate higher interest debt into a single, more manageable loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business loanline of credit?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific business loanline of credit and other forms. Find the template you need and change it using powerful tools.

How do I edit business loanline of credit online?

With pdfFiller, the editing process is straightforward. Open your business loanline of credit in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the business loanline of credit in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your business loanline of credit in minutes.

What is business loanline of credit?

A business loanline of credit is a flexible financing option that allows businesses to borrow funds up to a specified limit, which can be drawn upon as needed for various expenses or capital requirements.

Who is required to file business loanline of credit?

Businesses that utilize a line of credit for their financial operations, particularly those that exceed a certain threshold, are typically required to file documentation related to the business loanline of credit.

How to fill out business loanline of credit?

To fill out a business loanline of credit application, a business needs to provide detailed financial information, including revenue, existing debt, business structure, and purpose of the credit. Additionally, identification and any required financial documents must be submitted.

What is the purpose of business loanline of credit?

The purpose of a business loanline of credit is to provide companies with quick access to funds to cover short-term operational needs, manage cash flow fluctuations, and finance unexpected expenses without applying for a traditional loan.

What information must be reported on business loanline of credit?

Businesses must report details such as the total credit limit, the amount utilized, repayment history, interest rates, and any outstanding balances when filing for a business loanline of credit.

Fill out your business loanline of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loanline Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.