Canada RC232 2010 free printable template

Get, Create, Make and Sign Canada RC232

How to edit Canada RC232 online

Uncompromising security for your PDF editing and eSignature needs

Canada RC232 Form Versions

How to fill out Canada RC232

How to fill out Canada RC232

Who needs Canada RC232?

Instructions and Help about Canada RC232

Today you will learn about RS 232 It is a phrase you may hear fairly regularly in industry especially by the older guys Hopefully this video will clear some things up for you Before we get into todaysvideo if you love our videos be sure to click the like button below and make sure to click subscribe and the bell to receive notifications of new Reappears videos This way you never miss another one What exactly is RS-232First and foremost it is a form of serial data transmission Or simply put it is form of communication Most people simply call edit a serial connection At one time it was the most used form of data transmission You will probably recognize the standard 9 pins DB9 cable Simply put RS-232 transmits signals using a positive voltage for a binary 0 and a negative voltage for a binary 1 But what do the Bliss rs-232formlesss use RS 232 to talktoothedr modules or even other Plus These modules can be anything that also uses RS 232 such as operator interface or HMI computers motor controllers or drives a robot or some kind of vision system One important thing to remember if you find yourself using RS 232 devices is that there are actually two different types DUE stands for DataTerminal Equipment A common example of this is a computer DCE stands for NTT Communications Equipment An example of DCE is a modem The reason this is import antis because two DUE or two DCE devices cannot talk to each other without some help This is typically done by using a reversenull-modem cable to connect the devices Typically our Plus will be Dead our devices used will be DCE and our devices used will be DCE and everything should talk to each other One very common example that many people are probably familiar with is a computer connected to a printer While USB has become the standard RS 232 is still widely used for older printers in the workplace The RS 232 protocol and cable allow the computer to give commands to the printer via a voltage signal The printer then deciphers those commands and completes the print There are a couple of disadvantages of RS-232 One is the speed at which data can be transferred Data can be transferred at around 20 kilobytes per second That is pretty slow compared to what people are used to now Another issue with RS-232 is that the maximum length a cable is about 50 feet Wire resistance and voltage drops become an issue with cables longer than this is one reason RS-232 is not used as mochas newer technology for remote installations So let's review what we have learned For years RS-232 has been standard in industry Today USB and Ethernet have started to phase out this older serial communication standard However with the help of simple adapters devices can still talk to each other using the new and old standards There are still many manufacturers using RS-232 since it has always been widespread and inexpensive Manufacturers may us RS-232 to connect Plus to devices like His input and output modules and motor drives just to name a few Keep in...

People Also Ask about

What is the schedule 546 in Ontario?

What is the schedule 548 in Ontario?

Do I need to file Annual Return for Ontario?

How do I file my annual information return in Ontario?

What is Schedule 500 Ontario tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada RC232?

How do I edit Canada RC232 in Chrome?

Can I create an eSignature for the Canada RC232 in Gmail?

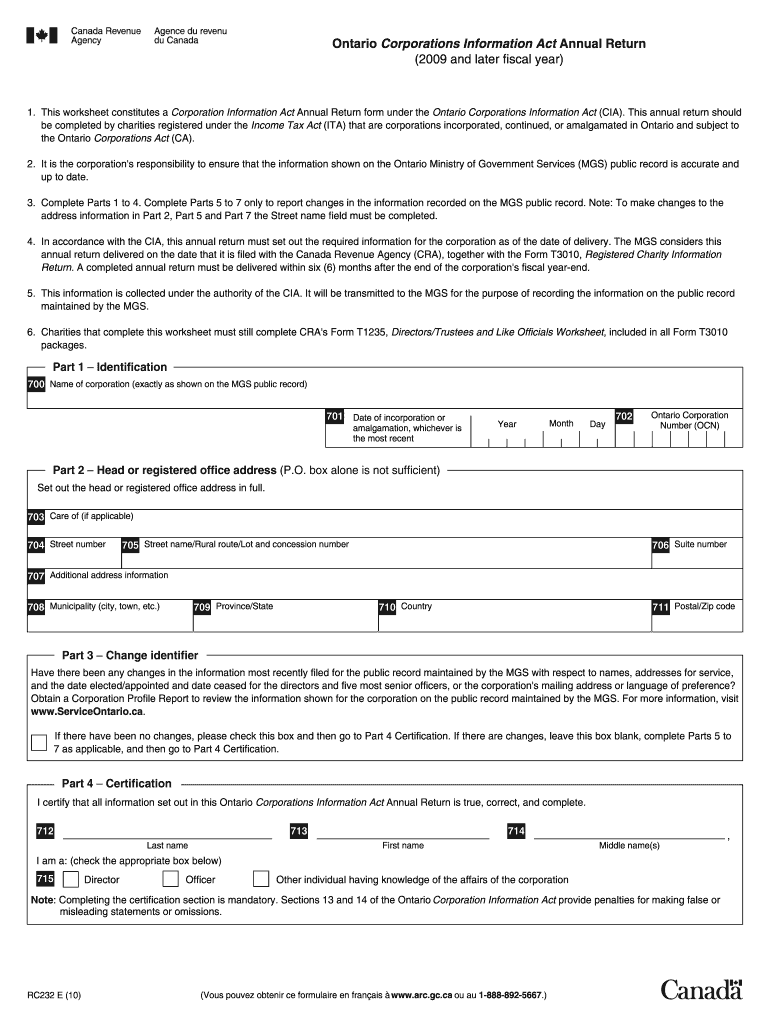

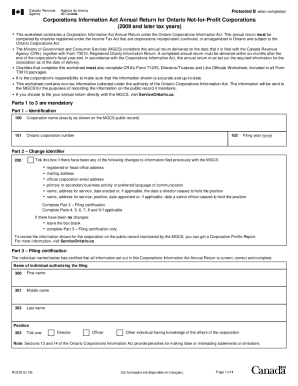

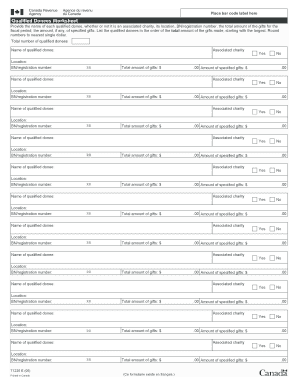

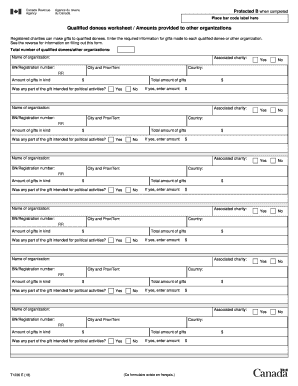

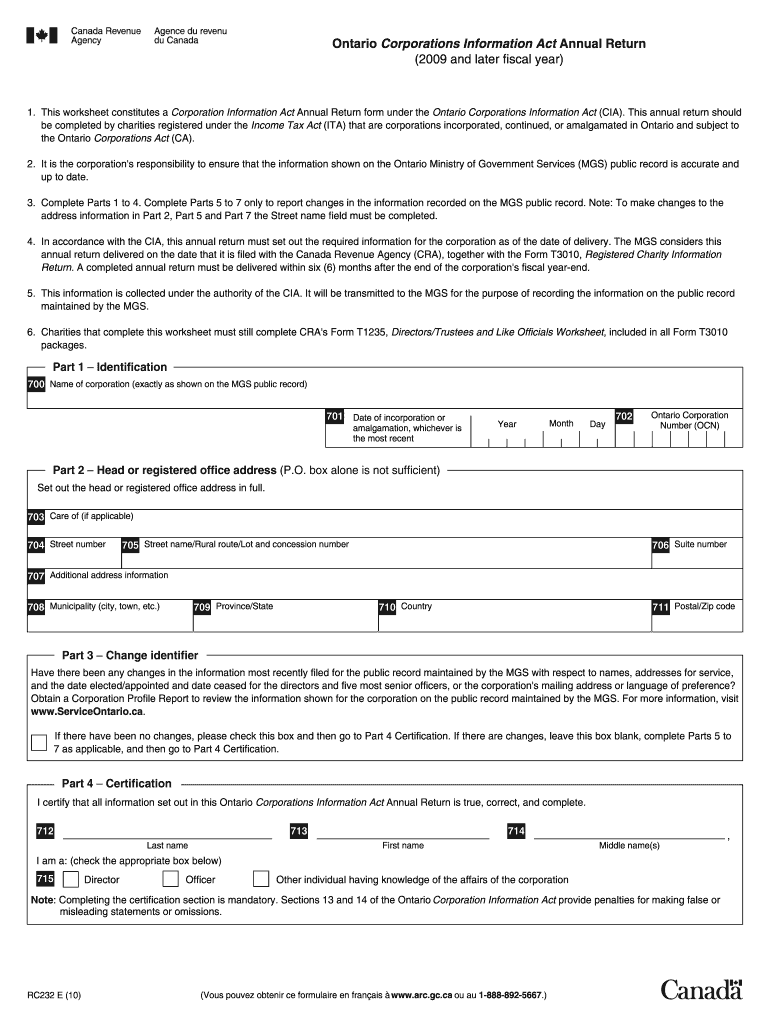

What is Canada RC232?

Who is required to file Canada RC232?

How to fill out Canada RC232?

What is the purpose of Canada RC232?

What information must be reported on Canada RC232?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.