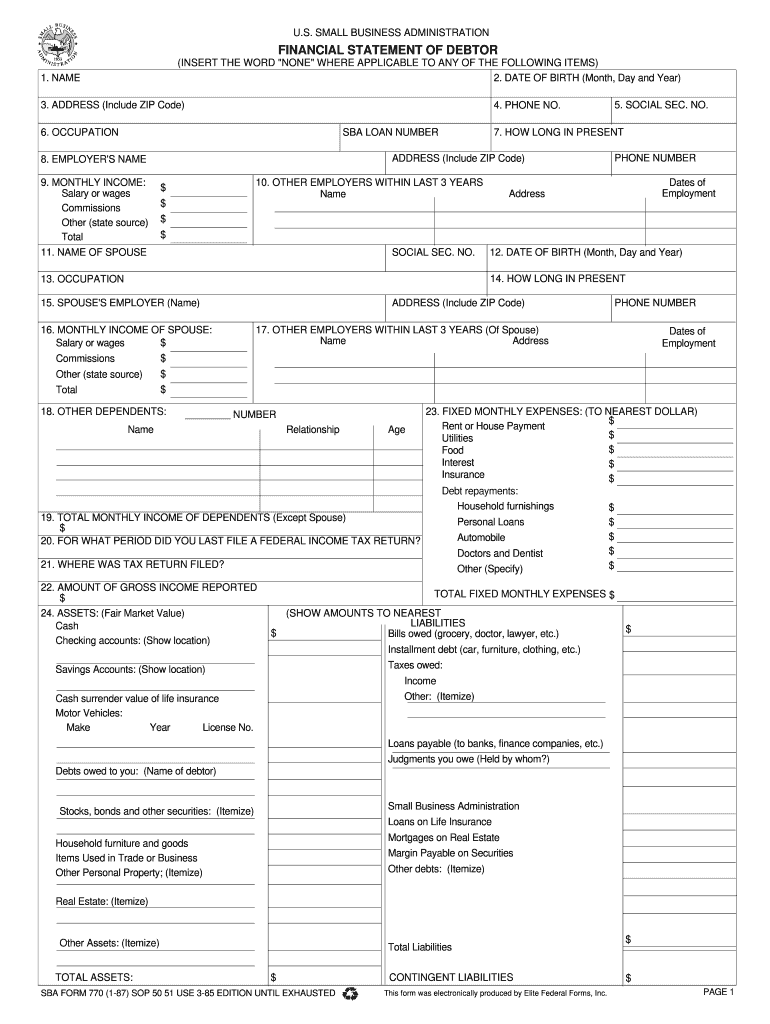

Who needs a Financial Statement of Debtor?

The Financial Statement of Debtor form, or SBA Form 770, is a United States Small Business Administration form. It must be filled out and filed by borrowers of an SBA-guaranteed loan. Such a loan can be taken at most US banks or commercial lending institutions.

What is the Financial Statement of Debtor Form for?

The primary purpose of this form is to enable the US Small Business Administration to evaluate the debtor’s financial capacity to repay the debt owed to the Agency and determine to what extent the debt may be compromised and the ways in which the Agency can maximize the likelihood of the Agency recovering the full amount of the debt and protect its interests.

How do I fill out SBA Form 770?

The completed Financial Statement of Debtor must provide the following information:

-

The debtor and their personal details (full name, date of birth, address, etc.)

-

Employment details

-

Monthly income

-

Dependents

-

Assets

-

Details about the loan, etc.

When completed, the form should be signed and dated by the obliged and directed to the lender. The lender should then file the original statement form with the local SBA servicing center.