Get the free FHA Net Tangible Benefit Worksheet Streamline Refinance

Show details

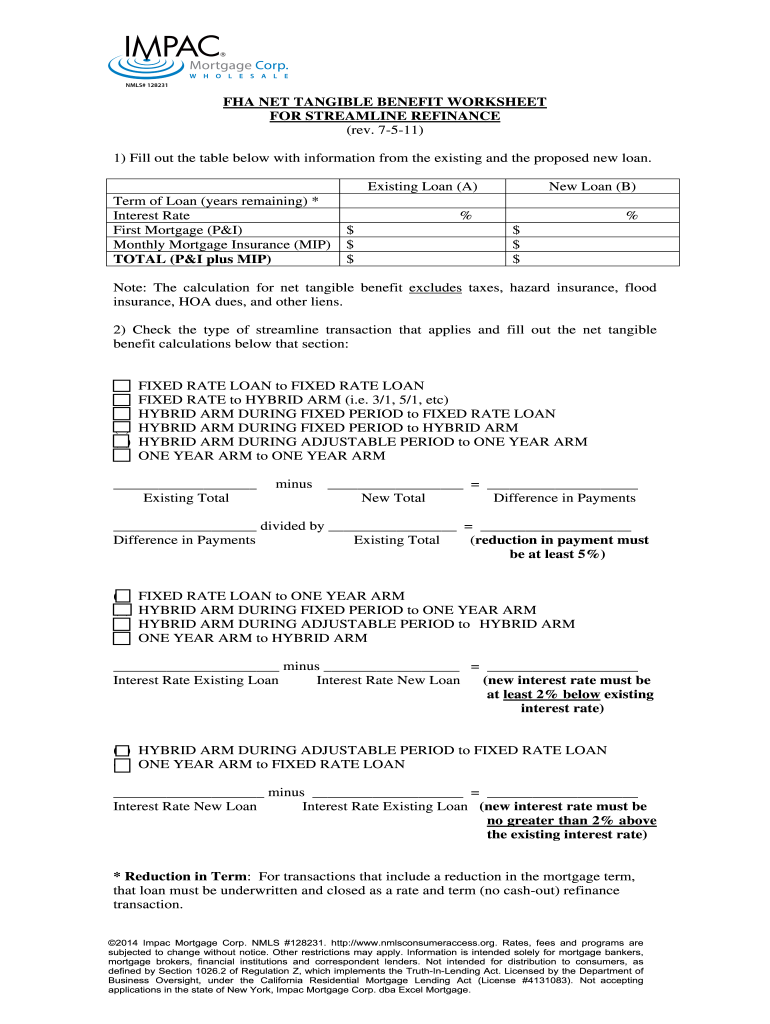

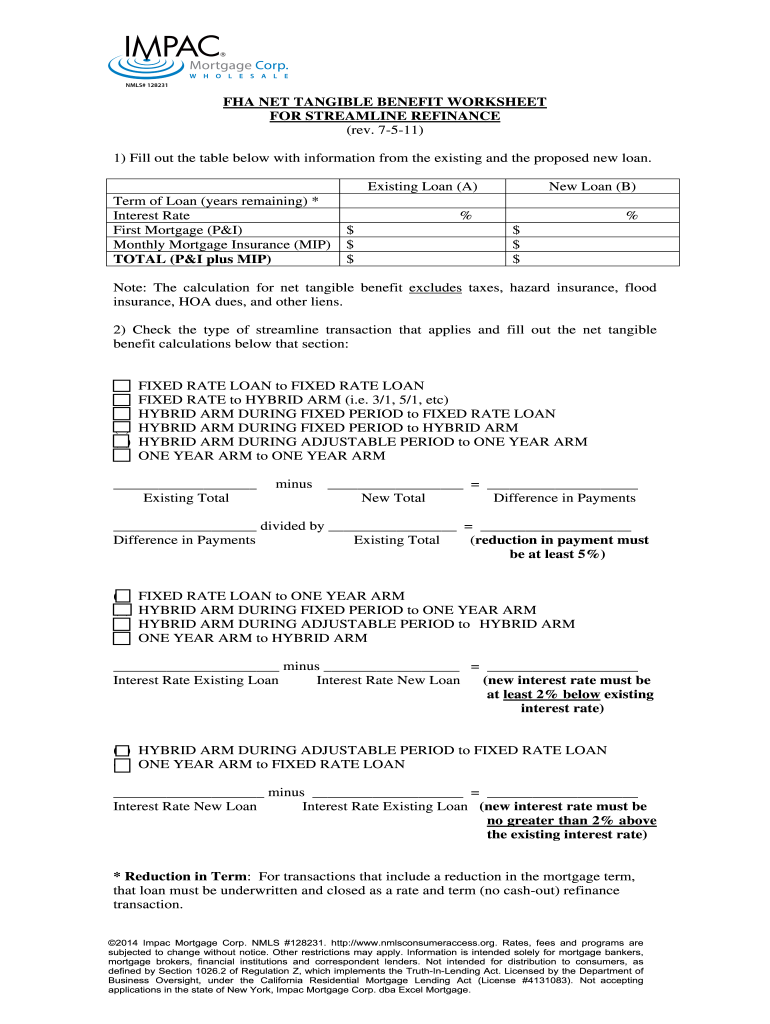

FHA NET TANGIBLE BENEFIT WORKSHEET FOR STREAMLINE REFINANCE (rev. 7511) 1) Fill out the table below with information from the existing and the proposed new loan. Existing Loan (A) Term of Loan (years

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha net tangible benefit

Edit your fha net tangible benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha net tangible benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha net tangible benefit online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fha net tangible benefit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha net tangible benefit

How to fill out fha net tangible benefit

01

To fill out the FHA Net Tangible Benefit form, you need to follow these steps:

02

Gather all the necessary documentation: This includes your current mortgage statement, pay stubs, tax returns, and bank statements.

03

Calculate your current loan-to-value (LTV) ratio: Use the formula LTV = (Current Loan Amount / Appraised Value) x 100. This will help determine if you meet the eligibility requirements.

04

Determine the potential benefits: Consider factors such as lowering your interest rate, reducing your monthly mortgage payment, or switching from an adjustable-rate mortgage to a fixed-rate mortgage.

05

Complete the FHA Net Tangible Benefit worksheet: This form helps assess whether the proposed refinance will provide a tangible benefit to you, such as savings over the life of the loan.

06

Submit the completed form to your lender: Once you have filled out the form accurately, provide it to your lender for review and processing.

07

Follow up with your lender: Stay in touch with your lender to ensure the process is moving forward and address any additional requirements or questions they may have.

08

Await the lender's decision: The lender will review your application and determine if you meet the FHA net tangible benefit requirements. Expect to receive a decision within a reasonable timeframe.

09

Proceed with the refinance if approved: If your application is approved, you can move forward with the refinancing process as per your lender's instructions.

Who needs fha net tangible benefit?

01

FHA Net Tangible Benefit is required for individuals who are considering refinancing their FHA-insured mortgage loans. This benefit is specifically designed to ensure that borrowers receive a tangible advantage from refinancing, such as reducing their monthly mortgage payments, obtaining a lower interest rate, or switching from an adjustable-rate mortgage to a fixed-rate mortgage. It is essential for individuals who want to avail themselves of the potential benefits provided by FHA net tangible benefit to fill out the form to determine their eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fha net tangible benefit in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your fha net tangible benefit and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit fha net tangible benefit on an Android device?

You can make any changes to PDF files, like fha net tangible benefit, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out fha net tangible benefit on an Android device?

Use the pdfFiller mobile app to complete your fha net tangible benefit on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is fha net tangible benefit?

The FHA net tangible benefit refers to a calculation that determines whether a borrower receives a meaningful benefit from refinancing their mortgage, typically assessed by comparing the current loan terms to new loan terms.

Who is required to file fha net tangible benefit?

Lenders who are processing FHA loans and refinancing must file the FHA net tangible benefit to ensure that the borrower qualifies for the refinancing based on tangible benefits.

How to fill out fha net tangible benefit?

To fill out the FHA net tangible benefit, lenders need to gather relevant loan information, calculate the benefit by comparing current and new loan terms, and provide the required documentation and calculations on the FHA forms.

What is the purpose of fha net tangible benefit?

The purpose of the FHA net tangible benefit is to protect borrowers by ensuring they receive significant and measurable advantages when refinancing, such as lower monthly payments, decreased interest rates, or reduced loan terms.

What information must be reported on fha net tangible benefit?

The information that must be reported includes current loan details, proposed loan terms, calculations of savings or benefits from refinancing, and any additional relevant borrower information.

Fill out your fha net tangible benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Net Tangible Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.