Get the free Plan 1 and Plan 2 Request for Corona-Virus Related Distribution form DRS MS 470 (DRS...

Show details

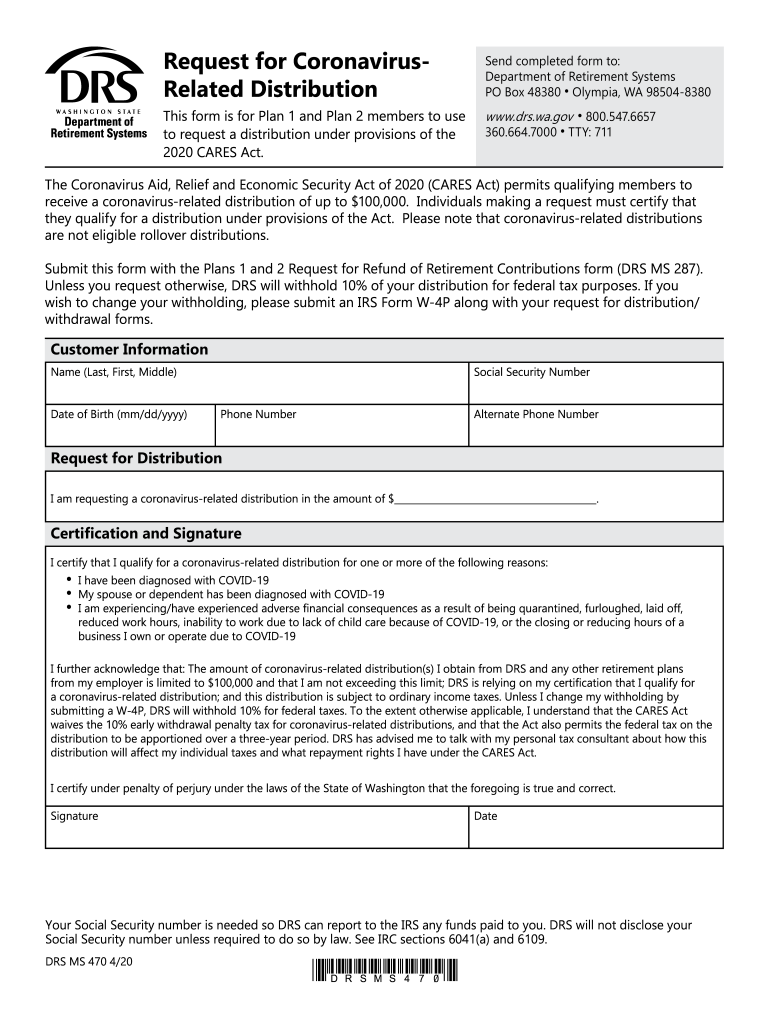

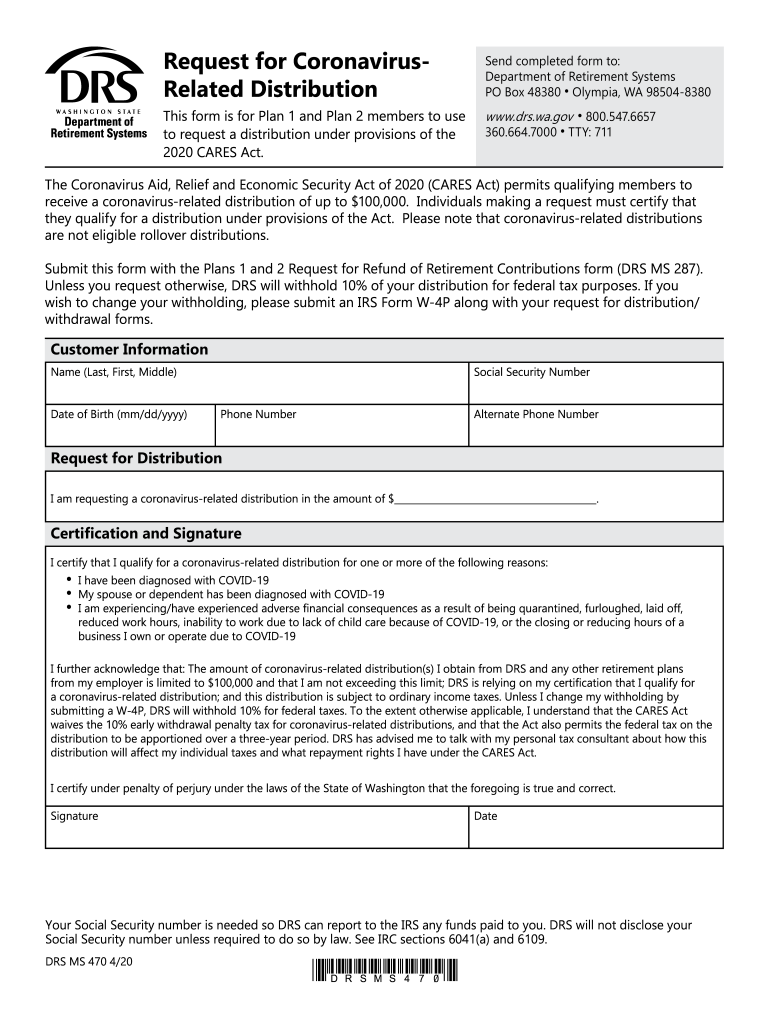

Clear FormRequest for CoronavirusRelated Distribution This form is for Plan 1 and Plan 2 members to use to request a distribution under provisions of the 2020 CARES Act. Send completed form to: Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plan 1 and plan

Edit your plan 1 and plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan 1 and plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit plan 1 and plan online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit plan 1 and plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out plan 1 and plan

How to fill out plan 1 and plan

01

To fill out plan 1, follow these steps:

1. Open the plan 1 form.

2. Enter your personal information in the designated fields, such as name, address, and contact details.

3. Provide details about your current financial situation, including income, expenses, and assets.

4. Indicate your financial goals and objectives.

5. Review the form for accuracy and completeness.

6. Sign and date the form.

7. Submit the filled-out plan 1 form to the appropriate authority or organization.

02

To fill out a plan, follow these steps:

1. Obtain the plan form from the relevant source or organization.

2. Read the instructions carefully to understand the required information.

3. Enter your personal details accurately, including name, contact information, and any other requested information.

4. Provide relevant financial information, such as income, expenses, and assets.

5. Specify your goals and objectives for the plan.

6. Check the form for any errors or missing information.

7. Sign and date the form.

8. Submit the completed plan to the designated authority.

Who needs plan 1 and plan?

01

Plan 1 is typically needed by individuals who want to manage their financial resources effectively and set clear goals for their future. It can be useful for anyone who wants to create a comprehensive financial plan, including budgeting, investment strategies, and financial goal-setting.

02

The need for a plan depends on the specific circumstances and goals of an individual or organization. Various individuals may benefit from having a plan, such as individuals seeking financial stability, families planning for their children's education or retirement, entrepreneurs starting a business, or organizations aiming for financial growth and sustainability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify plan 1 and plan without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your plan 1 and plan into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the plan 1 and plan form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign plan 1 and plan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit plan 1 and plan on an Android device?

You can edit, sign, and distribute plan 1 and plan on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is plan 1 and plan?

Plan 1 refers to a type of retirement savings plan, typically involving a defined contribution scheme that allows employees to save for retirement. 'Plan' in general can refer to any structured approach or strategical outline for saving, investing, or managing resources.

Who is required to file plan 1 and plan?

Employers who offer retirement savings plans, such as Plan 1, are generally required to file these plans to ensure compliance with regulatory standards. Employees enrolled in such plans might also be required to submit certain forms.

How to fill out plan 1 and plan?

To fill out Plan 1, participants typically need to provide personal information, contribution details, and beneficiary designations. Employers may also need to include financial projections and compliance checks as part of the filing process.

What is the purpose of plan 1 and plan?

The purpose of Plan 1 is to provide a structured savings vehicle for employees to accumulate retirement funds, enabling them to have financial security upon retirement. Plans aim to encourage saving and investment for long-term financial stability.

What information must be reported on plan 1 and plan?

Information that must typically be reported includes employee contributions, employer matching contributions, investment performance, and total assets held under the plan. Compliance adherence and beneficiary information may also need to be disclosed.

Fill out your plan 1 and plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan 1 And Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.